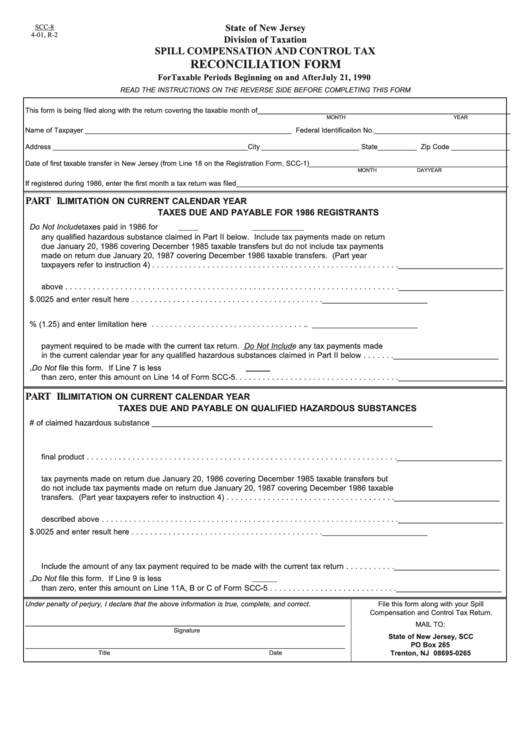

State of New Jersey

SCC-8

4-01, R-2

Division of Taxation

SPILL COMPENSATION AND CONTROL TAX

RECONCILIATION FORM

For Taxable Periods Beginning on and After July 21, 1990

READ THE INSTRUCTIONS ON THE REVERSE SIDE BEFORE COMPLETING THIS FORM

This form is being filed along with the return covering the taxable month of_________________________________________________________________

MONTH

YEAR

Name of Taxpayer _____________________________________________________ Federal Identificaiton No.___________________________________

Address __________________________________________________City _________________________ State__________ Zip Code _______________

Date of first taxable transfer in New Jersey (from Line 18 on the Registration Form, SCC-1)___________________________________________________

MONTH

DAY

YEAR

If registered during 1986, enter the first month a tax return was filed______________________________________________________________________

PART I

LIMITATION ON CURRENT CALENDAR YEAR

TAXES DUE AND PAYABLE FOR 1986 REGISTRANTS

1. Total taxes due and payable during the 1986 calendar year. Do Not Include taxes paid in 1986 for

any qualified hazardous substance claimed in Part II below. Include tax payments made on return

due January 20, 1986 covering December 1985 taxable transfers but do not include tax payments

made on return due January 20, 1987 covering December 1986 taxable transfers. (Part year

taxpayers refer to instruction 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

2. Enter the number of barrels of hazardous substances subject to tax for the same period described

above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

3. Multiply Line 2 by $.0025 and enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

4. Add the amounts on Lines 1 and 3 and enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

5. Multiply Line 4 by 125% (1.25) and enter limitation here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

6. Enter the total taxes paid to date during the current calendar year. Include the amount of any tax

payment required to be made with the current tax return. Do Not Include any tax payments made

in the current calendar year for any qualified hazardous substances claimed in Part II below . . . . . . . ________________________

7. Subtract Line 6 from Line 5. If Line 7 is greater than zero, Do Not file this form. If Line 7 is less

than zero, enter this amount on Line 14 of Form SCC-5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

PART II

LIMITATION ON CURRENT CALENDAR YEAR

TAXES DUE AND PAYABLE ON QUALIFIED HAZARDOUS SUBSTANCES

1. Name and C.A.S. # of claimed hazardous substance ________________________________________________________________

2. Name of nonhazardous final product manufactured by taxpayer________________________________________________________

3. Percent by weight of claimed hazardous substance used in the manufacture of the nonhazardous

final product . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

4. Total amount of taxes paid on claimed hazardous substance during the 1986 calendar year. Include

tax payments made on return due January 20, 1986 covering December 1985 taxable transfers but

do not include tax payments made on return due January 20, 1987 covering December 1986 taxable

transfers. (Part year taxpayers refer to instruction 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

5. Enter the number of barrels of claimed hazardous substance subject to tax for the same period

described above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

6. Multiply Line 5 by $.0025 and enter result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

7. Add the amounts on Lines 4 and 6 and enter limitation here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

8. Total amount of taxes paid to date on claimed hazardous substance during the current calendar year.

Include the amount of any tax payment required to be made with the current tax return . . . . . . . . . . . ________________________

9. Subtract Line 8 from Line 7. If Line 9 is greater the an zero, Do Not file this form. If Line 9 is less

than zero, enter this amount on Line 11A, B or C of Form SCC-5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________________________

Under penalty of perjury, I declare that the above information is true, complete, and correct.

File this form along with your Spill

Compensation and Control Tax Return.

_________________________________________________________________________

MAIL TO:

Signature

State of New Jersey, SCC

_________________________________________________________________________

PO Box 265

Title

Date

Trenton, NJ 08695-0265

1

1