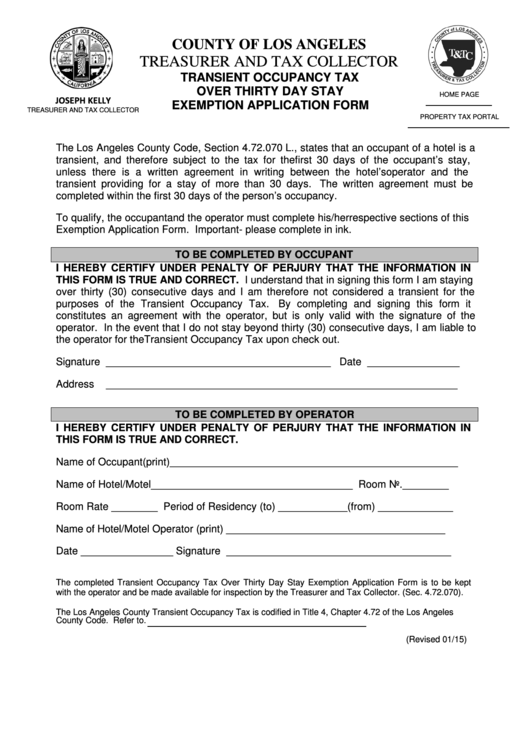

COUNTY OF LOS ANGELES

TREASURER AND TAX COLLECTOR

TRANSIENT OCCUPANCY TAX

OVER THIRTY DAY STAY

HOME PAGE

JOSEPH KELLY

TTC.LACOUNTY.GOV

EXEMPTION APPLICATION FORM

TREASURER AND TAX COLLECTOR

PROPERTY TAX PORTAL

The Los Angeles County Code, Section 4.72.070 L., states that an occupant of a hotel is a

transient, and therefore subject to the tax for the first 30 days of the occupant’s stay,

unless there is a written agreement in writing between the hotel’s operator and the

transient providing for a stay of more than 30 days. The written agreement must be

completed within the first 30 days of the person’s occupancy.

To qualify, the occupant and the operator must complete his/her respective sections of this

Exemption Application Form. Important- please complete in ink.

TO BE COMPLETED BY OCCUPANT

I HEREBY CERTIFY UNDER PENALTY OF PERJURY THAT THE INFORMATION IN

THIS FORM IS TRUE AND CORRECT. I understand that in signing this form I am staying

over thirty (30) consecutive days and I am therefore not considered a transient for the

purposes of the Transient Occupancy Tax.

By completing and signing this form it

constitutes an agreement with the operator, but is only valid with the signature of the

operator. In the event that I do not stay beyond thirty (30) consecutive days, I am liable to

the operator for the Transient Occupancy Tax upon check out.

Signature _______________________________________ Date ________________

Address

_____________________________________________________________

TO BE COMPLETED BY OPERATOR

I HEREBY CERTIFY UNDER PENALTY OF PERJURY THAT THE INFORMATION IN

THIS FORM IS TRUE AND CORRECT.

Name of Occupant (print)__________________________________________________

Name of Hotel/Motel___________________________________ Room No.________

Room Rate ________ Period of Residency (to) ____________(from) _____________

Name of Hotel/Motel Operator (print) ______________________________________

Date ________________ Signature _______________________________________

The completed Transient Occupancy Tax Over Thirty Day Stay Exemption Application Form is to be kept

with the operator and be made available for inspection by the Treasurer and Tax Collector. (Sec. 4.72.070).

The Los Angeles County Transient Occupancy Tax is codified in Title 4, Chapter 4.72 of the Los Angeles

County Code. Refer to Angeles County.

(Revised 01/15)

1

1