Form Ftb 4684a - Demand For Tax Return - Questionnaire - 2013

ADVERTISEMENT

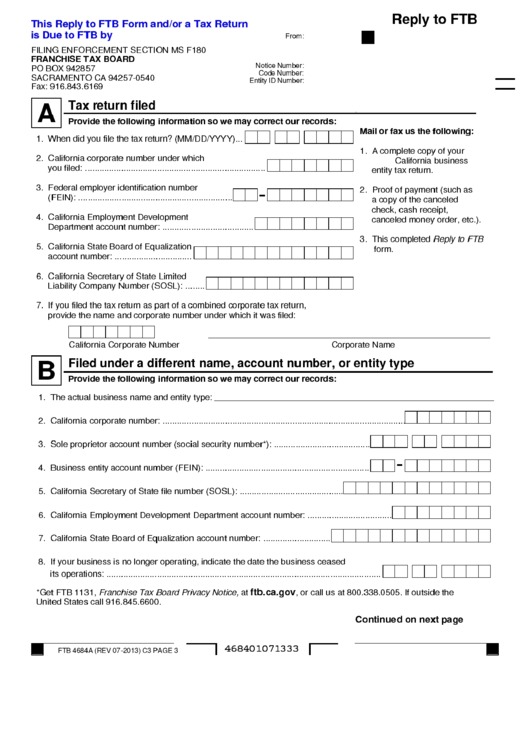

Reply to FTB

This Reply to FTB Form and/or a Tax Return

is Due to FTB by

From:

FILING ENFORCEMENT SECTION MS F180

FRANCHISE TAX BOARD

Notice Number:

PO BOX 942857

Code Number:

SACRAMENTO CA 94257-0540

Entity ID Number:

Fax: 916.843.6169

A

Tax return filed

Provide the following information so we may correct our records:

Mail or fax us the following:

1. When did you file the tax return? (MM/DD/YYYY)...

1. A complete copy of your

2. California corporate number under which

California business

you filed: ...........................................................................

entity tax return.

3. Federal employer identification number

2. Proof of payment (such as

(FEIN): ................................................................

a copy of the canceled

check, cash receipt,

4. California Employment Development

canceled money order, etc.).

Department account number: ......................................

Reply to FTB

3. This completed

5. California State Board of Equalization

form.

account number: ................................

6. California Secretary of State Limited

Liability Company Number (SOSL): ........

7. If you filed the tax return as part of a combined corporate tax return,

provide the name and corporate number under which it was filed:

California Corporate Number

Corporate Name

B

Filed under a different name, account number, or entity type

Provide the following information so we may correct our records:

1. The actual business name and entity type: __________________________________________________________

2. California corporate number: .....................................................................................................

3. Sole proprietor account number (social security number*): ........................................

4. Business entity account number (FEIN): ....................................................................

5. California Secretary of State file number (SOSL): ...........................................

6. California Employment Development Department account number: ...................................

7. California State Board of Equalization account number: ............................

8. If your business is no longer operating, indicate the date the business ceased

its operations: ..................................................................................................................

ftb.ca.gov

Franchise Tax Board Privacy Notice,

*Get FTB 1131,

at

, or call us at 800.338.0505. If outside the

United States call 916.845.6600.

Continued on next page

468401071333

FTB 4684A (REV 07-2013) C3 PAGE 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4