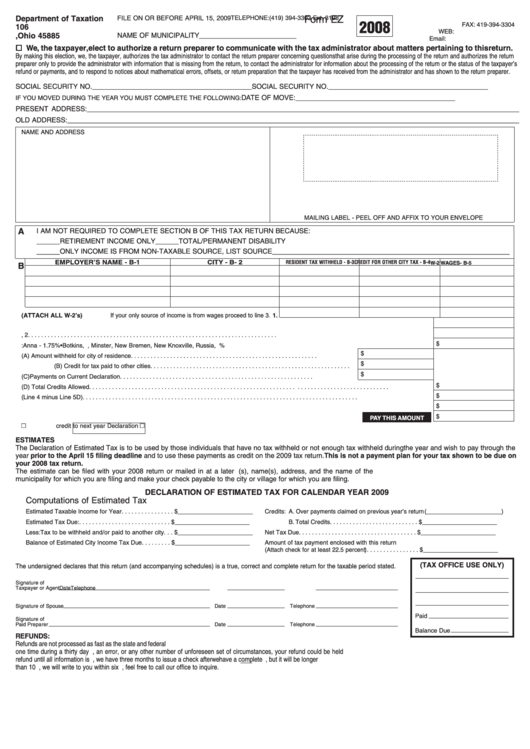

Form Ez St. Marys 2008

ADVERTISEMENT

Department of Taxation

FILE ON OR BEFORE APRIL 15, 2009

Form EZ

TELEPHONE: (419) 394-3303 Ext. 3198

2008

FAX: 419-394-3304

106 E. Spring St.

WEB:

St. Marys, Ohio 45885

NAME OF MUNICIPALITY_________________________

Email: jbond@cityofstmarys.net

We, the taxpayer, elect to authorize a return preparer to communicate with the tax administrator about matters pertaining to this return.

By making this election, we, the taxpayer, authorizes the tax administrator to contact the return preparer concerning questions that arise during the processing of the return and authorizes the return

preparer only to provide the administrator with information that is missing from the return, to contact the administrator for information about the processing of the return or the status of the taxpayer’s

refund or payments, and to respond to notices about mathematical errors, offsets, or return preparation that the taxpayer has received from the administrator and has shown to the return preparer.

SOCIAL SECURITY NO._________________________________________

SOCIAL SECURITY NO._________________________________________

DATE OF MOVE:_________________________________________

IF YOU MOVED DURING THE YEAR YOU MUST COMPLETE THE FOLLOWING:

PRESENT ADDRESS:_______________________________________________________________________________________________________________

OLD ADDRESS:____________________________________________________________________________________________________________________

NAME AND ADDRESS

MAILING LABEL - PEEL OFF AND AFFIX TO YOUR ENVELOPE

A

I AM NOT REQUIRED TO COMPLETE SECTION B OF THIS TAX RETURN BECAUSE:

______RETIREMENT INCOME ONLY

______TOTAL/PERMANENT DISABILITY

______ONLY INCOME IS FROM NON-TAXABLE SOURCE, LIST SOURCE _____________________________________________________________

EMPLOYER’S NAME - B-1

CITY - B- 2

RESIDENT TAX WITHHELD - B-3

CREDIT FOR OTHER CITY TAX - B-4

W-2 WAGES - B-5

B

1. TOTAL (ATTACH ALL W-2’s) If your only source of income is from wages proceed to line 3. 1.

2. Income other than Wages from Worksheet 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Net amount subject to Income Tax total of Lines 1, 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

4. Municipal Tax Due: Anna - 1.75% • Botkins, Ft. Loramie, Minster, New Bremen, New Knoxville, Russia, St. Marys - 1.5%

$

5. Credits (A) Amount withheld for city of residence . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

8.

Credits*(B) Credit for tax paid to other cities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

8. Credits

(C) Payments on Current Declaration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

8. Credits

(D) Total Credits Allowed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

6. Balance of Tax Due (Line 4 minus Line 5D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

7. a. Penalty__________

b. Interest__________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

8. Amount payable with this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PAY THIS AMOUNT

9. Overpayment

refund

credit to next year Declaration

ESTIMATES

The Declaration of Estimated Tax is to be used by those individuals that have no tax withheld or not enough tax withheld during the year and wish to pay through the

year prior to the April 15 filing deadline and to use these payments as credit on the 2009 tax return. This is not a payment plan for your tax shown to be due on

your 2008 tax return.

The estimate can be filed with your 2008 return or mailed in at a later date. Please enter your social security number(s), name(s), address, and the name of the

municipality for which you are filing and make your check payable to the city or village for which you are filing.

DECLARATION OF ESTIMATED TAX FOR CALENDAR YEAR 2009

Computations of Estimated Tax

Computations of Estimated Tax

Estimated Taxable Income for Year . . . . . . . . . . . . . . . . $______________________

Credits: A. Over payments claimed on previous year’s return (______________________)

Estimated Tax Due: . . . . . . . . . . . . . . . . . . . . . . . . . . . . $______________________

B. Total Credits. . . . . . . . . . . . . . . . . . . . . . . . . . . $______________________

Less: Tax to be withheld and/or paid to another city . . . $______________________

Net Tax Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $______________________

Balance of Estimated City Income Tax Due . . . . . . . . . $______________________

Amount of tax payment enclosed with this return

(Attach check for at least 22.5 percent). . . . . . . . . . . . . . . . $______________________

(TAX OFFICE USE ONLY)

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated.

Signature of

Taxpayer or Agent

Date

Telephone

Signature of Spouse

Date

Telephone

Paid

Signature of

Paid Preparer

Date

Telephone

Balance Due

REFUNDS:

Refunds are not processed as fast as the state and federal refunds.You can expect to wait for six weeks. We advise you not to plan to meet a deadline with your city refund. Refunds are processed

one time during a thirty day period. If there is missing documentation, an error, or any other number of unforeseen set of circumstances, your refund could be held up. We do not process a

refund until all information is complete. By law, we have three months to issue a check after we have a complete return. We do intend to process your refund before this time, but it will be longer

than 10 days. If there is a problem with your refund, we will write to you within six weeks. If you have not received a letter from us within 60 days, feel free to call our office to inquire.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2