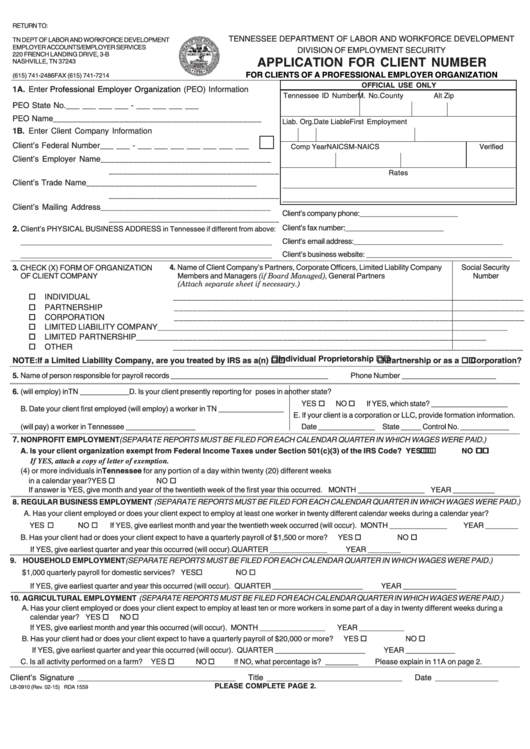

RETURN TO:

TENNESSEE DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT

TN DEPT OF LABOR AND WORKFORCE DEVELOPMENT

EMPLOYER ACCOUNTS/EMPLOYER SERVICES

DIVISION OF EMPLOYMENT SECURITY

220 FRENCH LANDING DRIVE, 3-B

APPLICATION FOR CLIENT NUMBER

NASHVILLE, TN 37243

FOR CLIENTS OF A PROFESSIONAL EMPLOYER ORGANIZATION

(615) 741-2486

FAX (615) 741-7214

OFFICIAL USE ONLY

1A. Enter

Professional Employer Organization

(PEO) Information

Tennessee ID Number

M. No.

County

Alt Zip

PEO State No. ___ ___ ___ ___ - ___ ___ ___ ___

PEO Name

____________________________________________

Liab. Org.

First Employment

Date Liable

1B. Enter Client Company Information

Client’s Federal Number ___ ___ - ___ ___ ___ ___ ___ ___ ___

Comp Year

NAICS

M-NAICS

Verified

Client’s Employer Name

____________________________________

____________________________________

Rates

Client’s Trade Name

____________________________________

____________________________________________________________

____________________________________

____________________________________________________________

Client’s Mailing Address

____________________________________

Client’s company phone: _________________________

____________________________________

Client’s fax number:

_________________________

2.

Client’s PHYSICAL BUSINESS ADDRESS

in Tennessee if different from above:

Client’s email address:

______________________________________

______________________________________________________________

Client’s business website: _____________________________________

______________________________________________________________

3. CHECK (X) FORM OF ORGANIZATION

4. Name of Client Company’s Partners, Corporate Officers, Limited Liability Company

Social Security

Members and Managers (if Board Managed), General Partners

OF CLIENT COMPANY

Number

(Attach separate sheet if necessary.)

INDIVIDUAL

__________________________________________________________________________

PARTNERSHIP

__________________________________________________________________________

CORPORATION

__________________________________________________________________________

LIMITED LIABILITY COMPANY

__________________________________________________________________________

LIMITED PARTNERSHIP

__________________________________________________________________________

OTHER

__________________________________________________________________________

NOTE: If a Limited Liability Company, are you treated by IRS as a(n)

Individual Proprietorship

Partnership or as a

Corporation?

5. Name of person responsible for payroll records _______________________________________

Phone Number _______________________

6. A. Number of workers your client has employed (will employ) in TN ____________

D. Is your client presently reporting for U.I. purposes in another state?

YES

NO

If YES, which state? ___________________

B. Date your client first employed (will employ) a worker in TN ________________

E. If your client is a corporation or LLC, provide formation information.

C.Date your client first paid (will pay) a worker in Tennessee _________________

Date ______________ State _____ Control No. ____________

7.

NONPROFIT EMPLOYMENT (SEPARATE REPORTS MUST BE FILED FOR EACH CALENDAR QUARTER IN WHICH WAGES WERE PAID.)

A. Is your client organization exempt from Federal Income Taxes under Section 501(c)(3) of the IRS Code? YES

NO

If YES, attach a copy of letter of exemption.

B. Has your client employed or expects to employ four (4) or more individuals in Tennessee for any portion of a day within twenty (20) different weeks

in a calendar year?

YES

NO

If answer is YES, give month and year of the twentieth week of the first year this occurred. MONTH ________________ YEAR __________

8. REGULAR BUSINESS EMPLOYMENT (SEPARATE REPORTS MUST BE FILED FOR EACH CALENDAR QUARTER IN WHICH WAGES WERE PAID.)

A. Has your client employed or does your client expect to employ at least one worker in twenty different calendar weeks during a calendar year?

YES

NO

If YES, give earliest month and year the twentieth week occurred (will occur). MONTH ______________

YEAR ________

B. Has your client had or does your client expect to have a quarterly payroll of $1,500 or more? YES

NO

If YES, give earliest quarter and year this occurred (will occur).

QUARTER ______________

YEAR ________

9. HOUSEHOLD EMPLOYMENT (SEPARATE REPORTS MUST BE FILED FOR EACH CALENDAR QUARTER IN WHICH WAGES WERE PAID.)

A. Has your client had or does your client expect to have a $1,000 quarterly payroll for domestic services? YES

NO

If YES, give earliest quarter and year this occurred (will occur). QUARTER ______________________

YEAR _____________

10. AGRICULTURAL EMPLOYMENT (SEPARATE REPORTS MUST BE FILED FOR EACH CALENDAR QUARTER IN WHICH WAGES WERE PAID.)

A. Has your client employed or does your client expect to employ at least ten or more workers in some part of a day in twenty different weeks during a

calendar year? YES

NO

If YES, give earliest month and year this occurred (will occur). MONTH ________________

YEAR ___________

B. Has your client had or does your client expect to have a quarterly payroll of $20,000 or more? YES

NO

If YES, give earliest quarter and year this occurred (will occur). QUARTER ______________________

YEAR ____________

C. Is all activity performed on a farm? YES

NO

If NO, what percentage is? ________

Please explain in 11A on page 2.

Client’s Signature ___________________________________

Title ______________________________

Date ______________

PLEASE COMPLETE PAGE 2.

LB-0910 (Rev. 02-15)

RDA 1559

1

1 2

2