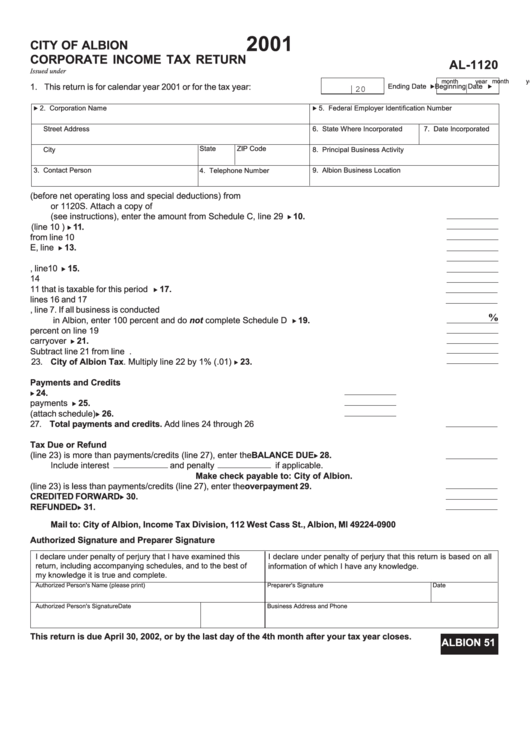

Form Al-1120 - Corporate Income Tax Return - City Of Albion - 2001

ADVERTISEMENT

2001

CITY OF ALBION

CORPORATE INCOME TAX RETURN

AL-1120

Issued under P.A. 284 of 1964. Filing is mandatory.

month

year

month

year

1. This return is for calendar year 2001 or for the tax year:

Beginning Date .

Ending Date .

20

. 2. Corporation Name

. 5. Federal Employer Identification Number

Street Address

6. State Where Incorporated

7. Date Incorporated

State

ZIP Code

City

8. Principal Business Activity

3. Contact Person

4. Telephone Number

9. Albion Business Location

10. Enter taxable income (before net operating loss and special deductions) from U.S. 1120

or 1120S. Attach a copy of U.S. 1120 or 1120S. If the separate accounting method is used

(see instructions), enter the amount from Schedule C, line 29 .......................................................

10.

.

11. Enter gain or loss from the sale or exchange of property included in taxable income (line 10 ) .....

11.

.

12. Subtract line 11 from line 10 ............................................................................................................

12.

13. Enter additions from Schedule E, line 5 ...........................................................................................

13.

.

14. Add lines 12 and 13 ........................................................................................................................

14.

15. Enter deductions from Schedule E, line 10 ......................................................................................

15.

.

16. Subtract line 15 from line 14 ............................................................................................................

16.

17. Enter the portion of the amount included in line 11 that is taxable for this period .............................

17.

.

18. Total income. Add lines 16 and 17 ...................................................................................................

18.

19. Apportionment percentage from Schedule D, line 7. If all business is conducted

%

in Albion, enter 100 percent and do not complete Schedule D .....................................................

19.

.

20. Multiply line 18 by the percent on line 19 .......................................................................................

20.

21. Enter the applicable portion of any net operating loss carryover or capital loss carryover .................

21.

.

22. Total income subject to tax. Subtract line 21 from line 20 ................................................................

22.

23. City of Albion Tax. Multiply line 22 by 1% (.01) .............................................................................

23.

.

Payments and Credits

24. Enter any amount of tax paid with a tentative return ...........................

24.

.

25. Enter any 2001 estimated tax payments ..............................................

25.

.

26. Other credits (attach schedule) ............................................................

26.

.

27. Total payments and credits. Add lines 24 through 26 ...................................................................

27.

Tax Due or Refund

28. If tax (line 23) is more than payments/credits (line 27), enter the BALANCE DUE ........................

28.

.

Include interest

and penalty

if applicable.

Make check payable to: City of Albion.

29. If tax (line 23) is less than payments/credits (line 27), enter the overpayment ...............................

29.

30. Enter the amount of overpayment from line 29 to be CREDITED FORWARD ...................................

30.

.

31. Enter the amount of overpayment from line 29 to be REFUNDED.....................................................

31.

.

Mail to: City of Albion, Income Tax Division, 112 West Cass St., Albion, MI 49224-0900

Authorized Signature and Preparer Signature

I declare under penalty of perjury that I have examined this

I declare under penalty of perjury that this return is based on all

return, including accompanying schedules, and to the best of

information of which I have any knowledge.

my knowledge it is true and complete.

Authorized Person's Name (please print)

Date

Preparer's Signature

Authorized Person's Signature

Date

Business Address and Phone

This return is due April 30, 2002, or by the last day of the 4th month after your tax year closes.

ALBION 51

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3