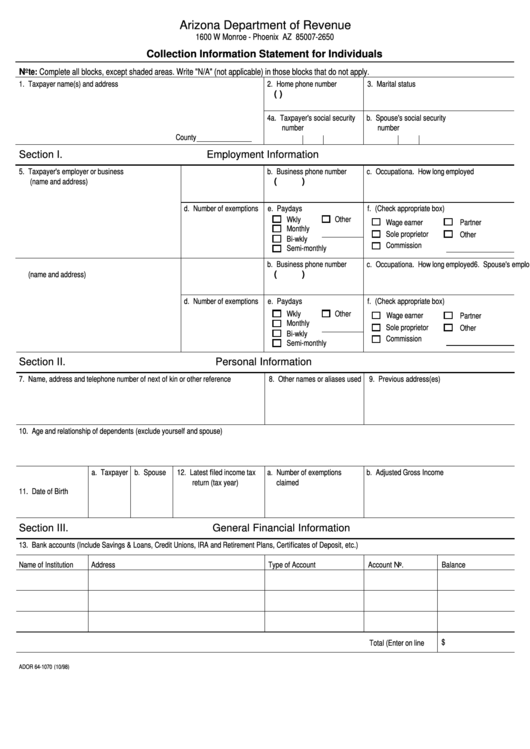

Form Ador 64-1070 - Collection Information Statement For Individuals

ADVERTISEMENT

Arizona Department of Revenue

1600 W Monroe - Phoenix AZ 85007-2650

Collection Information Statement for Individuals

Note: Complete all blocks, except shaded areas. Write "N/A" (not applicable) in those blocks that do not apply.

1. Taxpayer name(s) and address

2. Home phone number

3. Marital status

(

)

4a. Taxpayer's social security

b. Spouse's social security

number

number

County

Section I.

Employment Information

5. Taxpayer's employer or business

a. How long employed

b. Business phone number

c. Occupation

(name and address)

(

)

d. Number of exemptions

e. Paydays

f. (Check appropriate box)

Wkly

Other

Wage earner

Partner

Monthly

Sole proprietor

Other

Bi-wkly

Commission

Semi-monthly

6. Spouse's employer or business

a. How long employed

b. Business phone number

c. Occupation

(name and address)

(

)

d. Number of exemptions

e. Paydays

f. (Check appropriate box)

Wkly

Other

Wage earner

Partner

Monthly

Sole proprietor

Other

Bi-wkly

Commission

Semi-monthly

Section II.

Personal Information

7. Name, address and telephone number of next of kin or other reference

8. Other names or aliases used 9. Previous address(es)

10. Age and relationship of dependents (exclude yourself and spouse)

a. Taxpayer b. Spouse

12. Latest filed income tax

a. Number of exemptions

b. Adjusted Gross Income

return (tax year)

claimed

11. Date of Birth

Section III.

General Financial Information

13. Bank accounts (Include Savings & Loans, Credit Unions, IRA and Retirement Plans, Certificates of Deposit, etc.)

Name of Institution

Address

Type of Account

Account No.

Balance

$

Total (Enter on line

ADOR 64-1070 (10/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4