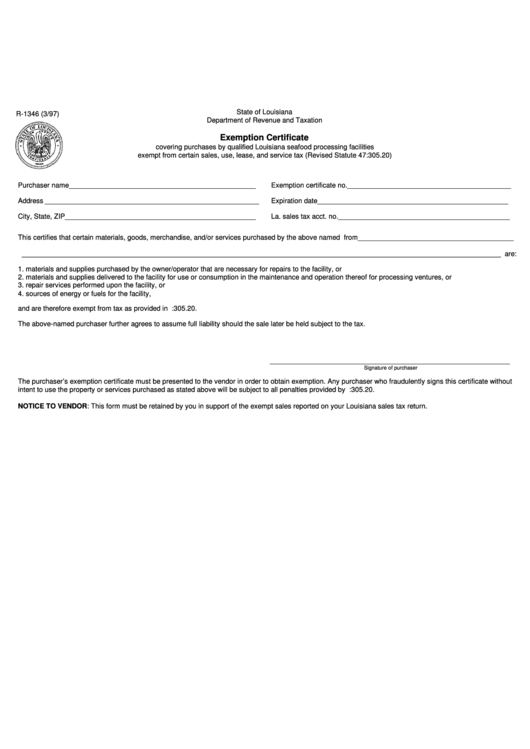

State of Louisiana

R-1346 (3/97)

Department of Revenue and Taxation

Exemption Certificate

covering purchases by qualified Louisiana seafood processing facilities

exempt from certain sales, use, lease, and service tax (Revised Statute 47:305.20)

Purchaser name ________________________________________________

Exemption certificate no. __________________________________________

Address _______________________________________________________

Expiration date _________________________________________________

City, State, ZIP _________________________________________________

La. sales tax acct. no. ____________________________________________

This certifies that certain materials, goods, merchandise, and/or services purchased by the above named from ________________________________________

___________________________________________________________________________________________________________________________ are:

1. materials and supplies purchased by the owner/operator that are necessary for repairs to the facility, or

2. materials and supplies delivered to the facility for use or consumption in the maintenance and operation thereof for processing ventures, or

3. repair services performed upon the facility, or

4. sources of energy or fuels for the facility,

and are therefore exempt from tax as provided in R.S. 47:305.20.

The above-named purchaser further agrees to assume full liability should the sale later be held subject to the tax.

Signature of purchaser

The purchaser’s exemption certificate must be presented to the vendor in order to obtain exemption. Any purchaser who fraudulently signs this certificate without

intent to use the property or services purchased as stated above will be subject to all penalties provided by R.S. 47:305.20.

NOTICE TO VENDOR: This form must be retained by you in support of the exempt sales reported on your Louisiana sales tax return.

1

1