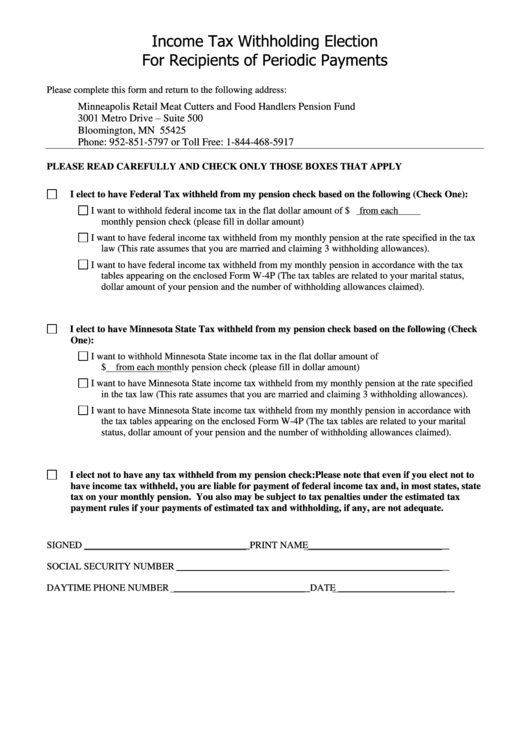

Income Tax Withholding Election

For Recipients of Periodic Payments

Please complete this form and return to the following address:

Minneapolis Retail Meat Cutters and Food Handlers Pension Fund

3001 Metro Drive – Suite 500

Bloomington, MN 55425

Phone: 952-851-5797 or Toll Free: 1-844-468-5917

PLEASE READ CAREFULLY AND CHECK ONLY THOSE BOXES THAT APPLY

I elect to have Federal Tax withheld from my pension check based on the following (Check One):

I want to withhold federal income tax in the flat dollar amount of $

from each

monthly pension check (please fill in dollar amount)

I want to have federal income tax withheld from my monthly pension at the rate specified in the tax

law (This rate assumes that you are married and claiming 3 withholding allowances).

I want to have federal income tax withheld from my monthly pension in accordance with the tax

tables appearing on the enclosed Form W-4P (The tax tables are related to your marital status,

dollar amount of your pension and the number of withholding allowances claimed).

I elect to have Minnesota State Tax withheld from my pension check based on the following (Check

One):

I want to withhold Minnesota State income tax in the flat dollar amount of

$

from each monthly pension check (please fill in dollar amount)

I want to have Minnesota State income tax withheld from my monthly pension at the rate specified

in the tax law (This rate assumes that you are married and claiming 3 withholding allowances).

I want to have Minnesota State income tax withheld from my monthly pension in accordance with

the tax tables appearing on the enclosed Form W-4P (The tax tables are related to your marital

status, dollar amount of your pension and the number of withholding allowances claimed).

I elect not to have any tax withheld from my pension check: Please note that even if you elect not to

have income tax withheld, you are liable for payment of federal income tax and, in most states, state

tax on your monthly pension. You also may be subject to tax penalties under the estimated tax

payment rules if your payments of estimated tax and withholding, if any, are not adequate.

SIGNED __________________________________PRINT NAME_____________________________

SOCIAL SECURITY NUMBER ________________________________________________________

DAYTIME PHONE NUMBER ____________________________DATE ________________________

1

1