Form Dr-42a - Ownership Declaration And Sales And Use Tax Report On Aircraft

ADVERTISEMENT

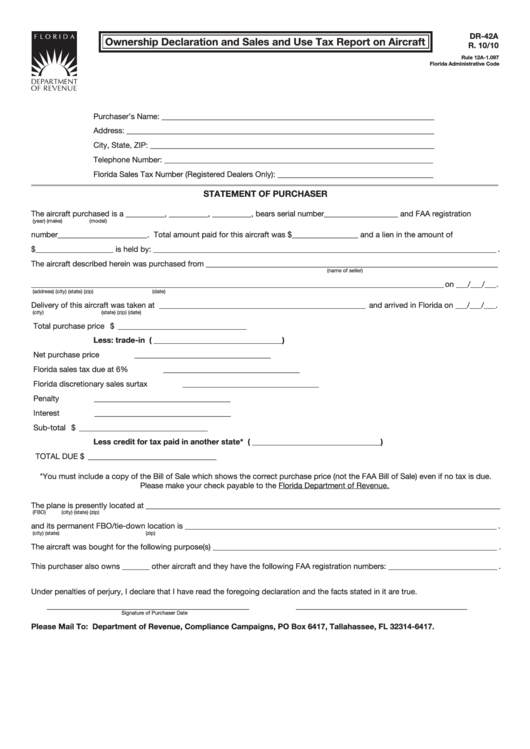

DR-42A

Ownership Declaration and Sales and Use Tax Report on Aircraft

R. 10/10

Rule 12A-1.097

Florida Administrative Code

Purchaser’s Name: _ _____________________________________________________________________

Address: _ ______________________________________________________________________________

City, State, ZIP: _ ________________________________________________________________________

Telephone Number: _____________________________________________________________________

Florida Sales Tax Number (Registered Dealers Only): ________________________________________

STATEMENT OF PURCHASER

The aircraft purchased is a __________, __________, __________, bears serial number___________________ and FAA registration

(year)

(make)

(model)

number_______________________. Total amount paid for this aircraft was $_________________ and a lien in the amount of

$____________________ is held by: ________________________________________________________________________________________ .

The aircraft described herein was purchased from ___________________________________________________________________________

(name of seller)

__________________________________________________________________________________________________________ on ___/___/___.

(address)

(city)

(state)

(zip)

(date)

Delivery of this aircraft was taken at _____________________________________________________ and arrived in Florida on ___/___/___.

(city)

(state)

(zip)

(date)

Total purchase price ....................................................

$ _________________________________

Less: trade-in .............................................................

( _________________________________ )

Net purchase price ......................................................

___________________________________

Florida sales tax due at 6% . ........................................

___________________________________

Florida discretionary sales surtax ................................

___________________________________

Penalty . ........................................................................

___________________________________

Interest . ........................................................................

___________________________________

Sub-total . .....................................................................

$ _________________________________

Less credit for tax paid in another state* ................

( _________________________________ )

TOTAL DUE

$ _________________________________

*You must include a copy of the Bill of Sale which shows the correct purchase price (not the FAA Bill of Sale) even if no tax is due.

Please make your check payable to the Florida Department of Revenue.

The plane is presently located at _ __________________________________________________________________________________________

(FBO)

(city)

(state)

(zip)

and its permanent FBO/tie-down location is _ _______________________________________________________________________________ .

(city)

(state)

(zip)

The aircraft was bought for the following purpose(s) _ ________________________________________________________________________ .

This purchaser also owns _______ other aircraft and they have the following FAA registration numbers: _ ___________________________ .

Under penalties of perjury, I declare that I have read the foregoing declaration and the facts stated in it are true.

____________________________________________________

____________________________________________

Signature of Purchaser

Date

Please Mail To: Department of Revenue, Compliance Campaigns, PO Box 6417, Tallahassee, FL 32314-6417.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1