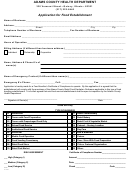

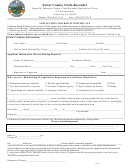

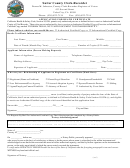

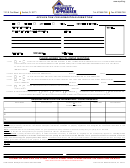

Application For Special Assessment Form Berkeley County

ADVERTISEMENT

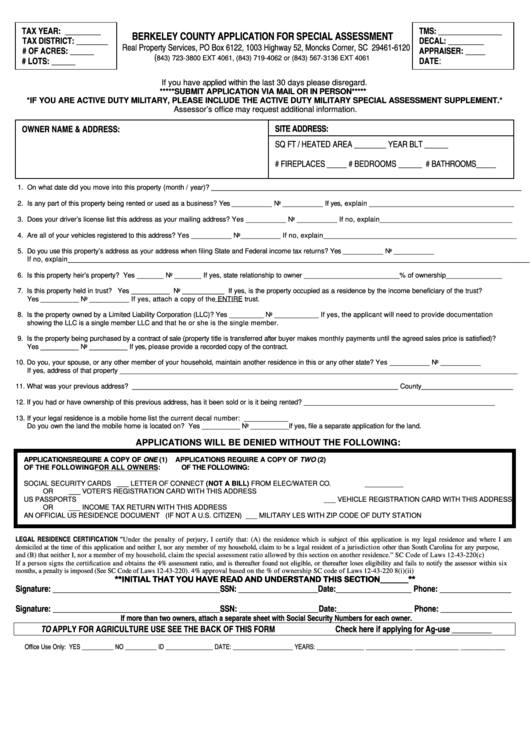

TAX YEAR: _________

TMS: ________________

BERKELEY COUNTY APPLICATION FOR SPECIAL ASSESSMENT

TAX DISTRICT: ________

DECAL: _________

Real Property Services, PO Box 6122, 1003 Highway 52, Moncks Corner, SC 29461-6120

# OF ACRES: ______

APPRAISER: _____

(

# LOTS: ______

DATE:

843) 723-3800 EXT 4061, (843) 719-4062 or (843) 567-3136 EXT 4061

If you have applied within the last 30 days please disregard.

*****SUBMIT APPLICATION VIA MAIL OR IN PERSON*****

*IF YOU ARE ACTIVE DUTY MILITARY, PLEASE INCLUDE THE ACTIVE DUTY MILITARY SPECIAL ASSESSMENT SUPPLEMENT.*

Assessor’s office may request additional information.

SITE ADDRESS:

OWNER NAME & ADDRESS:

SQ FT / HEATED AREA ________ YEAR BLT ______

# FIREPLACES _____ # BEDROOMS ______ # BATHROOMS _____

1. On what date did you move into this property (month / year)? _____________________________________________________________________________

2. Is any part of this property being rented or used as a business? Yes __________ No __________ If yes, explain ____________________________________

3. Does your driver’s license list this address as your mailing address? Yes __________ No __________ If no, explain_________________________________

4. Are all of your vehicles registered to this address? Yes __________ No__________ If no, explain________________________________________________

5. Do you use this property’s address as your address when filing State and Federal income tax returns? Yes __________ No __________

If no, explain___________________________________________________________________________________________________________________

6. Is this property heir’s property? Yes _______ No _______ If yes, state relationship to owner _________________________% of ownership______________

7. Is this property held in trust? Yes __________ No ___________ If yes, is the property occupied as a residence by the income beneficiary of the trust?

Yes __________ No __________ If yes, attach a copy of the ENTIRE trust.

8. Is the property owned by a Limited Liability Corporation (LLC)? Yes _________ No ___________ If yes, the applicant will need to provide documentation

showing the LLC is a single member LLC and that he or she is the single member.

9. Is the property being purchased by a contract of sale (property title is transferred after buyer makes monthly payments until the agreed sales price is satisfied)?

Yes __________ No __________ If yes, please provide a recorded copy of the contract.

10. Do you, your spouse, or any other member of your household, maintain another residence in this or any other state? Yes __________ No __________

If yes, address of that property ____________________________________________________________________________________________________

11. What was your previous address? __________________________________________________________________ County________________________

12. If you had or have ownership of this previous address, has it been sold or is it being rented? __________________________________________________

13. If your legal residence is a mobile home list the current decal number: ___________

Do you own the land the mobile home is located on? Yes __________ No __________ If yes, file a separate application for the land.

APPLICATIONS WILL BE DENIED WITHOUT THE FOLLOWING:

APPLICATIONS REQUIRE A COPY OF ONE (1)

APPLICATIONS REQUIRE A COPY OF TWO (2)

OF THE FOLLOWING FOR ALL OWNERS:

OF THE FOLLOWING:

SOCIAL SECURITY CARDS

___ LETTER OF CONNECT (NOT A BILL) FROM ELEC/WATER CO.

OR

___ VOTER’S REGISTRATION CARD WITH THIS ADDRESS

US PASSPORTS

___ VEHICLE REGISTRATION CARD WITH THIS ADDRESS

OR

___ INCOME TAX RETURN WITH THIS ADDRESS

AN OFFICIAL US RESIDENCE DOCUMENT (IF NOT A U.S. CITIZEN)

___ MILITARY LES WITH ZIP CODE OF DUTY STATION

LEGAL RESIDENCE CERTIFICATION “Under the penalty of perjury, I certify that: (A) the residence which is subject of this application is my legal residence and where I am

domiciled at the time of this application and neither I, nor any member of my household, claim to be a legal resident of a jurisdiction other than South Carolina for any purpose,

and (B) that neither I, nor a member of my household, claim the special assessment ratio allowed by this section on another residence.” SC Code of Laws 12-43-220(c)

If a person signs the certification and obtains the 4% assessment ratio, and is thereafter found not eligible, or thereafter loses eligibility and fails to notify the assessor within six

months, a penalty is imposed (See SC Code of Laws 12-43-220). 4% approval based on the % of ownership SC code of Laws 12-43-220 8(i)(ii)

**INITIAL THAT YOU HAVE READ AND UNDERSTAND THIS SECTION_______**

Signature: __________________________________________SSN: ____________________Date:___________________ Phone: __________________

Signature: __________________________________________SSN: ____________________Date:___________________ Phone: __________________

If more than two owners, attach a separate sheet with Social Security Numbers for each owner.

TO APPLY FOR AGRICULTURE USE SEE THE BACK OF THIS FORM

Check here if applying for Ag-use __________

Office Use Only: YES __________ NO __________ ID _______________ DATE: ___________________ YEARS: _______________ _______________ ______________ ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2