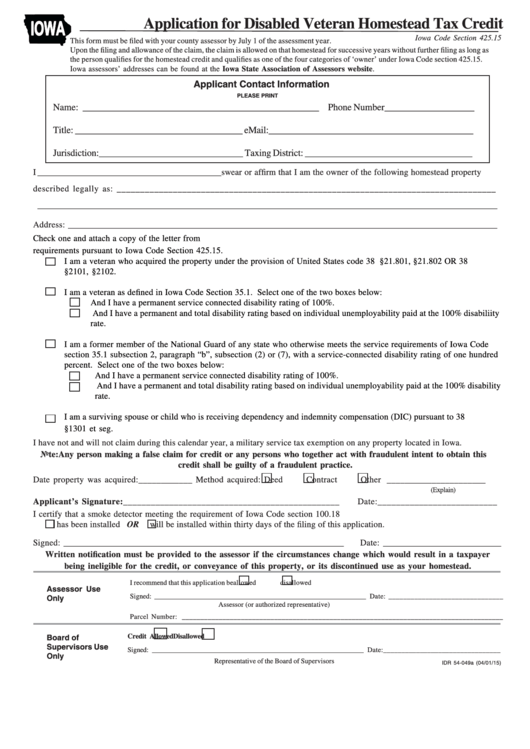

IOWA

Application for Disabled Veteran Homestead Tax Credit

Iowa Code Section 425.15

This form must be filed with your county assessor by July 1 of the assessment year.

Upon the filing and allowance of the claim, the claim is allowed on that homestead for successive years without further filing as long as

the person qualifies for the homestead credit and qualifies as one of the four categories of ‘owner’ under Iowa Code section 425.15.

Iowa assessors’ addresses can be found at the Iowa State Association of Assessors website.

Applicant Contact Information

PLEASE PRINT

Name: __________________________________________________ Phone Number___________________

Title: ____________________________________ eMail:____________________________________________

Jurisdiction:_______________________________ Taxing District: ____________________________________

I __________________________________________ swear or affirm that I am the owner of the following homestead property

described legally as: _________________________________________________________________________________

_________________________________________________________________________________________________________

Address: __________________________________________________________________________________________________

Check one and attach a copy of the letter from U.S. Department of Veteran Affairs indicating applicant meets eligibility

requirements pursuant to Iowa Code Section 425.15.

I am a veteran who acquired the property under the provision of United States code 38 U.S.C §21.801, §21.802 OR 38

U.S.C §2101, §2102.

I am a veteran as defined in Iowa Code Section 35.1. Select one of the two boxes below:

And I have a permanent service connected disability rating of 100%.

And I have a permanent and total disability rating based on individual unemployability paid at the 100% disabiliity

rate.

I am a former member of the National Guard of any state who otherwise meets the service requirements of Iowa Code

section 35.1 subsection 2, paragraph “b”, subsection (2) or (7), with a service-connected disability rating of one hundred

percent. Select one of the two boxes below:

And I have a permanent service connected disability rating of 100%.

And I have a permanent and total disability rating based on individual unemployability paid at the 100% disability

rate.

I am a surviving spouse or child who is receiving dependency and indemnity compensation (DIC) pursuant to 38 U.S.C

§1301 et seg.

I have not and will not claim during this calendar year, a military service tax exemption on any property located in Iowa.

Note: Any person making a false claim for credit or any persons who together act with fraudulent intent to obtain this

credit shall be guilty of a fraudulent practice.

Date property was acquired:____________ Method acquired:

Deed

Contract

Other ______________________

(Explain)

Applicant’s Signature:_______________________________________________

Date:__________________________

I certify that a smoke detector meeting the requirement of Iowa Code section 100.18

has been installed OR

will be installed within thirty days of the filing of this application.

Signed: ________________________________________________________________

Date: ___________________________

Written notification must be provided to the assessor if the circumstances change which would result in a taxpayer

being ineligible for the credit, or conveyance of this property, or its discontinued use as your homestead.

I recommend that this application be

allowed

disallowed

Assessor Use

Only

Signed: ____________________________________________________________ Date: _______________________________

Assessor (or authorized representative)

Parcel Number: _______________________________________________________________________________________

Board of

Credit

Allowed

Disallowed

Supervisors Use

Signed: ____________________________________________________________ Date:________________________________

Only

Representative of the Board of Supervisors

IDR 54-049a (04/01/15)

1

1 2

2