Form Tc106 - Application For Correction Of Assessment On Grounds Other Than, Or In Addition To, Overvaluation, Including Exemption Or Classification Claims - 2004

ADVERTISEMENT

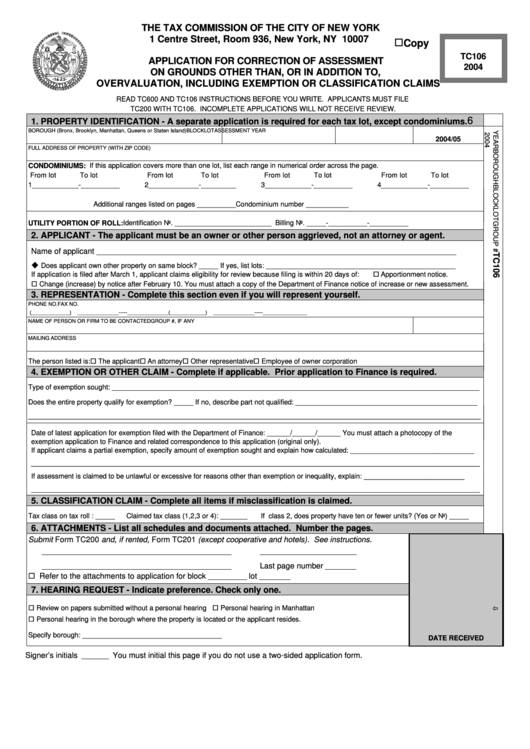

THE TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

Copy

TC106

APPLICATION FOR CORRECTION OF ASSESSMENT

2004

ON GROUNDS OTHER THAN, OR IN ADDITION TO,

OVERVALUATION, INCLUDING EXEMPTION OR CLASSIFICATION CLAIMS

READ TC600 AND TC106 INSTRUCTIONS BEFORE YOU WRITE. APPLICANTS MUST FILE

TC200 WITH TC106. INCOMPLETE APPLICATIONS WILL NOT RECEIVE REVIEW.

6

1. PROPERTY IDENTIFICATION - A separate application is required for each tax lot, except condominiums.

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

ASSESSMENT YEAR

2004/05

FULL ADDRESS OF PROPERTY (WITH ZIP CODE)

CONDOMINIUMS: If this application covers more than one lot, list each range in numerical order across the page.

From lot

To lot

From lot

To lot

From lot

To lot

From lot

To lot

1____________-__________

2_____________-_________

3____________-__________

4____________-__________

Additional ranges listed on pages __________

Condominium number ___________

UTILITY PORTION OF ROLL: Identification No. _________________________ Billing No. _____-__________-__________

2. APPLICANT - The applicant must be an owner or other person aggrieved, not an attorney or agent.

Name of applicant

_____________________________________________________________________________________________

Does applicant own other property on same block? _____ If yes, list lots: _________________________________________________

If application is filed after March 1, applicant claims eligibility for review because filing is within 20 days of:

Apportionment notice.

Change (increase) by notice after February 10. You must attach a copy of the Department of Finance notice of increase or new assessment.

3. REPRESENTATION - Complete this section even if you will represent yourself.

PHONE NO.

FAX NO.

(_____________)

______________-----______________

(____________)

______________-----_______________

NAME OF PERSON OR FIRM TO BE CONTACTED

GROUP #, IF ANY

MAILING ADDRESS

The person listed is:

The applicant

An attorney

Other representative

Employee of owner corporation

4. EXEMPTION OR OTHER CLAIM - Complete if applicable. Prior application to Finance is required.

Type of exemption sought: _______________________________________________________________________________________________

Does the entire property qualify for exemption? _____ If no, describe part not qualified: _______________________________________________

_____________________________________________________________________________________________________________________

Date of latest application for exemption filed with the Department of Finance: ______/______/______ You must attach a photocopy of the

exemption application to Finance and related correspondence to this application (original only).

If applicant claims a partial exemption, specify amount of exemption sought and explain how calculated: ________________________________

____________________________________________________________________________________________________________________

If assessment is claimed to be unlawful or excessive for reasons other than exemption or inequality, explain: __________________________

____________________________________________________________________________________________________________________

5. CLASSIFICATION CLAIM - Complete all items if misclassification is claimed.

Tax class on tax roll : _____

Claimed tax class (1,2,3 or 4): _______

If class 2, does property have ten or fewer units? (Yes or No) _____

6. ATTACHMENTS - List all schedules and documents attached. Number the pages.

Submit Form TC200 and, if rented, Form TC201 (except cooperative and hotels). See instructions.

________________________

_________________________

_________________________

Last page number

________________________

_________________________

________

Refer to the attachments to application for block

lot

__________

________

7. HEARING REQUEST - Indicate preference. Check only one.

Review on papers submitted without a personal hearing

Personal hearing in Manhattan

Personal hearing in the borough where the property is located or the applicant resides.

Specify borough: ____________________________________

DATE RECEIVED

Signer’s initials

You must initial this page if you do not use a two-sided application form.

_______

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2