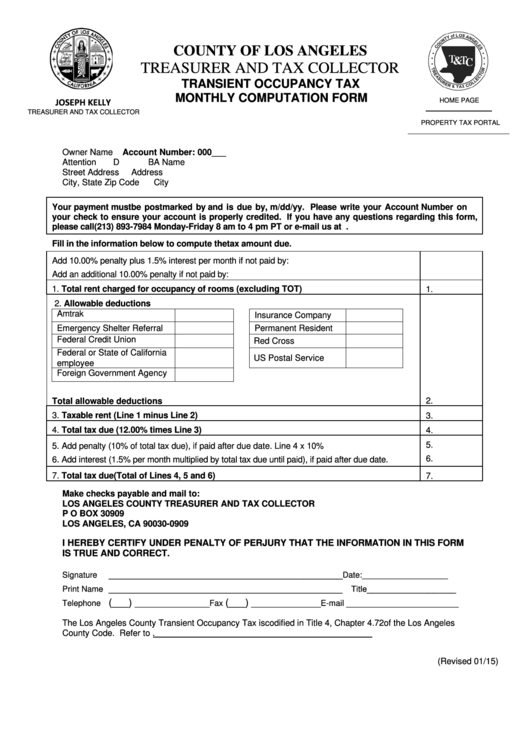

COUNTY OF LOS ANGELES

TREASURER AND TAX COLLECTOR

TRANSIENT OCCUPANCY TAX

MONTHLY COMPUTATION FORM

JOSEPH KELLY

HOME PAGE

TTC.LACOUNTY.GOV

TREASURER AND TAX COLLECTOR

PROPERTY TAX PORTAL

Owner Name

Account Number: 000___

Attention

DBA Name

Street Address

Address

City, State Zip Code

City

Your payment must be postmarked by and is due by, m/dd/yy. Please write your Account Number on

your check to ensure your account is properly credited. If you have any questions regarding this form,

please call (213) 893-7984 Monday-Friday 8 am to 4 pm PT or e-mail us at tot@ttc.lacounty.gov.

Fill in the information below to compute the tax amount due.

Add 10.00% penalty plus 1.5% interest per month if not paid by:

Add an additional 10.00% penalty if not paid by:

1. Total rent charged for occupancy of rooms (excluding TOT)

1.

2. Allowable deductions

Amtrak

Insurance Company

Emergency Shelter Referral

Permanent Resident

Federal Credit Union

Red Cross

Federal or State of California

US Postal Service

employee

Foreign Government Agency

Total allowable deductions

2.

3. Taxable rent (Line 1 minus Line 2)

3.

4. Total tax due (12.00% times Line 3)

4.

5.

5. Add penalty (10% of total tax due), if paid after due date. Line 4 x 10%

6.

6. Add interest (1.5% per month multiplied by total tax due until paid), if paid after due date.

7. Total tax due (Total of Lines 4, 5 and 6)

7.

Make checks payable and mail to:

LOS ANGELES COUNTY TREASURER AND TAX COLLECTOR

P O BOX 30909

LOS ANGELES, CA 90030-0909

I HEREBY CERTIFY UNDER PENALTY OF PERJURY THAT THE INFORMATION IN THIS FORM

IS TRUE AND CORRECT.

__________________________________________

Signature

Date: ___________________

__________________________________________

________________

Print Name

Title

(___) ______________

(___) _____________

_____________________

Telephone

Fax

E-mail

The Los Angeles County Transient Occupancy Tax is codified in Title 4, Chapter 4.72 of the Los Angeles

County Code. Refer to Angeles County.

(Revised 01/15)

1

1