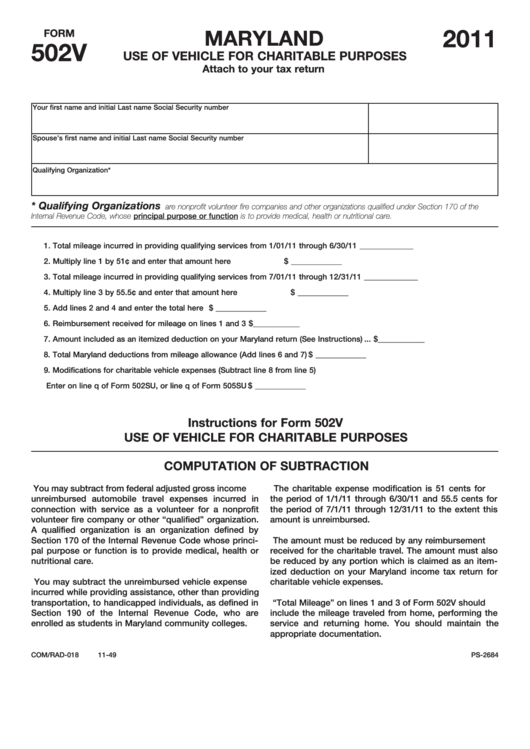

2011

MARYLAND

FORM

502V

USE OF VEHICLE FOR CHARITABLE PURPOSES

Attach to your tax return

Your first name and initial

Last name

Social Security number

Spouse’s first name and initial

Last name

Social Security number

Qualifying Organization*

* Qualifying Organizations

are nonprofit volunteer fire companies and other organizations qualified under Section 170 of the

Internal Revenue Code, whose principal purpose or function is to provide medical, health or nutritional care.

1. Total mileage incurred in providing qualifying services from 1/01/11 through 6/30/11 ....... _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

2. Multiply line 1 by 51¢ and enter that amount here ................................................................

$ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

3. Total mileage incurred in providing qualifying services from 7/01/11 through 12/31/11 ..... _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

4. Multiply line 3 by 55.5¢ and enter that amount here .............................................................

$ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

5. Add lines 2 and 4 and enter the total here .............................................................................

$ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

6. Reimbursement received for mileage on lines 1 and 3 ......................................................... $_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

7. Amount included as an itemized deduction on your Maryland return (See Instructions) ... $_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

8. Total Maryland deductions from mileage allowance (Add lines 6 and 7) ..................................................... $ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

9. Modifications for charitable vehicle expenses (Subtract line 8 from line 5)

Enter on line q of Form 502SU, or line q of Form 505SU .............................................................................. $ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Instructions for Form 502V

USE OF VEHICLE FOR CHARITABLE PURPOSES

COMPUTATION OF SUBTRACTION

You may subtract from federal adjusted gross income

The charitable expense modification is 51 cents for

unreimbursed automobile travel expenses incurred in

the period of 1/1/11 through 6/30/11 and 55.5 cents for

connection with service as a volunteer for a nonprofit

the period of 7/1/11 through 12/31/11 to the extent this

volunteer fire company or other “qualified” organization.

amount is unreimbursed.

A qualified organization is an organization defined by

Section 170 of the Internal Revenue Code whose princi-

The amount must be reduced by any reimbursement

pal purpose or function is to provide medical, health or

received for the charitable travel. The amount must also

nutritional care.

be reduced by any portion which is claimed as an item-

ized deduction on your Maryland income tax return for

You may subtract the unreimbursed vehicle expense

charitable vehicle expenses.

incurred while providing assistance, other than providing

transportation, to handicapped individuals, as defined in

“Total Mileage” on lines 1 and 3 of Form 502V should

Section 190 of the Internal Revenue Code, who are

include the mileage traveled from home, performing the

enrolled as students in Maryland community colleges.

service and returning home. You should maintain the

appropriate documentation.

COM/RAD-018

11-49

PS-2684

1

1