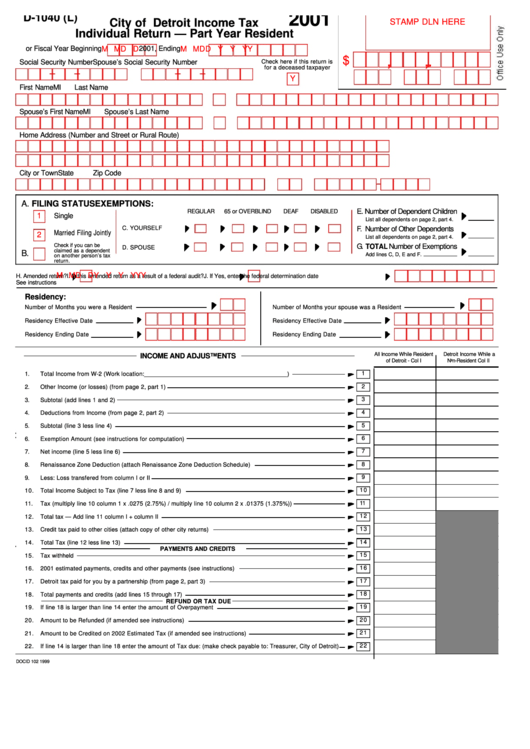

Form D-1040 (L) - City Of Detroit Income Tax Individual Return - Part Year Resident - 2001

ADVERTISEMENT

2001

D-1040 (L)

City of Detroit Income Tax

STAMP DLN HERE

Individual Return — Part Year Resident

or Fiscal Year Beginning

M M D D

2001, Ending

M M D D Y Y Y Y

$

,

,

.

Social Security Number

Spouse’s Social Security Number

Check here if this return is

for a deceased taxpayer

Y

First Name

MI

Last Name

Spouse’s First Name

MI

Spouse’s Last Name

Home Address (Number and Street or Rural Route)

City or Town

State

Zip Code

A. FILING STATUS

EXEMPTIONS:

E. Number of Dependent Children

REGULAR

65 or OVER

BLIND

DEAF

DISABLED

1

Single

List all dependents on page 2, part 4.

C. YOURSELF

F. Number of Other Dependents

Married Filing Jointly

2

List all dependents on page 2, part 4.

Check if you can be

G. TOTAL Number of Exemptions

D. SPOUSE

claimed as a dependent

B.

Add lines C, D, E and F.

on another person’s tax

return.

Y

Y

M M D D Y Y Y Y

H. Amended return?

I. Is this amended return as a result of a federal audit?

J. If Yes, enter the federal determination date

See instructions

Residency:

Number of Months you were a Resident

Number of Months your spouse was a Resident

Residency Effective Date

Residency Effective Date

Residency Ending Date

Residency Ending Date

All Income While Resident

Detroit Income While a

INCOME AND ADJUSTMENTS

of Detroit - Col I

Non-Resident Col II

1

1.

Total Income from W-2 (Work location: __________________________________________)

2

2.

Other Income (or losses) (from page 2, part 1)

3

3.

Subtotal (add lines 1 and 2)

4

4.

Deductions from Income (from page 2, part 2)

5

5.

Subtotal (line 3 less line 4)

6

6.

Exemption Amount (see instructions for computation)

7

7.

Net income (line 5 less line 6)

8

8.

Renaissance Zone Deduction (attach Renaissance Zone Deduction Schedule)

9

9.

Less: Loss transfered from column I or II

1 0

10.

Total Income Subject to Tax (line 7 less line 8 and 9)

11

11.

Tax (multiply line 10 column 1 x .0275 (2.75%) / multiply line 10 column 2 x .01375 (1.375%))

1 2

12.

Total tax — Add line 11 column I + column II

1 3

13.

Credit tax paid to other cities (attach copy of other city returns)

1 4

14.

Total Tax (line 12 less line 13)

PAYMENTS AND CREDITS

1 5

15.

Tax withheld

1 6

16.

2001 estimated payments, credits and other payments (see instructions)

1 7

17.

Detroit tax paid for you by a partnership (from page 2, part 3)

1 8

18.

Total payments and credits (add lines 15 through 17)

REFUND OR TAX DUE

1 9

19.

If line 18 is larger than line 14 enter the amount of Overpayment

2 0

20.

Amount to be Refunded (if amended see instructions)

2 1

21.

Amount to be Credited on 2002 Estimated Tax (if amended see instructions)

2 2

22.

If line 14 is larger than line 18 enter the amount of Tax due: (make check payable to: Treasurer, City of Detroit)

DOCID 102 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2