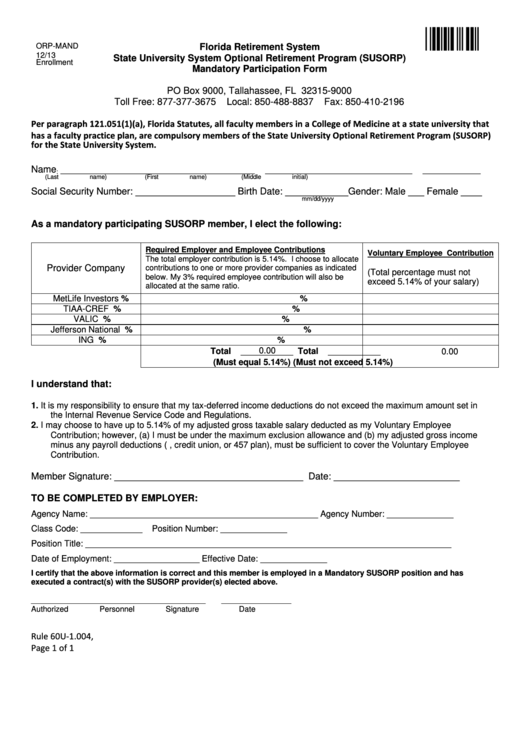

*EZ

ORP-MAND

Florida Retirement System

12/13

State University System Optional Retirement Program (SUSORP)

Enrollment

Mandatory Participation Form

PO Box 9000, Tallahassee, FL 32315-9000

Toll Free: 877-377-3675

Local: 850-488-8837

Fax: 850-410-2196

Per paragraph 121.051(1)(a), Florida Statutes, all faculty members in a College of Medicine at a state university that

has a faculty practice plan, are compulsory members of the State University Optional Retirement Program (SUSORP)

for the State University System.

Name

_____________________________________

____________________________

___________

:

(Last name)

(First name)

(Middle initial)

Social Security Number: ___________________ Birth Date: ____________Gender: Male ___ Female ____

mm/dd/yyyy

As a mandatory participating SUSORP member, I elect the following:

Required Employer and Employee Contributions

Voluntary Employee Contribution

The total employer contribution is 5.14%. I choose to allocate

Provider Company

contributions to one or more provider companies as indicated

(Total percentage must not

below. My 3% required employee contribution will also be

exceed 5.14% of your salary)

allocated at the same ratio.

MetLife Investors

%

%

TIAA-CREF

%

%

VALIC

%

%

Jefferson National

%

%

ING

%

%

0.00

Total

___________

Total

___________

0.00

(Must equal 5.14%)

(Must not exceed 5.14%)

I understand that:

1.

It is my responsibility to ensure that my tax-deferred income deductions do not exceed the maximum amount set in

the Internal Revenue Service Code and Regulations.

2.

I may choose to have up to 5.14% of my adjusted gross taxable salary deducted as my Voluntary Employee

Contribution; however, (a) I must be under the maximum exclusion allowance and (b) my adjusted gross income

minus any payroll deductions (e.g., credit union, or 457 plan), must be sufficient to cover the Voluntary Employee

Contribution.

Member Signature: ____________________________________

Date: ________________________

TO BE COMPLETED BY EMPLOYER:

Agency Name: ________________________________________________ Agency Number: ______________

Class Code: _____________

Position Number: ______________

Position Title: _____________________________________________________________________________

Date of Employment: __________________ Effective Date: ______________

I certify that the above information is correct and this member is employed in a Mandatory SUSORP position and has

executed a contract(s) with the SUSORP provider(s) elected above.

________________________________________

________________

Authorized Personnel Signature

Date

Rule 60U‐1.004, F.A.C.

Page 1 of 1

1

1