Form 1040ext-Me - Extension Payment Voucher For Individual Income Tax 2004

ADVERTISEMENT

34e. Type of Account: Indicate whether the account is a

Line 35c. Total Amount Due. This is the amount you owe. Do not

checking, savings, or NextGen Account. NOTE: Except for

send cash. If the amount you owe is less than $1.00, do not pay it.

NextGen Accounts, the account to receive the direct deposit

Enclose (do not staple or tape) a check or money order payable

must be in your name. If you are married, the account can be in

to Treasurer, State of Maine. Include your complete name, address

either name or in both your names. Some banks will not allow a

and telephone number on your check or money order. We will

joint refund to be deposited into an individual account. Refunds

send you a receipt for your payment only if you request it in writing

directed to your NextGen Account are subject to the terms and

and if you include a stamped, self-addressed envelope with your

conditions of the Program Description, Participation Agreement

request.

and any Supplement(s).

Line 36. FOR MAINE RESIDENTS ONLY: Maine Residents

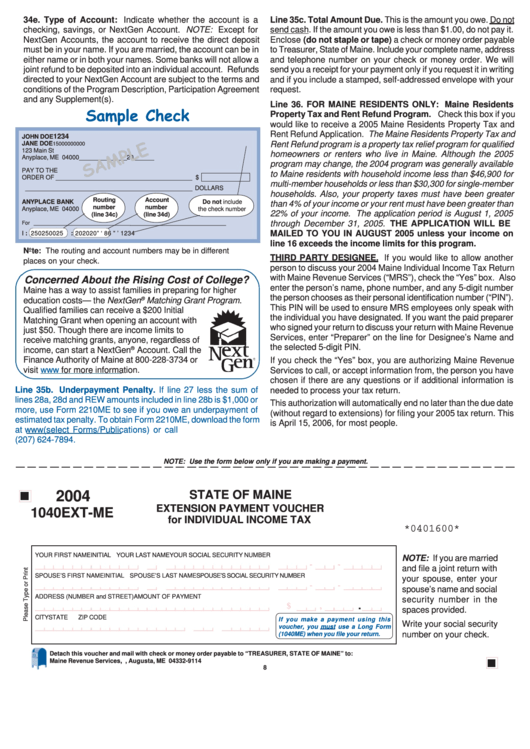

Sample Check

Property Tax and Rent Refund Program. Check this box if you

would like to receive a 2005 Maine Residents Property Tax and

Rent Refund Application. The Maine Residents Property Tax and

1234

JOHN DOE

Rent Refund program is a property tax relief program for qualified

JANE DOE

15000000000

123 Main St

homeowners or renters who live in Maine. Although the 2005

Anyplace, ME 04000

______________ 20 ______

program may change, the 2004 program was generally available

PAY TO THE

to Maine residents with household income less than $46,900 for

ORDER OF ________________________________________ $

multi-member households or less than $30,300 for single-member

_________________________________________________ DOLLARS

households. Also, your property taxes must have been greater

Routing

Account

ANYPLACE BANK

Do not include

than 4% of your income or your rent must have been greater than

number

number

Anyplace, ME 04000

the check number

22% of your income. The application period is August 1, 2005

(line 34c)

(line 34d)

____________________________

through December 31, 2005. THE APPLICATION WILL BE

For _________________________________

MAILED TO YOU IN AUGUST 2005 unless your income on

I : 250250025

: 202020” ‘ 86 ” ’ 1234

line 16 exceeds the income limits for this program.

Note: The routing and account numbers may be in different

THIRD PARTY DESIGNEE. If you would like to allow another

places on your check.

person to discuss your 2004 Maine Individual Income Tax Return

with Maine Revenue Services (“MRS”), check the “Yes” box. Also

Concerned About the Rising Cost of College?

enter the person’s name, phone number, and any 5-digit number

Maine has a way to assist families in preparing for higher

the person chooses as their personal identification number (“PIN”).

education costs— the NextGen

®

Matching Grant Program.

This PIN will be used to ensure MRS employees only speak with

Qualified families can receive a $200 Initial

the individual you have designated. If you want the paid preparer

Matching Grant when opening an account with

who signed your return to discuss your return with Maine Revenue

just $50. Though there are income limits to

Services, enter “Preparer” on the line for Designee’s Name and

receive matching grants, anyone, regardless of

the selected 5-digit PIN.

®

income, can start a NextGen

Account. Call the

Finance Authority of Maine at 800-228-3734 or

If you check the “Yes” box, you are authorizing Maine Revenue

visit

for more information.

Services to call, or accept information from, the person you have

chosen if there are any questions or if additional information is

Line 35b. Underpayment Penalty. If line 27 less the sum of

needed to process your tax return.

lines 28a, 28d and REW amounts included in line 28b is $1,000 or

This authorization will automatically end no later than the due date

more, use Form 2210ME to see if you owe an underpayment of

(without regard to extensions) for filing your 2005 tax return. This

estimated tax penalty. To obtain Form 2210ME, download the form

is April 15, 2006, for most people.

at (select Forms/Publications) or call

(207) 624-7894.

NOTE: Use the form below only if you are making a payment.

2004

STATE OF MAINE

*0401600*

EXTENSION PAYMENT VOUCHER

1040EXT-ME

00

for INDIVIDUAL INCOME TAX

*0401600*

YOUR FIRST NAME

INITIAL YOUR LAST NAME

YOUR SOCIAL SECURITY NUMBER

NOTE: If you are married

-

-

and file a joint return with

SPOUSE’S FIRST NAME

INITIAL SPOUSE’S LAST NAME

SPOUSE’S SOCIAL SECURITY NUMBER

your spouse, enter your

-

-

spouse’s name and social

ADDRESS (NUMBER and STREET)

AMOUNT OF PAYMENT

security number in the

.

$

,

spaces provided.

CITY

STATE

ZIP CODE

If you make a payment using this

Write your social security

voucher, you must use a Long Form

number on your check.

(1040ME) when you file your return.

Detach this voucher and mail with check or money order payable to “TREASURER, STATE OF MAINE” to:

Maine Revenue Services, P.O. Box 9114, Augusta, ME 04332-9114

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1