Form D-1 - Declaration Of Estimated Income Tax - City Of Hamilton

ADVERTISEMENT

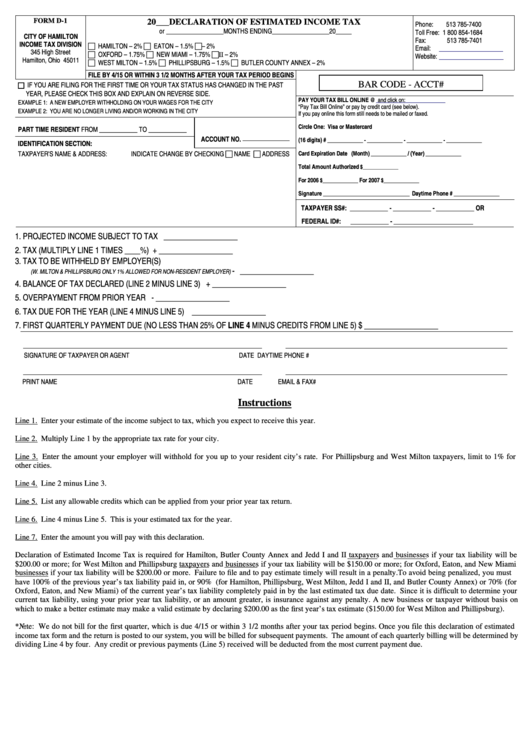

FORM D-1

20___DECLARATION OF ESTIMATED INCOME TAX

Phone:

513 785-7400

or __________________MONTHS ENDING__________________20_____

Toll Free: 1 800 854-1684

CITY OF HAMILTON

Fax:

513 785-7401

INCOME TAX DIVISION

HAMILTON – 2%

EATON – 1.5%

J.E.D.D. – 2%

Email:

citytax@ci.hamilton.oh.us

345 High Street

OXFORD – 1.75%

NEW MIAMI – 1.75%

J.E.D.D. II – 2%

Website:

Hamilton, Ohio 45011

WEST MILTON – 1.5%

PHILLIPSBURG – 1.5%

BUTLER COUNTY ANNEX – 2%

FILE BY 4/15 OR WITHIN 3 1/2 MONTHS AFTER YOUR TAX PERIOD BEGINS

IF YOU ARE FILING FOR THE FIRST TIME OR YOUR TAX STATUS HAS CHANGED IN THE PAST

BAR CODE - ACCT#

YEAR, PLEASE CHECK THIS BOX AND EXPLAIN ON REVERSE SIDE.

PAY YOUR TAX BILL ONLINE @

and click on:

EXAMPLE 1: A NEW EMPLOYER WITHHOLDING ON YOUR WAGES FOR THE CITY

“Pay Tax Bill Online” or pay by credit card (see below).

EXAMPLE 2: YOU ARE NO LONGER LIVING AND/OR WORKING IN THE CITY

If you pay online this form still needs to be mailed or faxed.

Circle One: Visa or Mastercard

PART TIME RESIDENT FROM ____________ TO ____________

ACCOUNT NO.

(16 digits) #

______________ - ______________ - ______________ - ______________

IDENTIFICATION SECTION:

TAXPAYER’S NAME & ADDRESS:

INDICATE CHANGE BY CHECKING

NAME

ADDRESS

Card Expiration Date (Month)

/ (Year)

______________

______________

Total Amount Authorized

$______________

For 2006

For 2007

$______________

$______________

Signature

Daytime Phone #

__________________________________

__________________

TAXPAYER SS#: ____________ - ____________ - ____________ OR

FEDERAL ID#:

____________ - _________________________

1.

PROJECTED INCOME SUBJECT TO TAX

___________________

2.

TAX (MULTIPLY LINE 1 TIMES ____%)

+ ___________________

3.

TAX TO BE WITHHELD BY EMPLOYER(S)

- ___________________

(W. MILTON & PHILLIPSBURG ONLY 1% ALLOWED FOR NON-RESIDENT EMPLOYER)

4.

BALANCE OF TAX DECLARED (LINE 2 MINUS LINE 3)

+ ___________________

5.

OVERPAYMENT FROM PRIOR YEAR

- ___________________

6.

TAX DUE FOR THE YEAR (LINE 4 MINUS LINE 5)

___________________

7.

FIRST QUARTERLY PAYMENT DUE (NO LESS THAN 25% OF LINE 4 MINUS CREDITS FROM LINE 5)

$ ___________________

SIGNATURE OF TAXPAYER OR AGENT

DATE

DAYTIME PHONE #

PRINT NAME

DATE

EMAIL & FAX#

Instructions

Line 1. Enter your estimate of the income subject to tax, which you expect to receive this year.

Line 2. Multiply Line 1 by the appropriate tax rate for your city.

Line 3. Enter the amount your employer will withhold for you up to your resident city’s rate. For Phillipsburg and West Milton taxpayers, limit to 1% for

other cities.

Line 4. Line 2 minus Line 3.

Line 5. List any allowable credits which can be applied from your prior year tax return.

Line 6. Line 4 minus Line 5. This is your estimated tax for the year.

Line 7. Enter the amount you will pay with this declaration.

Declaration of Estimated Income Tax is required for Hamilton, Butler County Annex and Jedd I and II taxpayers and businesses if your tax liability will be

$200.00 or more; for West Milton and Phillipsburg taxpayers and businesses if your tax liability will be $150.00 or more; for Oxford, Eaton, and New Miami

businesses if your tax liability will be $200.00 or more. Failure to file and to pay estimate timely will result in a penalty. To avoid being penalized, you must

have 100% of the previous year’s tax liability paid in, or 90% (for Hamilton, Phillipsburg, West Milton, Jedd I and II, and Butler County Annex) or 70% (for

Oxford, Eaton, and New Miami) of the current year’s tax liability completely paid in by the last estimated tax due date. Since it is difficult to determine your

current tax liability, using your prior year tax liability, or an amount greater, is insurance against any penalty. A new business or taxpayer without basis on

which to make a better estimate may make a valid estimate by declaring $200.00 as the first year’s tax estimate ($150.00 for West Milton and Phillipsburg).

*Note: We do not bill for the first quarter, which is due 4/15 or within 3 1/2 months after your tax period begins. Once you file this declaration of estimated

income tax form and the return is posted to our system, you will be billed for subsequent payments. The amount of each quarterly billing will be determined by

dividing Line 4 by four. Any credit or previous payments (Line 5) received will be deducted from the most current payment due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1