General Tips For Forms 5208 A, B, And C

ADVERTISEMENT

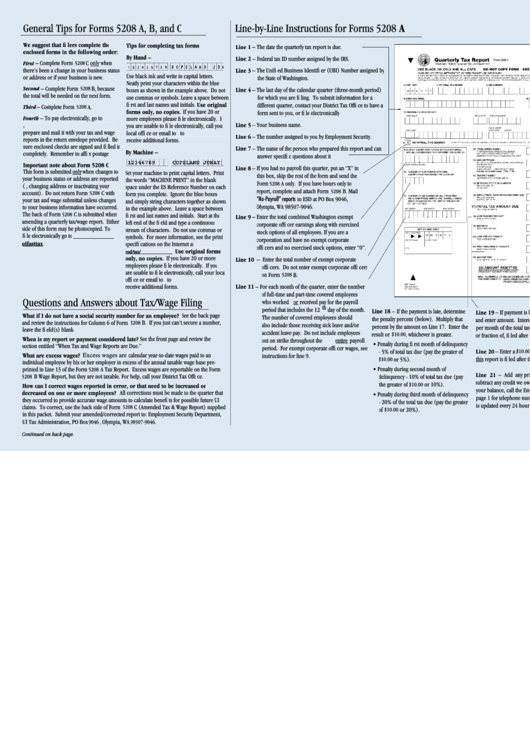

General Tips for Forms 5208 A, B, and C

Line-by-Line Instructions for Forms 5208 A

We suggest that filers complete the

Tips for completing tax forms

Line 1 – The date the quarterly tax report is due.

enclosed forms in the following order:

By Hand –

Line 2 – Federal tax ID number assigned by the IRS.

First

First

First

– Complete Form

– Complete Form

C only

only when

only when

only

5208

there’s been a change in your business status

Line 3 – The Unified Business Identifier (UBI) Number assigned by

Use black ink and write in capital letters.

or address or if your business is new.

the State of Washington.

Neatly print your characters within the blue

Second

Second

Second

– Complete Form

– Complete Form

5208

B, because

Line 4 – The last day of the calendar quarter (three-month period)

boxes as shown in the example above. Do not

the total will be needed on the next form.

use commas or symbols. Leave a space between

for which you are filing. To submit information for a

first and last names and initials. Use original

different quarter, contact your District Tax Office to have a

Line 12 –

Enter the total gross wages

Third

Third

Third

– Complete Form

– Complete Form

5208

A.

forms only, no copies. If you have 20 or

form sent to you, or file electronically.

paid to covered employees this quarter.

Fourth

– To pay electronically, go to

more employees please file electronically. If

Include all wages, including those

Line 5 – Your business name.

pay by check,

you are unable to file electronically, call your

that exceed the taxable wage base for

prepare and mail it with your tax and wage

local office or email to taxforms@esd.wa.gov to

Line 6 – The number assigned to you by Employment Security.

unemployment insurance purposes.

reports in the return envelope provided. Be

receive additional forms.

This amount should equal the total of

sure enclosed checks are signed and filled in

Line 7 – The name of the person who prepared this report and can

By Machine –

all entries on Form

B.

5208

completely. Remember to affix postage.

answer specific questions about it.

12346789

COPELAND JONAT

Important note about Form 5208 C

Line 8 – If you had no payroll this quarter, put an “X” in

Line 13 – Enter the total excess wages

This form is submitted only

only when changes to

only when changes to

only

Set your machine to print capital letters. Print

this box, skip the rest of the form and send the

paid to all employees during this quarter

during this quarter

your business status or address are reported

the words “MACHINE PRINT” in the blank

Form

A only. If you have hours only to

only

only. If total includes out of state wages,

only. If total includes out of state wages,

only

5208

(i.e., changing address or inactivating your

space under the ES Reference Number on each

check “Yes,” if not, check “No.”

report, complete and attach Form

5208

B. Mail

account). Do not return Form

C with

5208

form you complete. Ignore the blue boxes

“No-Payroll” reports to ESD at PO Box 9046,

your tax and wage submittal unless changes

and simply string characters together as shown

to your business information have occurred.

