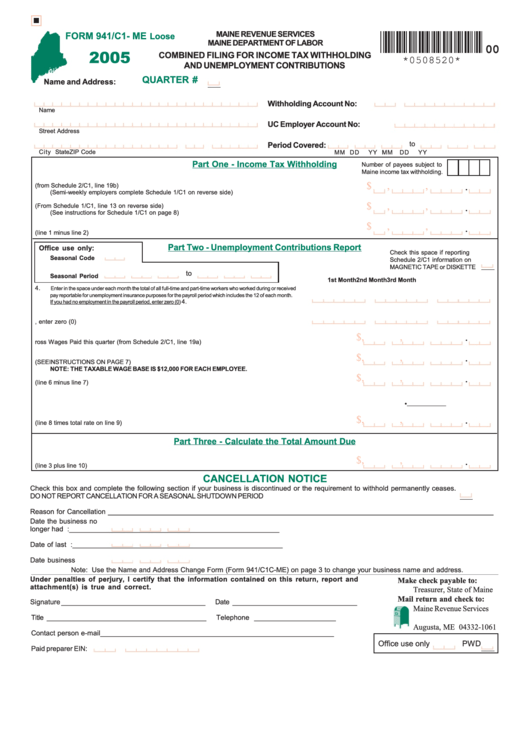

Form 941/c1- Me Loose - Combined Filing For Income Tax Withholding And Unemployment Contributions - 2005

ADVERTISEMENT

MAINE REVENUE SERVICES

FORM 941/C1- ME

Loose

MAINE DEPARTMENT OF LABOR

00

2005

COMBINED FILING FOR INCOME TAX WITHHOLDING

*0508520*

AND UNEMPLOYMENT CONTRIBUTIONS

QUARTER #

Name and Address:

Withholding Account No:

Name

UC Employer Account No:

Street Address

to

Period Covered:

City

State

ZIP Code

MM

DD

YY

MM

DD

YY

Part One - Income Tax Withholding

Number of payees subject to

Maine income tax withholding.

$

,

,

1.

Maine income tax withheld this quarter (from Schedule 2/C1, line 19b)

.

(Semi-weekly employers complete Schedule 1/C1 on reverse side) ......................................................................... 1.

$

,

,

2.

Less any semi-weekly payments (From Schedule 1/C1, line 13 on reverse side)

.

(See instructions for Schedule 1/C1 on page 8) ......................................................................................................... 2.

$

,

,

.

3.

Income tax withholding due (line 1 minus line 2) ......................................................................................................... 3.

Part Two - Unemployment Contributions Report

Office use only:

Check this space if reporting

Seasonal Code

Schedule 2/C1 information on

MAGNETIC TAPE or DISKETTE

to

Seasonal Period

1st Month

2nd Month

3rd Month

4.

Enter in the space under each month the total of all full-time and part-time workers who worked during or received

pay reportable for unemployment insurance purposes for the payroll period which includes the 12 of each month.

4.

If you had no employment in the payroll period, enter zero (0) .......................................................................................

5.

Number of female employees included on line 4. If none, enter zero (0) .................................. 5.

$

,

,

.

6.

Total Unemployment Compensation Gross Wages Paid this quarter (from Schedule 2/C1, line 19a) .................. 6.

$

,

,

.

7.

DEDUCT EXCESS WAGES (SEE INSTRUCTIONS ON PAGE 7) ......................................................................... 7.

NOTE: THE TAXABLE WAGE BASE IS $12,000 FOR EACH EMPLOYEE.

$

,

,

.

8.

Taxable wages paid in this quarter (line 6 minus line 7) .......................................................................................... 8.

.

__________

9.

Contribution rate ..................................................................................................................................................... 9.

$

,

,

.

10.

Contributions due (line 8 times total rate on line 9) .............................................................................................. 10.

Part Three - Calculate the Total Amount Due

$

,

,

.

11.

Amount due with this return (line 3 plus line 10) .................................................................................................... 11.

CANCELLATION NOTICE

Check this box and complete the following section if your business is discontinued or the requirement to withhold permanently ceases.

DO NOT REPORT CANCELLATION FOR A SEASONAL SHUTDOWN PERIOD ....................................................................................................

FINAL

Reason for Cancellation ___________________________________________________________________________________________________

Date the business no

longer had employees ...

Business Sold to Name: ______________________________________________________

Date of last payroll ........

Business Sold to Address: ______________________________________________________

Date business sold ........

______________________________________________________

Note: Use the Name and Address Change Form (Form 941/C1C-ME) on page 3 to change your business name and address.

Under penalties of perjury, I certify that the information contained on this return, report and

Make check payable to:

attachment(s) is true and correct.

Treasurer, State of Maine

Mail return and check to:

Signature _____________________________________

Date ________________________________

Maine Revenue Services

P.O. Box 1061

Title _________________________________________

Telephone _____________________

Augusta, ME 04332-1061

Contact person e-mail ____________________________________________________________

Office use only

PWD

Paid preparer EIN:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3