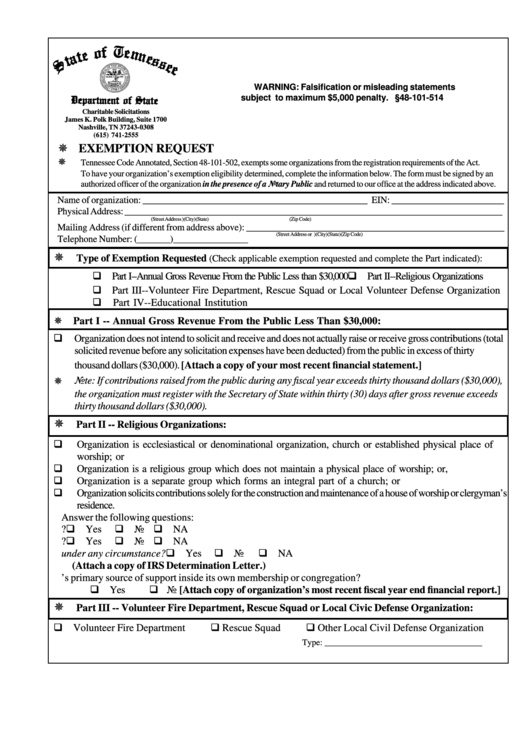

Form Ss-6042 - Exemption Request Form

ADVERTISEMENT

WARNING: Falsification or misleading statements

subject to maximum $5,000 penalty. T.C.A. §48-101-514

Charitable Solicitations

James K. Polk Building, Suite 1700

Nashville, TN 37243-0308

(615) 741-2555

¯ EXEMPTION REQUEST

¯

Tennessee Code Annotated, Section 48-101-502, exempts some organizations from the registration requirements of the Act.

To have your organization’s exemption eligibility determined, complete the information below. The form must be signed by an

authorized officer of the organization in the presence of a Notary Public and returned to our office at the address indicated above.

Name of organization: ________________________________________________ EIN: ________________________

Physical Address: _________________________________________________________________________________

(Street Address )

(City)

(State)

(Zip Code)

Mailing Address (if different from address above): _______________________________________________________

(Street Address or P.O. Box)

(City)

(State)

(Zip Code)

Telephone Number: (_______)________________

¯

Type of Exemption Requested

(Check applicable exemption requested and complete the Part indicated):

q

q

Part I--Annual Gross Revenue From the Public Less than $30,000

Part II--Religious Organizations

q

Part III--Volunteer Fire Department, Rescue Squad or Local Volunteer Defense Organization

q

Part IV--Educational Institution

¯

Part I -- Annual Gross Revenue From the Public Less Than $30,000:

q

Organization does not intend to solicit and receive and does not actually raise or receive gross contributions (total

solicited revenue before any solicitation expenses have been deducted) from the public in excess of thirty

thousand dollars ($30,000). [Attach a copy of your most recent financial statement.]

¯

Note: If contributions raised from the public during any fiscal year exceeds thirty thousand dollars ($30,000),

the organization must register with the Secretary of State within thirty (30) days after gross revenue exceeds

thirty thousand dollars ($30,000).

¯

Part II -- Religious Organizations:

q

Organization is ecclesiastical or denominational organization, church or established physical place of

worship; or

q

Organization is a religious group which does not maintain a physical place of worship; or,

q

Organization is a separate group which forms an integral part of a church; or

q

Organization solicits contributions solely for the construction and maintenance of a house of worship or clergyman’s

residence.

Answer the following questions:

q

q

No q NA

1. Is there an established specific place for worship?

Yes

q

q

No q NA

2. Are religious services and activities held on a regular basis?

Yes

q Yes

q No

q NA

3. Are you required to file an IRS Form 990 under any circumstance?

(Attach a copy of IRS Determination Letter.)

4. Is the organization’s primary source of support inside its own membership or congregation?

q Yes

q No [Attach copy of organization’s most recent fiscal year end financial report.]

¯

Part III -- Volunteer Fire Department, Rescue Squad or Local Civic Defense Organization:

q Volunteer Fire Department

q Rescue Squad

q Other Local Civil Defense Organization

Type: ____________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2