Reset

Print

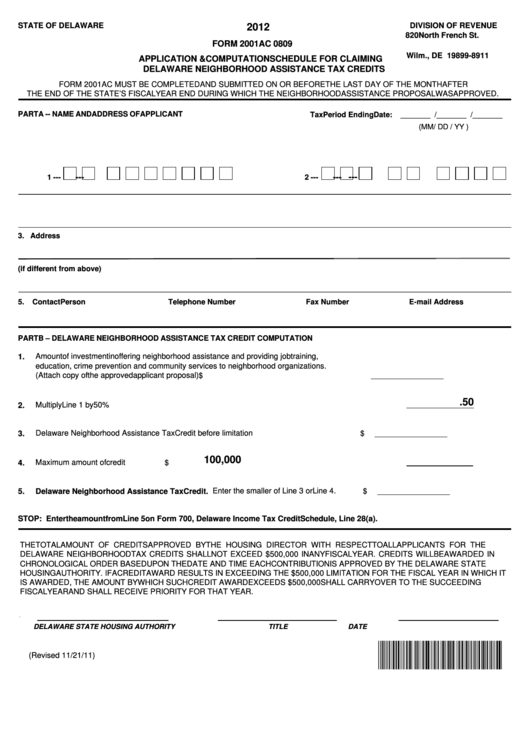

STATE OF DELAWARE

DIVISION OF REVENUE

2012

820 North French St.

FORM 2001AC 0809

P.O. Box 8911

Wilm., DE 19899-8911

APPLICATION & COMPUTATION SCHEDULE FOR CLAIMING

DELAWARE NEIGHBORHOOD ASSISTANCE TAX CREDITS

FORM 2001AC MUST BE COMPLETED AND SUBMITTED ON OR BEFORE THE LAST DAY OF THE MONTH AFTER

THE END OF THE STATE’S FISCAL YEAR END DURING WHICH THE NEIGHBORHOOD ASSISTANCE PROPOSAL WAS APPROVED.

PART A -- NAME AND ADDRESS OF APPLICANT

_______ / _______ /_______

Tax Period Ending Date:

( MM / DD / YY )

1. Enter Federal Employer Identification Number

OR

2. Enter Social Security Number

---

---

---

1 ---

2 ---

2. Name of Applicant

3. Address

4. Delaware Address (if different from above)

5.

Contact Person

Telephone Number

Fax Number

E-mail Address

PART B – DELAWARE NEIGHBORHOOD ASSISTANCE TAX CREDIT COMPUTATION

Amount of investment in offering neighborhood assistance and providing job training,

1.

education, crime prevention and community services to neighborhood organizations.

(Attach copy of the approved applicant proposal)

_________________

$

.50

Multiply Line 1 by 50%

2.

Delaware Neighborhood Assistance Tax Credit before limitation

$

_________________

3.

100,000

Maximum amount of credit

$

4.

Delaware Neighborhood Assistance Tax Credit. Enter the smaller of Line 3 or Line 4.

5.

$

_________________

STOP: Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line 28(a).

THE TOTAL AMOUNT OF CREDITS APPROVED BY THE HOUSING DIRECTOR WITH RESPECT TO ALL APPLICANTS FOR THE

DELAWARE NEIGHBORHOOD TAX CREDITS SHALL NOT EXCEED $500,000 IN ANY FISCAL YEAR. CREDITS WILL BE AWARDED IN

CHRONOLOGICAL ORDER BASED UPON THE DATE AND TIME EACH CONTRIBUTION IS APPROVED BY THE DELAWARE STATE

HOUSING AUTHORITY. IF A CREDIT AWARD RESULTS IN EXCEEDING THE $500,000 LIMITATION FOR THE FISCAL YEAR IN WHICH IT

IS AWARDED, THE AMOUNT BY WHICH SUCH CREDIT AWARD EXCEEDS $500,000 SHALL CARRY OVER TO THE SUCCEEDING

FISCAL YEAR AND SHALL RECEIVE PRIORITY FOR THAT YEAR.

DELAWARE STATE HOUSING AUTHORITY

TITLE

DATE

(Revised 11/21/11)

1

1