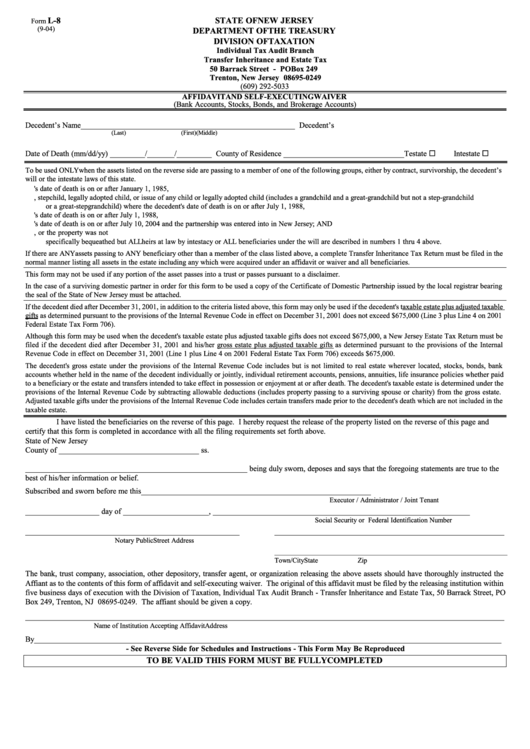

L-8

STATE OF NEW JERSEY

Form

(9-04)

DEPARTMENT OF THE TREASURY

DIVISION OF TAXATION

Individual Tax Audit Branch

Transfer Inheritance and Estate Tax

50 Barrack Street - PO Box 249

Trenton, New Jersey 08695-0249

(609) 292-5033

AFFIDAVIT AND SELF-EXECUTING WAIVER

(Bank Accounts, Stocks, Bonds, and Brokerage Accounts)

Decedent’s Name_______________________________________________________ Decedent’s S.S. No. ____________/__________/____________

(Last)

(First)

(Middle)

Date of Death (mm/dd/yy) _________/_______/_________ County of Residence _______________________________

Testate

Intestate

To be used ONLY when the assets listed on the reverse side are passing to a member of one of the following groups, either by contract, survivorship, the decedent’s

will or the intestate laws of this state.

1. Surviving spouse where the decedent's date of death is on or after January 1, 1985,

2. Child, stepchild, legally adopted child, or issue of any child or legally adopted child (includes a grandchild and a great-grandchild but not a step-grandchild

or a great-stepgrandchild) where the decedent's date of death is on or after July 1, 1988,

3. Parent and/or grandparent where the decedent's date of death is on or after July 1, 1988,

4. Surviving domestic partner where the decedent's date of death is on or after July 10, 2004 and the partnership was entered into in New Jersey; AND

5. The beneficiary succeeds to the assets by contract or survivorship or the property is specifically bequeathed to said beneficiary, or the property was not

specifically bequeathed but ALL heirs at law by intestacy or ALL beneficiaries under the will are described in numbers 1 thru 4 above.

If there are ANY assets passing to ANY beneficiary other than a member of the class listed above, a complete Transfer Inheritance Tax Return must be filed in the

normal manner listing all assets in the estate including any which were acquired under an affidavit or waiver and all beneficiaries.

This form may not be used if any portion of the asset passes into a trust or passes pursuant to a disclaimer.

In the case of a surviving domestic partner in order for this form to be used a copy of the Certificate of Domestic Partnership issued by the local registrar bearing

the seal of the State of New Jersey must be attached.

If the decedent died after December 31, 2001, in addition to the criteria listed above, this form may only be used if the decedent's taxable estate plus adjusted taxable

gifts as determined pursuant to the provisions of the Internal Revenue Code in effect on December 31, 2001 does not exceed $675,000 (Line 3 plus Line 4 on 2001

Federal Estate Tax Form 706).

Although this form may be used when the decedent's taxable estate plus adjusted taxable gifts does not exceed $675,000, a New Jersey Estate Tax Return must be

filed if the decedent died after December 31, 2001 and his/her gross estate plus adjusted taxable gifts as determined pursuant to the provisions of the Internal

Revenue Code in effect on December 31, 2001 (Line 1 plus Line 4 on 2001 Federal Estate Tax Form 706) exceeds $675,000.

The decedent's gross estate under the provisions of the Internal Revenue Code includes but is not limited to real estate wherever located, stocks, bonds, bank

accounts whether held in the name of the decedent individually or jointly, individual retirement accounts, pensions, annuities, life insurance policies whether paid

to a beneficiary or the estate and transfers intended to take effect in possession or enjoyment at or after death. The decedent's taxable estate is determined under the

provisions of the Internal Revenue Code by subtracting allowable deductions (includes property passing to a surviving spouse or charity) from the gross estate.

Adjusted taxable gifts under the provisions of the Internal Revenue Code includes certain transfers made prior to the decedent's death which are not included in the

taxable estate.

I have listed the beneficiaries on the reverse of this page. I hereby request the release of the property listed on the reverse of this page and

certify that this form is completed in accordance with all the filing requirements set forth above.

State of New Jersey

County of ____________________________________ ss.

_________________________________________________________ being duly sworn, deposes and says that the foregoing statements are true to the

best of his/her information or belief.

Subscribed and sworn before me this

___________________________________________________________

Executor / Administrator / Joint Tenant

___________________ day of ______________________, _______

___________________________________________________________

Social Security or Federal Identification Number

_______________________________________________________

___________________________________________________________

Notary Public

Street Address

__________________________________________________________________

Town/City

State

Zip

The bank, trust company, association, other depository, transfer agent, or organization releasing the above assets should have thoroughly instructed the

Affiant as to the contents of this form of affidavit and self-executing waiver. The original of this affidavit must be filed by the releasing institution within

five business days of execution with the Division of Taxation, Individual Tax Audit Branch - Transfer Inheritance and Estate Tax, 50 Barrack Street, PO

Box 249, Trenton, NJ 08695-0249. The affiant should be given a copy.

___________________________________________________________________________________________________________________________

Name of Institution Accepting Affidavit

Address

By________________________________________________________________________________________________________________________

- See Reverse Side for Schedules and Instructions - This Form May Be Reproduced

TO BE VALID THIS FORM MUST BE FULLY COMPLETED

1

1 2

2