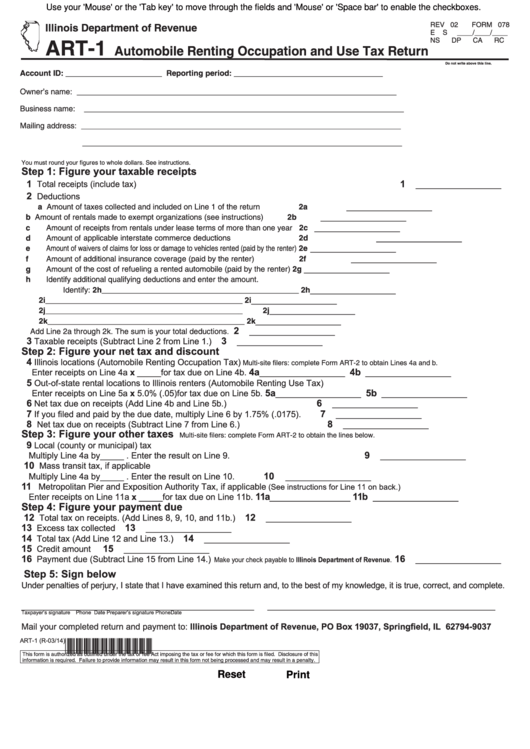

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

REV 02

FORM 078

Illinois Department of Revenue

E

S

____/____/____

ART-1

NS

DP

CA

RC

Automobile Renting Occupation and Use Tax Return

Do not write above this line.

Account ID: ______________________ Reporting period: __________________________________

Owner’s name:

_________________________________________________________________________

Business name: _________________________________________________________________________

Mailing address: _________________________________________________________________________

_________________________________________________________________________

You must round your figures to whole dollars. See instructions.

Step 1: Figure your taxable receipts

1

1

Total receipts (include tax)

__________________

2

Deductions

__________________

a Amount of taxes collected and included on Line 1 of the return

2a

__________________

b Amount of rentals made to exempt organizations (see instructions)

2b

__________________

c Amount of receipts from rentals under lease terms of more than one year 2c

__________________

d Amount of applicable interstate commerce deductions

2d

__________________

e Amount of waivers of claims for loss or damage to vehicles rented (paid by the renter) 2e

__________________

f Amount of additional insurance coverage (paid by the renter)

2f

__________________

g Amount of the cost of refueling a rented automobile (paid by the renter)

2g

h Identify additional qualifying deductions and enter the amount.

__________________

Identify: 2h_____________________________________________

2h

__________________

2i_____________________________________________

2i

__________________

2j_____________________________________________

2j

__________________

2k_____________________________________________

2k

2

__________________

Add Line 2a through 2k. The sum is your total deductions.

3

3

Taxable receipts (Subtract Line 2 from Line 1.)

__________________

Step 2: Figure your net tax and discount

4

Illinois locations (Automobile Renting Occupation Tax)

Multi-site filers: complete Form ART-2 to obtain Lines 4a and b.

4a

4b

Enter receipts on Line 4a x _____ for tax due on Line 4b.

__________________

__________________

5

Out-of-state rental locations to Illinois renters (Automobile Renting Use Tax)

5a

5b

Enter receipts on Line 5a x 5.0% (.05) for tax due on Line 5b.

__________________

__________________

6

6

Net tax due on receipts (Add Line 4b and Line 5b.)

__________________

7

7

If you filed and paid by the due date, multiply Line 6 by 1.75% (.0175).

__________________

8

8

Net tax due on receipts (Subtract Line 7 from Line 6.)

__________________

Step 3: Figure your other taxes

Multi-site filers: complete Form ART-2 to obtain the lines below.

9

Local (county or municipal) tax

9

Multiply Line 4a by _____ . Enter the result on Line 9.

__________________

10

Mass transit tax, if applicable

10

Multiply Line 4a by _____ . Enter the result on Line 10.

__________________

11

Metropolitan Pier and Exposition Authority Tax, if applicable

(See instructions for Line 11 on back.)

11a

11b

Enter receipts on Line 11a x _____ for tax due on Line 11b.

_________________

__________________

Step 4: Figure your payment due

12

12

Total tax on receipts. (Add Lines 8, 9, 10, and 11b.)

__________________

13

13

Excess tax collected

__________________

14

14

Total tax (Add Line 12 and Line 13.)

__________________

15

15

Credit amount

__________________

16

16

Payment due (Subtract Line 15 from Line 14.)

__________________

Make your check payable to Illinois Department of Revenue.

Step 5: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_________________________________________________

________________________________________________

Taxpayer’s signature

Phone

Date

Preparer’s signature

Phone

Date

Mail your completed return and payment to: Illinois Department of Revenue, PO Box 19037, Springfield, IL 62794-9037

ART-1 (R-03/14)

*407821110*

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Reset

Print

1

1