Form Ador 20-2056 - Authorization Agreement For Electronic Funds Transfer And Disclosure Agreement

ADVERTISEMENT

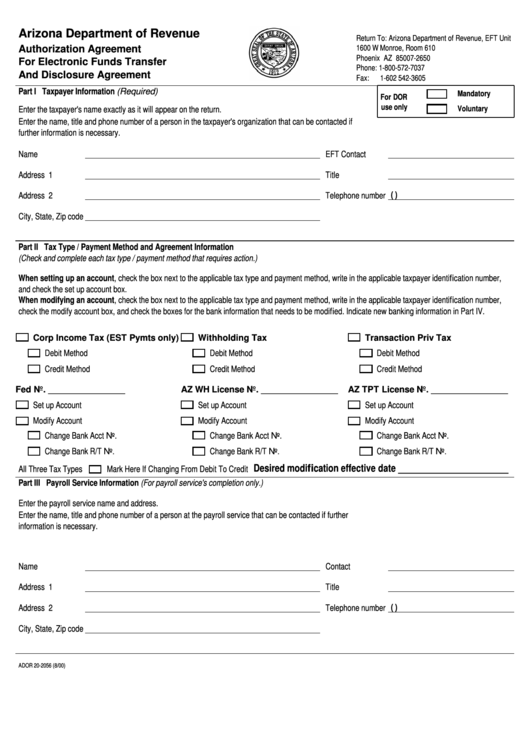

Arizona Department of Revenue

Return To: Arizona Department of Revenue, EFT Unit

1600 W Monroe, Room 610

Authorization Agreement

Phoenix AZ 85007-2650

For Electronic Funds Transfer

Phone: 1-800-572-7037

And Disclosure Agreement

Fax:

1-602 542-3605

Part I Taxpayer Information (Required)

Mandatory

For DOR

use only

Voluntary

Enter the taxpayer's name exactly as it will appear on the return.

Enter the name, title and phone number of a person in the taxpayer's organization that can be contacted if

further information is necessary.

Name

EFT Contact

Address 1

Title

(

)

Address 2

Telephone number

City, State, Zip code

Part II Tax Type / Payment Method and Agreement Information

(Check and complete each tax type / payment method that requires action.)

When setting up an account, check the box next to the applicable tax type and payment method, write in the applicable taxpayer identification number,

and check the set up account box.

When modifying an account, check the box next to the applicable tax type and payment method, write in the applicable taxpayer identification number,

check the modify account box, and check the boxes for the bank information that needs to be modified. Indicate new banking information in Part IV.

Corp Income Tax (EST Pymts only)

Withholding Tax

Transaction Priv Tax

Debit Method

Debit Method

Debit Method

Credit Method

Credit Method

Credit Method

Fed I.D. No. ________________

AZ WH License No. ________________

AZ TPT License No. ________________

Set up Account

Set up Account

Set up Account

Modify Account

Modify Account

Modify Account

Change Bank Acct No.

Change Bank Acct No.

Change Bank Acct No.

Change Bank R/T No.

Change Bank R/T No.

Change Bank R/T No.

Desired modification effective date _______________________

Mark Here If Changing From Debit To Credit

All Three Tax Types

Part III Payroll Service Information (For payroll service's completion only.)

Enter the payroll service name and address.

Enter the name, title and phone number of a person at the payroll service that can be contacted if further

information is necessary.

Name

Contact

Address 1

Title

(

)

Address 2

Telephone number

City, State, Zip code

ADOR 20-2056 (8/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2