Interview Handouts

Instructions

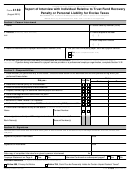

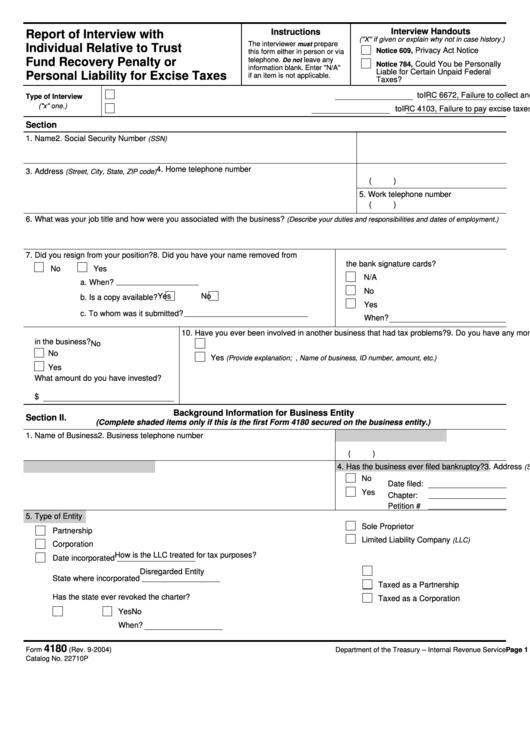

Report of Interview with

(''X'' if given or explain why not in case history.)

The interviewer

prepare

must

Individual Relative to Trust

Privacy Act Notice

Notice 609,

this form either in person or via

Fund Recovery Penalty or

telephone.

leave any

Do not

Could You be Personally

Notice 784,

information blank. Enter ''N/A''

Liable for Certain Unpaid Federal

Personal Liability for Excise Taxes

if an item is not applicable.

Taxes?

IRC 6672, Failure to collect and pay over tax from

to

(mmddyyyy)

Type of Interview

("x" one.)

IRC 4103, Failure to pay excise taxes from

to

(mmddyyyy)

Section I.

Background Information for Person Interviewed

1. Name

2. Social Security Number

(SSN)

4. Home telephone number

3. Address

(Street, City, State, ZIP code)

(

)

5. Work telephone number

(

)

6. What was your job title and how were you associated with the business?

(Describe your duties and responsibilities and dates of employment.)

7. Did you resign from your position?

8. Did you have your name removed from

the bank signature cards?

No

Yes

N/A

a. When?

No

Yes

No

b. Is a copy available?

Yes

c. To whom was it submitted?

When?

9. Do you have any money invested

10. Have you ever been involved in another business that had tax problems?

in the business?

No

No

Yes

(Provide explanation; i.e., Name of business, ID number, amount, etc.)

Yes

What amount do you have invested?

$

Background Information for Business Entity

Section II.

(Complete shaded items only if this is the first Form 4180 secured on the business entity.)

1. Name of Business

2. Business telephone number

(

)

3. Address

4. Has the business ever filed bankruptcy?

(Street City State, ZIP code)

No

Date filed:

Yes

Chapter:

Petition #

5. Type of Entity

Sole Proprietor

Partnership

Limited Liability Company

(LLC)

Corporation

How is the LLC treated for tax purposes?

Date incorporated

Disregarded Entity

State where incorporated

Taxed as a Partnership

Has the state ever revoked the charter?

Taxed as a Corporation

No

Yes

When?

4180

Page 1 of 5

Department of the Treasury – Internal Revenue Service

Form

(Rev. 9-2004)

Catalog No. 22710P

1

1 2

2 3

3 4

4 5

5