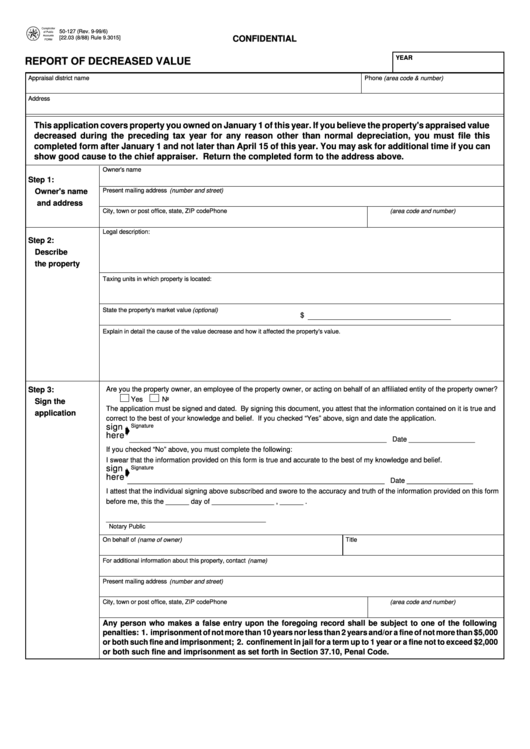

Form 50-127 - Report Of Decreased Value

ADVERTISEMENT

50-127 (Rev. 9-99/6)

CONFIDENTIAL

[22.03 (8/88) Rule 9.3015]

YEAR

REPORT OF DECREASED VALUE

Appraisal district name

Phone (area code & number)

Address

This application covers property you owned on January 1 of this year. If you believe the property's appraised value

decreased during the preceding tax year for any reason other than normal depreciation, you must file this

completed form after January 1 and not later than April 15 of this year. You may ask for additional time if you can

show good cause to the chief appraiser. Return the completed form to the address above.

Owner's name

Step 1:

Present mailing address (number and street)

Owner's name

and address

City, town or post office, state, ZIP code

Phone (area code and number)

Legal description:

Step 2:

Describe

the property

Taxing units in which property is located:

State the property's market value (optional)

$

Explain in detail the cause of the value decrease and how it affected the property's value.

Step 3:

Are you the property owner, an employee of the property owner, or acting on behalf of an affiliated entity of the property owner?

Yes

No

Sign the

The application must be signed and dated. By signing this document, you attest that the information contained on it is true and

application

correct to the best of your knowledge and belief. If you checked “Yes” above, sign and date the application.

sign

Signature

here

__________________________________________________________________ Date _________________

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and accurate to the best of my knowledge and belief.

sign

Signature

here

__________________________________________________________________ Date _________________

I attest that the individual signing above subscribed and swore to the accuracy and truth of the information provided on this form

before me, this the ______ day of ________________ , ______ .

_________________________________________

Notary Public

On behalf of (name of owner)

Title

For additional information about this property, contact (name)

Present mailing address (number and street)

City, town or post office, state, ZIP code

Phone (area code and number)

Any person who makes a false entry upon the foregoing record shall be subject to one of the following

penalties: 1. imprisonment of not more than 10 years nor less than 2 years and/or a fine of not more than $5,000

or both such fine and imprisonment; 2. confinement in jail for a term up to 1 year or a fine not to exceed $2,000

or both such fine and imprisonment as set forth in Section 37.10, Penal Code.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2