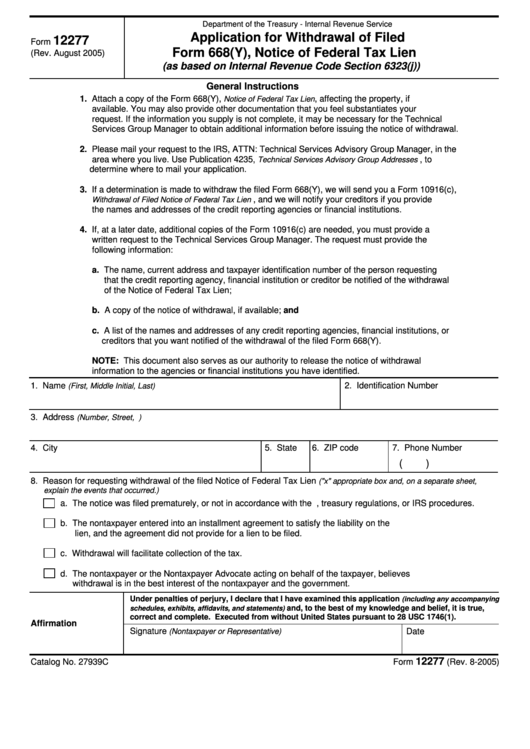

Form 12277 - Application For Withdrawal Of Filed Form 668(Y), Notice Of Federal Tax Lien

ADVERTISEMENT

Department of the Treasury - Internal Revenue Service

Application for Withdrawal of Filed

12277

Form

Form 668(Y), Notice of Federal Tax Lien

(Rev. August 2005)

(as based on Internal Revenue Code Section 6323(j))

General Instructions

1. Attach a copy of the Form 668(Y),

, affecting the property, if

Notice of Federal Tax Lien

available. You may also provide other documentation that you feel substantiates your

request. If the information you supply is not complete, it may be necessary for the Technical

Services Group Manager to obtain additional information before issuing the notice of withdrawal.

2. Please mail your request to the IRS, ATTN: Technical Services Advisory Group Manager, in the

area where you live. Use Publication 4235,

, to

Technical Services Advisory Group Addresses

determine where to mail your application.

3. If a determination is made to withdraw the filed Form 668(Y), we will send you a Form 10916(c),

, and we will notify your creditors if you provide

Withdrawal of Filed Notice of Federal Tax Lien

the names and addresses of the credit reporting agencies or financial institutions.

4. If, at a later date, additional copies of the Form 10916(c) are needed, you must provide a

written request to the Technical Services Group Manager. The request must provide the

following information:

a. The name, current address and taxpayer identification number of the person requesting

that the credit reporting agency, financial institution or creditor be notified of the withdrawal

of the Notice of Federal Tax Lien;

b. A copy of the notice of withdrawal, if available; and

c. A list of the names and addresses of any credit reporting agencies, financial institutions, or

creditors that you want notified of the withdrawal of the filed Form 668(Y).

NOTE: This document also serves as our authority to release the notice of withdrawal

information to the agencies or financial institutions you have identified.

1. Name

2. Identification Number

(First, Middle Initial, Last)

3. Address

(Number, Street, P.O. Box)

4. City

5. State

6. ZIP code

7. Phone Number

(

)

8. Reason for requesting withdrawal of the filed Notice of Federal Tax Lien

("x" appropriate box and, on a separate sheet,

explain the events that occurred.)

a. The notice was filed prematurely, or not in accordance with the I.R.C., treasury regulations, or IRS procedures.

b. The nontaxpayer entered into an installment agreement to satisfy the liability on the

lien, and the agreement did not provide for a lien to be filed.

c. Withdrawal will facilitate collection of the tax.

d. The nontaxpayer or the Nontaxpayer Advocate acting on behalf of the taxpayer, believes

withdrawal is in the best interest of the nontaxpayer and the government.

Under penalties of perjury, I declare that I have examined this application

(including any accompanying

and, to the best of my knowledge and belief, it is true,

schedules, exhibits, affidavits, and statements)

correct and complete. Executed from without United States pursuant to 28 USC 1746(1).

Affirmation

Signature

Date

(Nontaxpayer or Representative)

12277

Catalog No. 27939C

Form

(Rev. 8-2005)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1