Form W1-Deposit - Monthly Withholding Deposit - 1998

ADVERTISEMENT

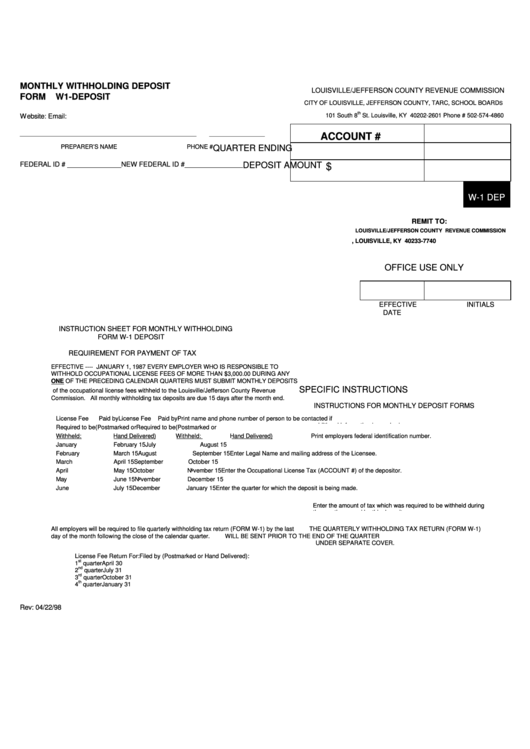

MONTHLY WITHHOLDING DEPOSIT

LOUISVILLE/JEFFERSON COUNTY REVENUE COMMISSION

FORM

W1-DEPOSIT

CITY OF LOUISVILLE, JEFFERSON COUNTY, TARC, SCHOOL BOARD

S

th

101 South 8

St. Louisville, KY 40202-2601 Phone # 502-574-4860

_________________

____________________________________________________________

ACCOUNT #

PREPARER’S NAME

PHONE #

QUARTER ENDING

FEDERAL ID # ______________

NEW FEDERAL ID #_______________

DEPOSIT AMOUNT

$

W-1 DEP

REMIT TO:

LOUISVILLE/JEFFERSON COUNTY REVENUE COMMISSION

P.O. BOX 37740, LOUISVILLE, KY 40233-7740

OFFICE USE ONLY

EFFECTIVE

INITIALS

DATE

INSTRUCTION SHEET FOR MONTHLY WITHHOLDING

FORM W-1 DEPOSIT

REQUIREMENT FOR PAYMENT OF TAX

EFFECTIVE ---- JANUARY 1, 1987 EVERY EMPLOYER WHO IS RESPONSIBLE TO

WITHHOLD OCCUPATIONAL LICENSE FEES OF MORE THAN $3,000.00 DURING ANY

ONE OF THE PRECEDING CALENDAR QUARTERS MUST SUBMIT MONTHLY DEPOSITS

SPECIFIC INSTRUCTIONS

of the occupational license fees withheld to the Louisville/Jefferson County Revenue

Commission. All monthly withholding tax deposits are due 15 days after the month end.

INSTRUCTIONS FOR MONTHLY DEPOSIT FORMS

License Fee

Paid by

License Fee

Paid by

Print name and phone number of person to be contacted if

additional information is required.

Required to be

(Postmarked or

Required to be

(Postmarked or

Withheld:

Hand Delivered)

Withheld:

Hand Delivered)

Print employers federal identification number.

January

February 15

July

August 15

February

March 15

August

September 15

Enter Legal Name and mailing address of the Licensee.

March

April 15

September

October 15

April

May 15

October

November 15

Enter the Occupational License Tax (ACCOUNT #) of the depositor.

May

June 15

November

December 15

June

July 15

December

January 15

Enter the quarter for which the deposit is being made.

Enter the amount of tax which was required to be withheld during

the month covered by this deposit.

All employers will be required to file quarterly withholding tax return (FORM W-1) by the last

THE QUARTERLY WITHHOLDING TAX RETURN (FORM W-1)

day of the month following the close of the calendar quarter.

WILL BE SENT PRIOR TO THE END OF THE QUARTER

UNDER SEPARATE COVER.

License Fee Return For:

Filed by (Postmarked or Hand Delivered):

st

1

quarter

April 30

nd

2

quarter

July 31

rd

3

quarter

October 31

th

4

quarter

January 31

Rev: 04/22/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1