PRINT

CLEAR

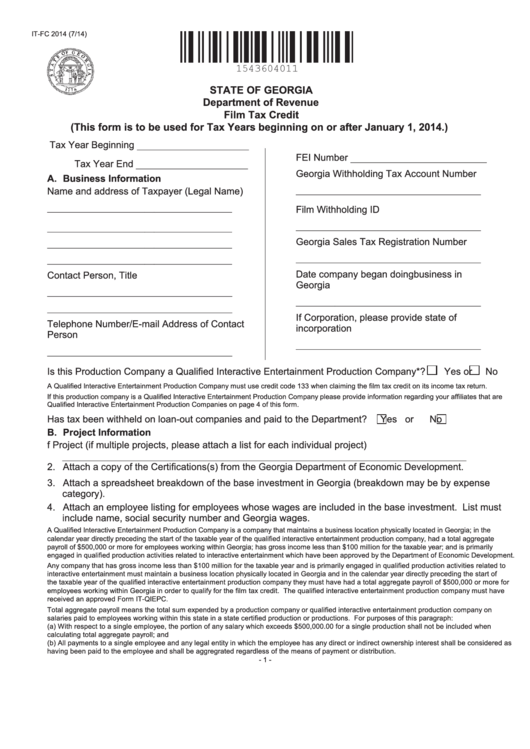

IT-FC 2014 (7/14)

STATE OF GEORGIA

Department of Revenue

Film Tax Credit

(This form is to be used for Tax Years beginning on or after January 1, 2014.)

Tax Year Beginning _______________________

FEI Number ____________________________

Tax Year End _______________________

Georgia Withholding Tax Account Number

A. Business Information

______________________________________

Name and address of Taxpayer (Legal Name)

______________________________________

Film Withholding ID

______________________________________

______________________________________

Georgia Sales Tax Registration Number

______________________________________

______________________________________

______________________________________

Date company began doing business in

Contact Person, Title

Georgia

______________________________________

______________________________________

______________________________________

If Corporation, please provide state of

Telephone Number/E-mail Address of Contact

incorporation

Person

______________________________________

______________________________________

Is this Production Company a Qualified Interactive Entertainment Production Company*?

Yes or

No

A Qualified Interactive Entertainment Production Company must use credit code 133 when claiming the film tax credit on its income tax return.

If this production company is a Qualified Interactive Entertainment Production Company please provide information regarding your affiliates that are

Qualified Interactive Entertainment Production Companies on page 4 of this form.

Has tax been withheld on loan-out companies and paid to the Department?

Yes or

No

B. Project Information

1. Name of Project (if multiple projects, please attach a list for each individual project)

___________________________________________________________________________________

2. Attach a copy of the Certifications(s) from the Georgia Department of Economic Development.

3. Attach a spreadsheet breakdown of the base investment in Georgia (breakdown may be by expense

category).

4. Attach an employee listing for employees whose wages are included in the base investment. List must

include name, social security number and Georgia wages.

A Qualified Interactive Entertainment Production Company is a company that maintains a business location physically located in Georgia; in the

calendar year directly preceding the start of the taxable year of the qualified interactive entertainment production company, had a total aggregate

payroll of $500,000 or more for employees working within Georgia; has gross income less than $100 million for the taxable year; and is primarily

engaged in qualified production activities related to interactive entertainment which have been approved by the Department of Economic Development.

Any company that has gross income less than $100 million for the taxable year and is primarily engaged in qualified production activities related to

interactive entertainment must maintain a business location physically located in Georgia and in the calendar year directly preceding the start of

the taxable year of the qualified interactive entertainment production company they must have had a total aggregate payroll of $500,000 or more for

employees working within Georgia in order to qualify for the film tax credit. The qualified interactive entertainment production company must have

received an approved Form IT-QIEPC.

Total aggregate payroll means the total sum expended by a production company or qualified interactive entertainment production company on

salaries paid to employees working within this state in a state certified production or productions. For purposes of this paragraph:

(a) With respect to a single employee, the portion of any salary which exceeds $500,000.00 for a single production shall not be included when

calculating total aggregate payroll; and

(b) All payments to a single employee and any legal entity in which the employee has any direct or indirect ownership interest shall be considered as

having been paid to the employee and shall be aggregrated regardless of the means of payment or distribution.

- 1 -

1

1 2

2 3

3 4

4