Olympia, WA 98507-9046.

Line 14 – Subtract Line 13 from Line

in the example above. Leave a space between

The back of Form

C is submitted when

5208

12 and enter the result.

first and last names and initials. Start at the

Line 9 – Enter the total combined Washington exempt

amending a quarterly tax/wage report. Either

left end of the field and type a continuous

corporate officer earnings along with exercised

side of this form may be photocopied. To

stream of characters. Do not use commas or

Line 15 – Enter the amount on Line 14

stock options of all employees. If you are a

file electronically go to

symbols. For more information, see the print

multiplied by your tax rate shown.

corporation and have no exempt corporate

uifasttax.

specifications on the Internet at

officers and no exercised stock options, enter “0”.

Use original forms

esd/tax/5208specs.htm.

esd/tax/5208specs.htm.

Line 16 – Enter the amount on Line 14

only, no copies. If you have 20 or more

Line 10 – Enter the total number of exempt corporate

Line 10 – Enter the total number of exempt corporate

Line 10

multiplied by your Employment Admin.

employees please file electronically. If you

officers. Do not enter exempt corporate officers

Fund (EAF) rate shown.

are unable to file electronically, call your local

on Form

B.

5208

office or email to taxforms@esd.wa.gov to

Line 17 – Enter the result of adding

Line 11 – For each month of the quarter, enter the number

receive additional forms.

Lines 15 and 16. This is the tax due.

of full-time and part-time covered employees

Questions and Answers about Tax/Wage Filing

who worked or received pay for the payroll

or received pay for the payroll

or

received pay for the payroll

received pay for the payroll

period that includes the 12 th

th

day of the month.

Line 18 – If the payment is late, determine

Line 19 – If payment is late, compute interest

Line 22 – Add Lines 17, 18, 19, 20 and

What if I do not have a social security number for an employee? See the back page

The number of covered employees should

the penalty percent (below). Multiply that

21 and enter the amount here. This is your

and enter amount. Interest is calculated at 1%

and review the instructions for Column 6 of Form

B. If you just can’t secure a number,

5208

also include those receiving sick leave and/or

percent by the amount on Line 17. Enter the

per month of the total tax due for each month

TOTAL AMOUNT DUE

for this quarter.

leave the field(s) blank.

accident leave pay. Do not include employees

result or

, whichever is greater.

$10.00

or fraction of, filed after the due date.

When is my report or payment considered late? See the front page and review the

out on strike throughout the entire payroll

Line 23 – Enter the amount you are remitting

• Penalty during first month of delinquency

section entitled “When Tax and Wage Reports are Due.”

period. For exempt corporate officer wages, see

at this time. It should equal Line 22.

- 5% of total tax due (pay the greater of

Line 20 – Enter a

$10.00

late report penalty if

What are excess wages? Excess wages are calendar year-to-date wages paid to an

instructions for line 9.

this report is filed after the due date (Line 1).

$10.00

or 5%).

individual employee by his or her employer in excess of the annual taxable wage base pre-

printed in Line 13 of the Form

A Tax Report. Excess wages are reportable on the Form

• Penalty during second month of

5208

Line 21 – Add any prior balance due or

(Please include your ES Reference

B Wage Report, but they are not taxable. For help, call your District Tax Office.

delinquency - 10% of total tax due (pay

5208

subtract any credit we owe you. To check

number on your check if you are

the greater of

or 10%).

How can I correct wages reported in error, or that need to be increased or

$10.00

your balance, call the Employer Help Line (see

not paying electronically.)

decreased on one or more employees? All corrections must be made to the quarter that

• Penalty during third month of delinquency

page 1 for telephone numbers). The balance

they occurred to provide accurate wage amounts to calculate benefits for possible future UI

- 20% of the total tax due (pay the greater

is updated every 24 hours.

claims. To correct, use the back side of Form

5208

C (Amended Tax & Wage Report) supplied

of

or 20%).

$10.00

in this packet. Submit your amended/corrected report to: Employment Security Department,

UI Tax Administration, PO Box

9046

, Olympia, WA

98507-9046

.

Continued on back page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2