Form Rp-436 -Application For Real Property Tax Exemption For Propert The Benefit Of Church Members - 2008

ADVERTISEMENT

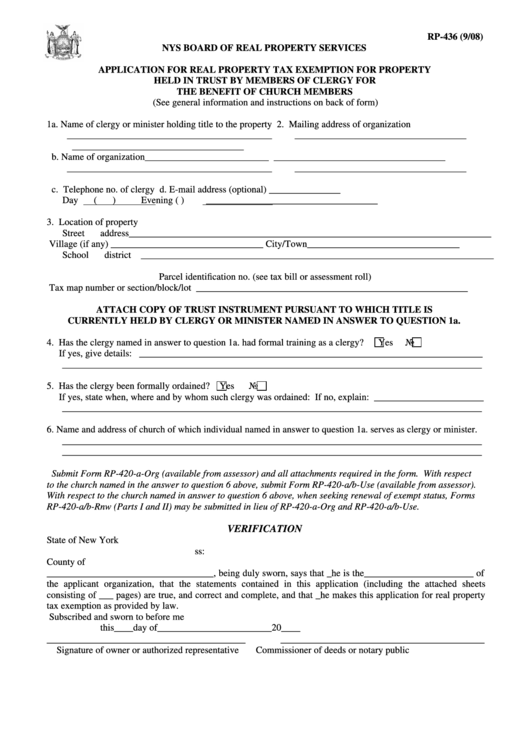

RP-436 (9/08)

NYS BOARD OF REAL PROPERTY SERVICES

APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR PROPERTY

HELD IN TRUST BY MEMBERS OF CLERGY FOR

THE BENEFIT OF CHURCH MEMBERS

(See general information and instructions on back of form)

1a. Name of clergy or minister holding title to the property

2. Mailing address of organization

___________________________________________

____________________________________

____________________________________

b. Name of organization __________________________

____________________________________

___________________________________________

____________________________________

c. Telephone no. of clergy

d. E-mail address (optional) _______________

Day (

)

Evening (

)

____________________________________

3. Location of property

Street address ____________________________________________________________________________

Village (if any) ________________________________

City/Town________________________________

School district

__________________________________________________________________________

Parcel identification no. (see tax bill or assessment roll)

Tax map number or section/block/lot _________________________________________________________

ATTACH COPY OF TRUST INSTRUMENT PURSUANT TO WHICH TITLE IS

CURRENTLY HELD BY CLERGY OR MINISTER NAMED IN ANSWER TO QUESTION 1a.

4. Has the clergy named in answer to question 1a. had formal training as a clergy?

Yes

No

If yes, give details: ________________________________________________________________________

________________________________________________________________________________________

5. Has the clergy been formally ordained?

Yes

No

If yes, state when, where and by whom such clergy was ordained: If no, explain: _______________________

________________________________________________________________________________________

6. Name and address of church of which individual named in answer to question 1a. serves as clergy or minister.

________________________________________________________________________________________

________________________________________________________________________________________

Submit Form RP-420-a-Org (available from assessor) and all attachments required in the form. With respect

to the church named in the answer to question 6 above, submit Form RP-420-a/b-Use (available from assessor).

With respect to the church named in answer to question 6 above, when seeking renewal of exempt status, Forms

RP-420-a/b-Rnw (Parts I and II) may be submitted in lieu of RP-420-a-Org and RP-420-a/b-Use.

VERIFICATION

State of New York

ss:

County of

___________________________________, being duly sworn, says that _he is the_______________________ of

the applicant organization, that the statements contained in this application (including the attached sheets

consisting of ___ pages) are true, and correct and complete, and that _he makes this application for real property

tax exemption as provided by law.

Subscribed and sworn to before me

this____day of________________________20____

______________________________________

_______________________________________

Signature of owner or authorized representative

Commissioner of deeds or notary public

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2