Form Idr 54-023 - Application For Family Farm Tax Credit

ADVERTISEMENT

IOWA

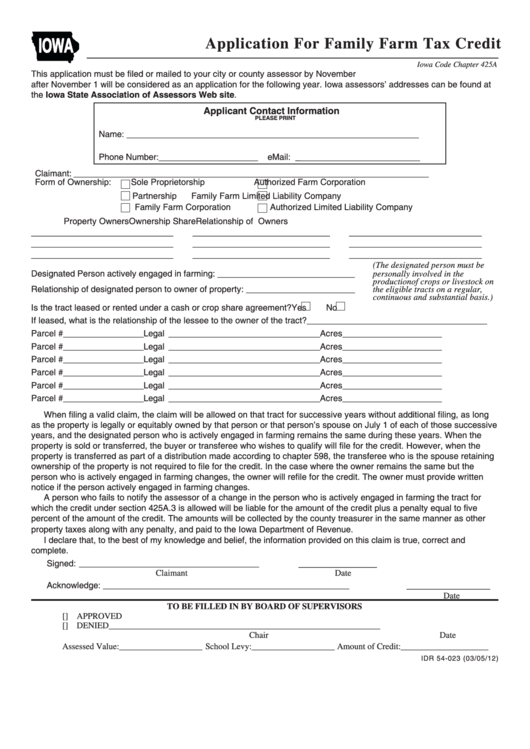

Application For Family Farm Tax Credit

Iowa Code Chapter 425A

This application must be filed or mailed to your city or county assessor by November 1.An application filed or postmarked

after November 1 will be considered as an application for the following year. Iowa assessors’ addresses can be found at

the Iowa State Association of Assessors Web site.

Applicant Contact Information

PLEASE PRINT

________________________________________________________

Name:

___________________

_______________________

Phone Number:

eMail: _

Claimant: ___________________________________________________________________________

Form of Ownership:

Sole Proprietorship

Authorized Farm Corporation

Partnership

Family Farm Limited Liability Company

Family Farm Corporation

Authorized Limited Liability Company

Property Owners

Ownership Share

Relationship of Owners

______________________________

_____________________________

____________________________

______________________________

_____________________________

____________________________

______________________________

_____________________________

____________________________

(The designated person must be

Designated Person actively engaged in farming: _____________________________

personally involved in the

production of crops or livestock on

Relationship of designated person to owner of property: _______________________

the eligible tracts on a regular,

continuous and substantial basis.)

Is the tract leased or rented under a cash or crop share agreement?

Yes

No

If leased, what is the relationship of the lessee to the owner of the tract? ______________________________________

Parcel # _________________

Legal ________________________________

Acres _____________________

Parcel # _________________

Legal ________________________________

Acres _____________________

Parcel # _________________

Legal ________________________________

Acres _____________________

Parcel # _________________

Legal ________________________________

Acres _____________________

Parcel # _________________

Legal ________________________________

Acres _____________________

Parcel # _________________

Legal ________________________________

Acres _____________________

When filing a valid claim, the claim will be allowed on that tract for successive years without additional filing, as long

as the property is legally or equitably owned by that person or that person’s spouse on July 1 of each of those successive

years, and the designated person who is actively engaged in farming remains the same during these years. When the

property is sold or transferred, the buyer or transferee who wishes to qualify will file for the credit. However, when the

property is transferred as part of a distribution made according to chapter 598, the transferee who is the spouse retaining

ownership of the property is not required to file for the credit. In the case where the owner remains the same but the

person who is actively engaged in farming changes, the owner will refile for the credit. The owner must provide written

notice if the person actively engaged in farming changes.

A person who fails to notify the assessor of a change in the person who is actively engaged in farming the tract for

which the credit under section 425A.3 is allowed will be liable for the amount of the credit plus a penalty equal to five

percent of the amount of the credit. The amounts will be collected by the county treasurer in the same manner as other

property taxes along with any penalty, and paid to the Iowa Department of Revenue.

I declare that, to the best of my knowledge and belief, the information provided on this claim is true, correct and

complete.

Signed: ______________________________________

_______________

Claimant

Date

Acknowledge: ____________________________________________________

________________

Date

TO BE FILLED IN BY BOARD OF SUPERVISORS

[

] APPROVED

[

] DENIED

__________________________________________

____________________

Chair

Date

Assessed Value: ___________________ School Levy: ___________________ Amount of Credit: ____________________

IDR 54-023 (03/05/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1