Dtaa Declaration Form

ADVERTISEMENT

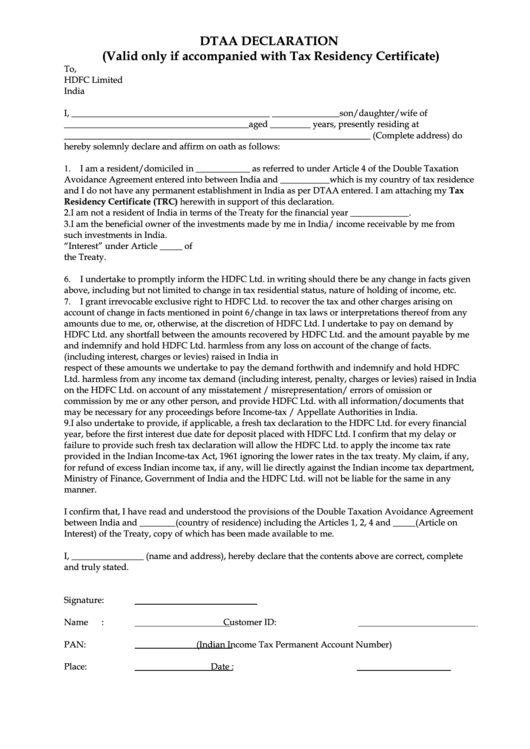

DTAA DECLARATION

(Valid only if accompanied with Tax Residency Certificate)

To,

HDFC Limited

India

I,

____________________________________________

_______________son/daughter/wife

of

_________________________________________aged

_________

years,

presently

residing

at

____________________________________________________________________ (Complete address) do

hereby solemnly declare and affirm on oath as follows:

1. I am a resident/domiciled in ____________ as referred to under Article 4 of the Double Taxation

Avoidance Agreement entered into between India and ___________which is my country of tax residence

and I do not have any permanent establishment in India as per DTAA entered. I am attaching my Tax

Residency Certificate (TRC) herewith in support of this declaration.

2. I am not a resident of India in terms of the Treaty for the financial year _____________.

3. I am the beneficial owner of the investments made by me in India/ income receivable by me from

such investments in India.

4. The amount receivable is towards interest and falls under the head “Interest” under Article _____ of

the Treaty.

5. The place of assessment of my world income is______________.

6. I undertake to promptly inform the HDFC Ltd. in writing should there be any change in facts given

above, including but not limited to change in tax residential status, nature of holding of income, etc.

7. I grant irrevocable exclusive right to HDFC Ltd. to recover the tax and other charges arising on

account of change in facts mentioned in point 6/change in tax laws or interpretations thereof from any

amounts due to me, or, otherwise, at the discretion of HDFC Ltd. I undertake to pay on demand by

HDFC Ltd. any shortfall between the amounts recovered by HDFC Ltd. and the amount payable by me

and indemnify and hold HDFC Ltd. harmless from any loss on account of the change of facts.

8. In the event there is any income tax demand (including interest, charges or levies) raised in India in

respect of these amounts we undertake to pay the demand forthwith and indemnify and hold HDFC

Ltd. harmless from any income tax demand (including interest, penalty, charges or levies) raised in India

on the HDFC Ltd. on account of any misstatement / misrepresentation/ errors of omission or

commission by me or any other person, and provide HDFC Ltd. with all information/documents that

may be necessary for any proceedings before Income-tax / Appellate Authorities in India.

9. I also undertake to provide, if applicable, a fresh tax declaration to the HDFC Ltd. for every financial

year, before the first interest due date for deposit placed with HDFC Ltd. I confirm that my delay or

failure to provide such fresh tax declaration will allow the HDFC Ltd. to apply the income tax rate

provided in the Indian Income-tax Act, 1961 ignoring the lower rates in the tax treaty. My claim, if any,

for refund of excess Indian income tax, if any, will lie directly against the Indian income tax department,

Ministry of Finance, Government of India and the HDFC Ltd. will not be liable for the same in any

manner.

I confirm that, I have read and understood the provisions of the Double Taxation Avoidance Agreement

between India and ________(country of residence) including the Articles 1, 2, 4 and _____(Article on

Interest) of the Treaty, copy of which has been made available to me.

I, ________________ (name and address), hereby declare that the contents above are correct, complete

and truly stated.

Signature

:

Name

:

Customer ID

:

PAN

:

__

(Indian Income Tax Permanent Account Number)

Place

:

Date

:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1