Form 72-442 - Contractor'S Blanket Bond - Ms Department Of Revenue - 2014

ADVERTISEMENT

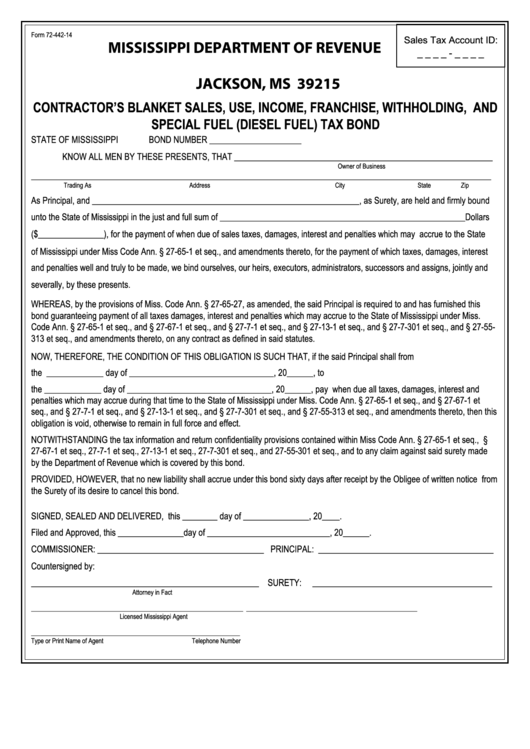

Form 72-442-14

Sales Tax Account ID:

MISSISSIPPI DEPARTMENT OF REVENUE

_ _ _ _ - _ _ _ _

P.O. BOX 1033

JACKSON, MS 39215

CONTRACTOR’S BLANKET SALES, USE, INCOME, FRANCHISE, WITHHOLDING, AND

SPECIAL FUEL (DIESEL FUEL) TAX BOND

STATE OF MISSISSIPPI

BOND NUMBER _____________________

KNOW ALL MEN BY THESE PRESENTS, THAT ___________________________________________________________

Owner of Business

_________________________________________________________________________________________________________

Trading As

Address

City

State

Zip

As Principal, and _____________________________________________________________, as Surety, are held and firmly bound

unto the State of Mississippi in the just and full sum of ________________________________________________________Dollars

($_______________), for the payment of when due of sales taxes, damages, interest and penalties which may accrue to the State

of Mississippi under Miss Code Ann. § 27-65-1 et seq., and amendments thereto, for the payment of which taxes, damages, interest

and penalties well and truly to be made, we bind ourselves, our heirs, executors, administrators, successors and assigns, jointly and

severally, by these presents.

WHEREAS, by the provisions of Miss. Code Ann. § 27-65-27, as amended, the said Principal is required to and has furnished this

bond guaranteeing payment of all taxes damages, interest and penalties which may accrue to the State of Mississippi under Miss.

Code Ann. § 27-65-1 et seq., and § 27-67-1 et seq., and § 27-7-1 et seq., and § 27-13-1 et seq., and § 27-7-301 et seq., and § 27-55-

313 et seq., and amendments thereto, on any contract as defined in said statutes.

NOW, THEREFORE, THE CONDITION OF THIS OBLIGATION IS SUCH THAT, if the said Principal shall from

the _____________ day of _________________________________, 20______, to

the _____________ day of _________________________________, 20______, pay when due all taxes, damages, interest and

penalties which may accrue during that time to the State of Mississippi under Miss. Code Ann. § 27-65-1 et seq., and § 27-67-1 et

seq., and § 27-7-1 et seq., and § 27-13-1 et seq., and § 27-7-301 et seq., and § 27-55-313 et seq., and amendments thereto, then this

obligation is void, otherwise to remain in full force and effect.

NOTWITHSTANDING the tax information and return confidentiality provisions contained within Miss Code Ann. § 27-65-1 et seq., §

27-67-1 et seq., 27-7-1 et seq., 27-13-1 et seq., 27-7-301 et seq., and 27-55-301 et seq., and to any claim against said surety made

by the Department of Revenue which is covered by this bond.

PROVIDED, HOWEVER, that no new liability shall accrue under this bond sixty days after receipt by the Obligee of written notice from

the Surety of its desire to cancel this bond.

SIGNED, SEALED AND DELIVERED, this ________ day of _______________, 20____.

Filed and Approved, this _______________day of ____________________________, 20______.

COMMISSIONER: ______________________________________ PRINCIPAL: ________________________________________

Countersigned by:

____________________________________________________ SURETY:

_________________________________________

Attorney in Fact

___________________________________________________________________

______________________________________________________

Licensed Mississippi Agent

__________________________________________________________________

Type or Print Name of Agent

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1