Form Dr-26 - Application For Refund 1999

ADVERTISEMENT

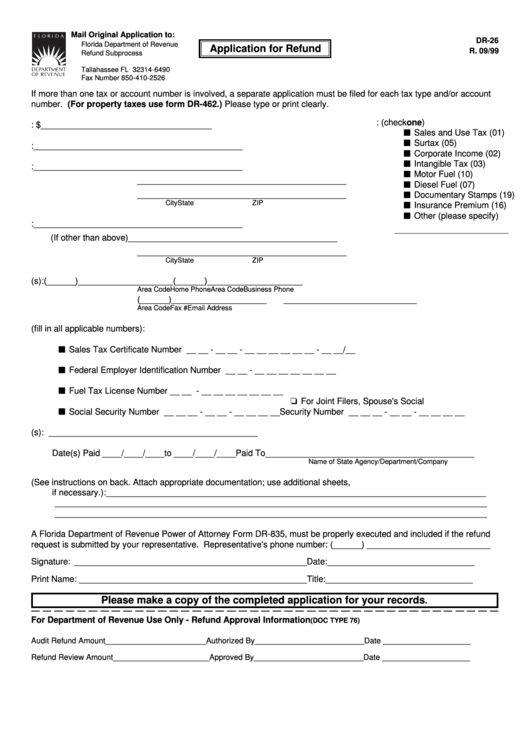

Mail Original Application to:

DR-26

Florida Department of Revenue

Application for Refund

R. 09/99

Refund Subprocess

P.O. Box 6490

Tallahassee FL 32314-6490

Fax Number 850-410-2526

If more than one tax or account number is involved, a separate application must be filed for each tax type and/or account

number. (For property taxes use form DR-462.) Please type or print clearly.

2.

Type of tax paid: (check one)

1.

Amount of Refund Requested: $ ____________________________________

Sales and Use Tax (01)

Surtax (05)

3.

Name of Payee:

____________________________________________

Corporate Income (02)

Intangible Tax (03)

4.

Mailing Address:

____________________________________________

Motor Fuel (10)

____________________________________________

Diesel Fuel (07)

____________________________________________

Documentary Stamps (19)

City

State

ZIP

Insurance Premium (16)

Other (please specify)

5.

Location Address:

____________________________________________

(If other than above) ____________________________________________

____________________________________________

City

State

ZIP

6.

Telephone Number(s):(______)____________________

(______)____________________

Area Code

Home Phone

Area Code

Business Phone

(______)____________________

____________________________

Area Code

Fax #

Email Address

7.

Identification Number of Applicant (fill in all applicable numbers):

Sales Tax Certificate Number __ __ - __ __ - __ __ __ __ __ __ - __ __/__

Federal Employer Identification Number __ __ - __ __ __ __ __ __ __

Fuel Tax License Number __ __ - __ __ __ __ __ __ __

For Joint Filers, Spouse's Social

Social Security Number __ __ __ - __ __ - __ __ __ __

Security Number __ __ __ - __ __ - __ __ __ __

8.

Payment for Tax Period(s): ____________________________________________

Date(s) Paid ____/____/____ to ____/____/____ Paid To ____________________________________________

Name of State Agency/Department/Company

9.

Explanation of Refund Request (See instructions on back. Attach appropriate documentation; use additional sheets,

if necessary.): ________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

A Florida Department of Revenue Power of Attorney Form DR-835, must be properly executed and included if the refund

request is submitted by your representative. Representative's phone number: (______) __________________________

Signature: _________________________________________________

Date: _______________________________

Print Name: ________________________________________________

Title: _______________________________

Please make a copy of the completed application for your records

.

For Department of Revenue Use Only - Refund Approval Information

(DOC TYPE 76)

Audit Refund Amount _______________________

Authorized By _________________________

Date ____________________

Refund Review Amount ______________________

Approved By _________________________

Date ____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1