Form St-7 - Farmer'S Exemption Certificate - 2017

ADVERTISEMENT

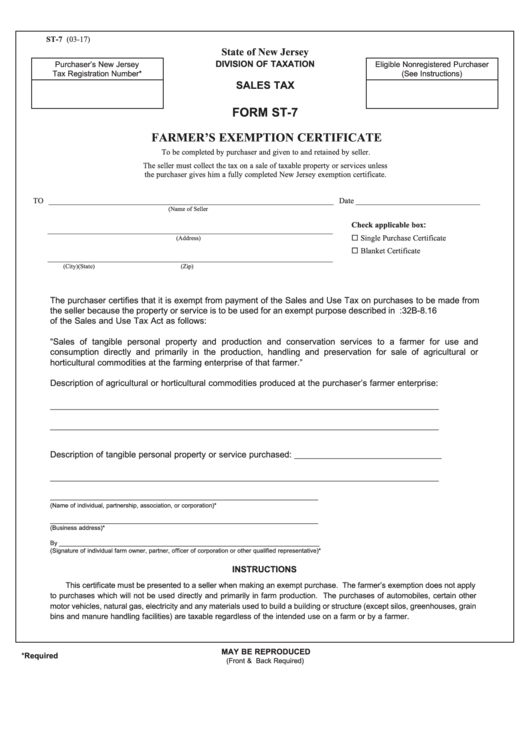

ST-7 (03-17)

State of New Jersey

DIVISION OF TAXATION

Purchaser’s New Jersey

Eligible Nonregistered Purchaser

Tax Registration Number*

(See Instructions)

SALES TAX

FORM ST-7

FARMER’S EXEMPTION CERTIFICATE

To be completed by purchaser and given to and retained by seller.

The seller must collect the tax on a sale of taxable property or services unless

the purchaser gives him a fully completed New Jersey exemption certificate.

TO _______________________________________________________________________ Date _______________________________

(Name of Seller

Check applicable box:

_______________________________________________________________________

¨ Single Purchase Certificate

(Address)

¨ Blanket Certificate

_______________________________________________________________________

(City)

(State)

(Zip)

The purchaser certifies that it is exempt from payment of the Sales and Use Tax on purchases to be made from

the seller because the property or service is to be used for an exempt purpose described in N.J.S.A. 54:32B-8.16

of the Sales and Use Tax Act as follows:

“Sales of tangible personal property and production and conservation services to a farmer for use and

consumption directly and primarily in the production, handling and preservation for sale of agricultural or

horticultural commodities at the farming enterprise of that farmer.”

Description of agricultural or horticultural commodities produced at the purchaser’s farmer enterprise:

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

Description of tangible personal property or service purchased:

_______________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________

(Name of individual, partnership, association, or corporation)*

_______________________________________________________________________

(Business address)*

_____________________________________________________________________

By

(Signature of individual farm owner, partner, officer of corporation or other qualified representative)*

INSTRUCTIONS

This certificate must be presented to a seller when making an exempt purchase. The farmer’s exemption does not apply

to purchases which will not be used directly and primarily in farm production. The purchases of automobiles, certain other

motor vehicles, natural gas, electricity and any materials used to build a building or structure (except silos, greenhouses, grain

bins and manure handling facilities) are taxable regardless of the intended use on a farm or by a farmer.

MAY BE REPRODUCED

*Required

(Front & Back Required)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1