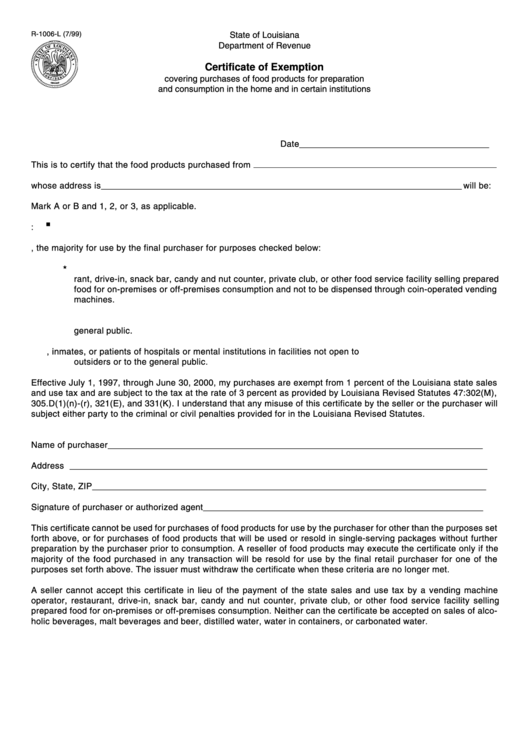

R-1006-L (7/99)

State of Louisiana

Department of Revenue

Certificate of Exemption

covering purchases of food products for preparation

and consumption in the home and in certain institutions

Date ________________________________________

This is to certify that the food products purchased from

whose address is ____________________________________________________________________________ will be:

Mark A or B and 1, 2, or 3, as applicable.

A.

used exclusively for the purposes checked below:

B.

resold, the majority for use by the final purchaser for purposes checked below:

1.

for preparation and human consumption by the final purchaser in the home or location other than a restau-

rant, drive-in, snack bar, candy and nut counter, private club, or other food service facility selling prepared

food for on-premises or off-premises consumption and not to be dispensed through coin-operated vending

machines.

2.

for consumption by the staff or students of educational institutions in facilities not open to outsiders or to the

general public.

3.

for consumption by the staff, inmates, or patients of hospitals or mental institutions in facilities not open to

outsiders or to the general public.

Effective July 1, 1997, through June 30, 2000, my purchases are exempt from 1 percent of the Louisiana state sales

and use tax and are subject to the tax at the rate of 3 percent as provided by Louisiana Revised Statutes 47:302(M),

305.D(1)(n)-(r), 321(E), and 331(K). I understand that any misuse of this certificate by the seller or the purchaser will

subject either party to the criminal or civil penalties provided for in the Louisiana Revised Statutes.

Name of purchaser _______________________________________________________________________________

Address ________________________________________________________________________________________

City, State, ZIP ___________________________________________________________________________________

Signature of purchaser or authorized agent ___________________________________________________________

This certificate cannot be used for purchases of food products for use by the purchaser for other than the purposes set

forth above, or for purchases of food products that will be used or resold in single-serving packages without further

preparation by the purchaser prior to consumption. A reseller of food products may execute the certificate only if the

majority of the food purchased in any transaction will be resold for use by the final retail purchaser for one of the

purposes set forth above. The issuer must withdraw the certificate when these criteria are no longer met.

A seller cannot accept this certificate in lieu of the payment of the state sales and use tax by a vending machine

operator, restaurant, drive-in, snack bar, candy and nut counter, private club, or other food service facility selling

prepared food for on-premises or off-premises consumption. Neither can the certificate be accepted on sales of alco-

holic beverages, malt beverages and beer, distilled water, water in containers, or carbonated water.

1

1