Form Ador 20-2056 - Authorization Agreement For Electronic Funds Transfer And Disclosure Agreement Page 2

ADVERTISEMENT

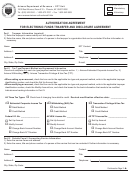

Part IV ACH Debit Option (Complete this section only if you select or are currently using this option.)

Complete the requested information regarding the financial institution to be used. If payments are to be debited to the taxpayer's account, the form must be

signed and dated by a person in the taxpayer's organization who is an authorized signatory on the account specified below. If payments are to be debited

to a payroll service's account, the form must be signed and dated by a person in the payroll service's organization who is authorized to enter into this

agreement on behalf of the payroll service and is an authorized signatory on the account specified below. We will contact you with the payment instructions

and the toll-free number for our Data Collection Center.

Financial Institution Name

Financial Institution Address

Financial Institution City, State, Zip code

Account Name

Account Type

Checking

Savings

Account Number

Financial Institution Routing/Transit No.

I hereby authorize the Arizona Department of Revenue to process debit entries into the bank account specified above. These debits will pertain only to

Electronic Funds Transfer payments the above named taxpayer or their agent initiates for payment of the tax type(s) specified above.

Taxpayer's Authorized Signature

Title

Date

Service Group's Authorized Signature

Title

Date

Part V ACH Credit Option (Complete this section only if you select or are currently using this option.)

I hereby request that the Arizona Department of Revenue grant authority for the above named taxpayer or their agent (Part I) to initiate ACH Credit

transactions to the Department of Revenue bank account. It is understood that these transactions must be in the NACHA CCD+ format using the Tax

Payment Convention and may only be initiated for the tax type(s) specified in Part II.

Authorized Signature

Title

Date

Part VI Disclosure Agreement (Complete this section only if a payroll service named in Part III or another third party not named in Part III is being

designated by the taxpayer indicated in Part I to receive taxpayer confidential information from the Arizona Department of Revenue.)

By signing this form, the undersigned, authorizes the Department to release confidential information relating to Arizona Department of Revenue

Authorization Agreement and Disclosure Agreement for Electronic Funds Transfer authorization to _____________________________________________.

This form is not a Power of Attorney and does not grant the contact person(s) any power of representation. This disclosure authorization is to

remain in force until rescinded by the undersigned.

Taxpayer's Signature

Title

Date

By signing this form, I certify that I have the authority to execute this authorization form on behalf of the above-mentioned corporation(s), limited liability

company(ies), trust(s), partnership(s), and / or individuals(s).

This disclosure agreement automatically revokes all earlier EFT authorization agreements and disclosure agreements on file with the Arizona Department

of Revenue. If you do not want to revoke a prior EFT authorization agreement and disclosure agreement, check this box ......

. You MUST attach a

copy of any prior agreements you want to remain in effect.

NOTE: This form may be duplicated. Please make a copy for future use.

Click Here for Information Publication Regarding EFT

ADOR 20-2056 (8/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2