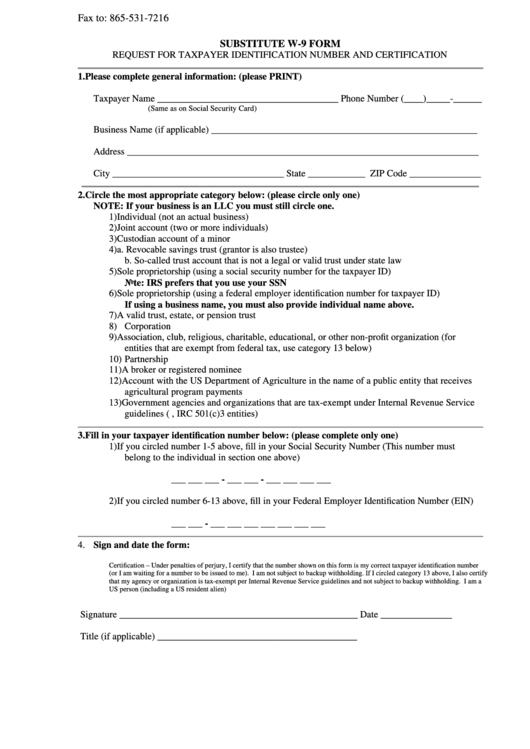

Substitute W-9 Form - Request For Taxpayer Identification Number And Certification

ADVERTISEMENT

Fax to: 865-531-7216

SUBSTITUTE W-9 FORM

REQUEST FOR TAXPAYER IDENTIFICATION NUMBER AND CERTIFICATION

1. Please complete general information: (please PRINT)

Taxpayer Name ______________________________________ Phone Number (____)_____-______

(Same as on Social Security Card)

Business Name (if applicable) ________________________________________________________

Address __________________________________________________________________________

City ____________________________________ State ____________ ZIP Code _______________

2. Circle the most appropriate category below: (please circle only one)

NOTE: If your business is an LLC you must still circle one.

1) Individual (not an actual business)

2) Joint account (two or more individuals)

3) Custodian account of a minor

4) a. Revocable savings trust (grantor is also trustee)

b. So-called trust account that is not a legal or valid trust under state law

5) Sole proprietorship (using a social security number for the taxpayer ID)

Note: IRS prefers that you use your SSN

6) Sole proprietorship (using a federal employer identification number for taxpayer ID)

If using a business name, you must also provide individual name above.

7) A valid trust, estate, or pension trust

8) Corporation

9) Association, club, religious, charitable, educational, or other non-profit organization (for

entities that are exempt from federal tax, use category 13 below)

10) Partnership

11) A broker or registered nominee

12) Account with the US Department of Agriculture in the name of a public entity that receives

agricultural program payments

13) Government agencies and organizations that are tax-exempt under Internal Revenue Service

guidelines (i.e., IRC 501(c)3 entities)

3. Fill in your taxpayer identification number below: (please complete only one)

1) If you circled number 1-5 above, fill in your Social Security Number (This number must

belong to the individual in section one above)

___ ___ ___ - ___ ___ - ___ ___ ___ ___

2) If you circled number 6-13 above, fill in your Federal Employer Identification Number (EIN)

___ ___ - ___ ___ ___ ___ ___ ___ ___

4. Sign and date the form:

Certification – Under penalties of perjury, I certify that the number shown on this form is my correct taxpayer identification number

(or I am waiting for a number to be issued to me). I am not subject to backup withholding. If I circled category 13 above, I also certify

that my agency or organization is tax-exempt per Internal Revenue Service guidelines and not subject to backup withholding. I am a

US person (including a US resident alien)

Signature __________________________________________________ Date _______________

Title (if applicable) __________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1