Quarterly Occupational License Fee Withholding Return Form - Nicholasville

ADVERTISEMENT

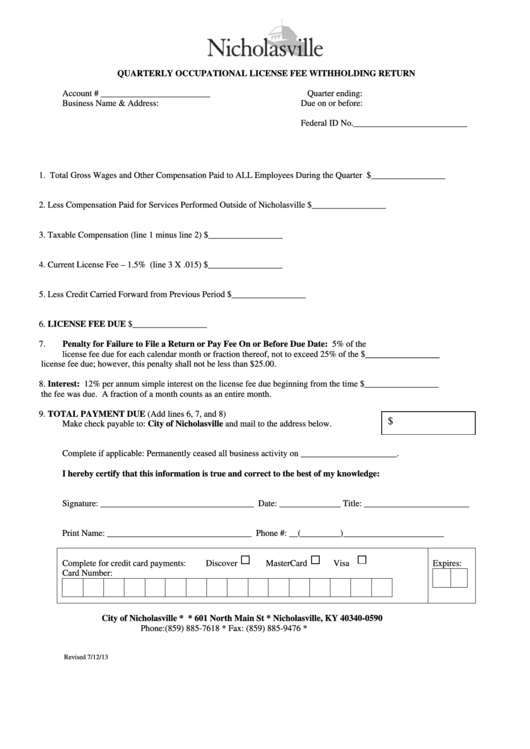

QUARTERLY OCCUPATIONAL LICENSE FEE WITHHOLDING RETURN

Account # _________________________

Quarter ending:

Business Name & Address:

Due on or before:

Federal ID No.__________________________

1.

Total Gross Wages and Other Compensation Paid to ALL Employees During the Quarter

$_________________

2.

Less Compensation Paid for Services Performed Outside of Nicholasville

$_________________

3.

Taxable Compensation (line 1 minus line 2)

$_________________

4.

Current License Fee – 1.5% (line 3 X .015)

$_________________

5.

Less Credit Carried Forward from Previous Period

$_________________

6.

$_________________

LICENSE FEE DUE

7.

Penalty for Failure to File a Return or Pay Fee On or Before Due Date: 5% of the

license fee due for each calendar month or fraction thereof, not to exceed 25% of the

$_________________

license fee due; however, this penalty shall not be less than $25.00.

8.

Interest: 12% per annum simple interest on the license fee due beginning from the time

$_________________

the fee was due. A fraction of a month counts as an entire month.

9.

TOTAL PAYMENT DUE (Add lines 6, 7, and 8)

$

Make check payable to: City of Nicholasville and mail to the address below.

Complete if applicable: Permanently ceased all business activity on ______________________.

I hereby certify that this information is true and correct to the best of my knowledge:

Signature: ___________________________________ Date: ______________ Title: ________________________

Print Name: _________________________________ Phone #: __(_________)_______________________

Complete for credit card payments:

Discover

MasterCard

Visa

Expires:

Card Number:

City of Nicholasville * P.O. Box 590 * 601 North Main St * Nicholasville, KY 40340-0590

Phone: (859) 885-7618 * Fax: (859) 885-9476 *

Revised 7/12/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1