Articles Of Incorporation Of A Non-Tax-Exempt Form - Kentucky

ADVERTISEMENT

DO

NOT

PUBLISH

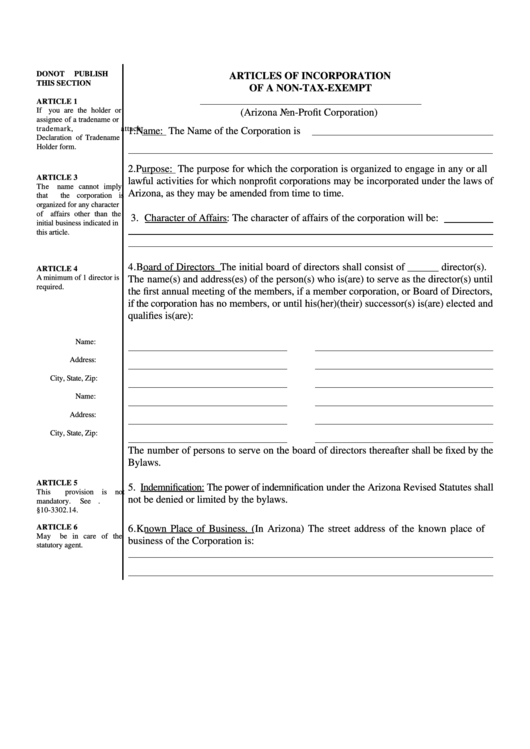

ARTICLES OF INCORPORATION

THIS SECTION

OF A NON-TAX-EXEMPT

ARTICLE 1

If you are the holder or

(Arizona Non-Profit Corporation)

assignee of a tradename or

trademark,

attach

1. Name: The Name of the Corporation is

Declaration of Tradename

Holder form.

2. Purpose: The purpose for which the corporation is organized to engage in any or all

ARTICLE 3

lawful activities for which nonprofit corporations may be incorporated under the laws of

The name cannot imply

Arizona, as they may be amended from time to time.

that the corporation is

organized for any character

of affairs other than the

3. Character of Affairs: The character of affairs of the corporation will be:

initial business indicated in

this article.

4. Board of Directors The initial board of directors shall consist of ______ director(s).

ARTICLE 4

A minimum of 1 director is

The name(s) and address(es) of the person(s) who is(are) to serve as the director(s) until

required.

the first annual meeting of the members, if a member corporation, or Board of Directors,

if the corporation has no members, or until his(her)(their) successor(s) is(are) elected and

qualifies is(are):

Name:

Address:

City, State, Zip:

Name:

Address:

City, State, Zip:

The number of persons to serve on the board of directors thereafter shall be fixed by the

Bylaws.

ARTICLE 5

5. Indemnification: The power of indemnification under the Arizona Revised Statutes shall

This

provision

is

not

not be denied or limited by the bylaws.

mandatory.

See A.R.S.

§10-3302.14.

ARTICLE 6

6. Known Place of Business. (In Arizona) The street address of the known place of

May be in care of the

business of the Corporation is:

statutory agent.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2