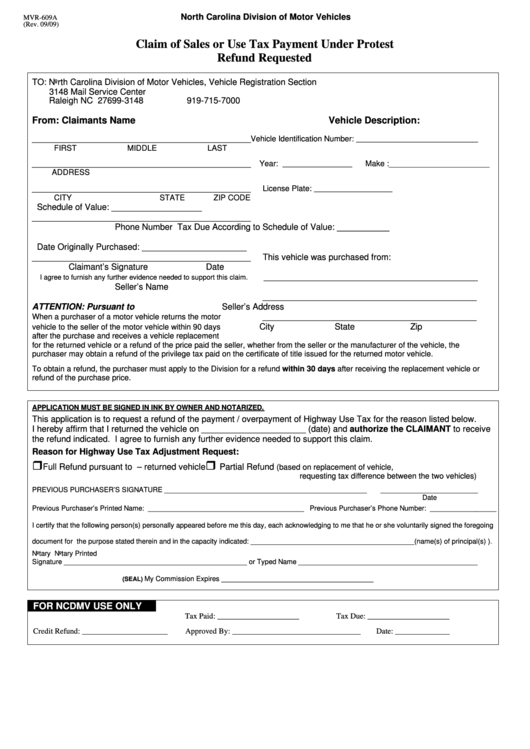

Form Mvr-609a - Claim Of Sales Or Use Tax Payment Under Protest Refund Requested

ADVERTISEMENT

North Carolina Division of Motor Vehicles

MVR-609A

(Rev. 09/09)

Claim of Sales or Use Tax Payment Under Protest

Refund Requested

TO: North Carolina Division of Motor Vehicles, Vehicle Registration Section

3148 Mail Service Center

Raleigh NC 27699-3148

919-715-7000

From: Claimants Name

Vehicle Description:

______________________________________________

____________________________

Vehicle Identification Number:

FIRST

MIDDLE

LAST

______________________________________________

Year:

________________

Make :_______________________

ADDRESS

______________________________________________

__________________

License Plate:

CITY

STATE

ZIP CODE

Schedule of Value: ___________________

______________________________________________

Phone Number

Tax Due According to Schedule of Value: ___________

Date Originally Purchased: ______________________

______________________________________________

This vehicle was purchased from:

Claimant’s Signature

Date

_____________________________________________

I agree to furnish any further evidence needed to support this claim.

Seller’s Name

_____________________________________________

ATTENTION: Pursuant to G.S. 105.187.8

Seller’s Address

_____________________________________________

When a purchaser of a motor vehicle returns the motor

City

State

Zip

vehicle to the seller of the motor vehicle within 90 days

after the purchase and receives a vehicle replacement

for the returned vehicle or a refund of the price paid the seller, whether from the seller or the manufacturer of the vehicle, the

purchaser may obtain a refund of the privilege tax paid on the certificate of title issued for the returned motor vehicle.

To obtain a refund, the purchaser must apply to the Division for a refund within 30 days after receiving the replacement vehicle or

refund of the purchase price.

APPLICATION MUST BE SIGNED IN INK BY OWNER AND NOTARIZED.

This application is to request a refund of the payment / overpayment of Highway Use Tax for the reason listed below.

I hereby affirm that I returned the vehicle on ______________________ (date) and authorize the CLAIMANT to receive

the refund indicated. I agree to furnish any further evidence needed to support this claim.

Reason for Highway Use Tax Adjustment Request:

Full Refund pursuant to G.S. 105.187.8 – returned vehicle

Partial Refund

(based on replacement of vehicle,

requesting tax difference between the two vehicles)

PREVIOUS PURCHASER’S SIGNATURE ____________________________________________________

_________________________

Date

Previous Purchaser’s Printed Name: ________________________________________ Previous Purchaser’s Phone Number: _________________

I certify that the following person(s) personally appeared before me this day, each acknowledging to me that he or she voluntarily signed the foregoing

document for the purpose stated therein and in the capacity indicated: __________________________________________(name(s) of principal(s) ).

Notary

Notary Printed

Signature _______________________________________________

or Typed Name ______________________________________________

My Commission Expires _______________________________________

(SEAL)

FOR NCDMV USE ONLY

.

Tax Paid: _____________________

Tax Due: _____________________

Credit Refund: ______________________

Approved By: _________________________________

Date: ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1