Instructions For Form Rhm-1 - Occupation Tax Return - 2005

ADVERTISEMENT

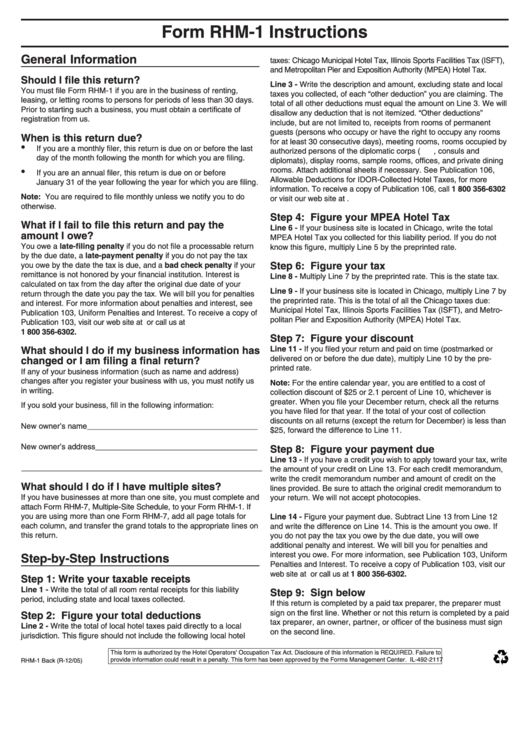

Form RHM-1 Instructions

General Information

taxes: Chicago Municipal Hotel Tax, Illinois Sports Facilities Tax (ISFT),

and Metropolitan Pier and Exposition Authority (MPEA) Hotel Tax.

Should I file this return?

Line 3 - Write the description and amount, excluding state and local

You must file Form RHM-1 if you are in the business of renting,

taxes you collected, of each “other deduction” you are claiming. The

leasing, or letting rooms to persons for periods of less than 30 days.

total of all other deductions must equal the amount on Line 3. We will

Prior to starting such a business, you must obtain a certificate of

disallow any deduction that is not itemized. “Other deductions”

registration from us.

include, but are not limited to, receipts from rooms of permanent

guests (persons who occupy or have the right to occupy any rooms

When is this return due?

for at least 30 consecutive days), meeting rooms, rooms occupied by

•

If you are a monthly filer, this return is due on or before the last

authorized persons of the diplomatic corps ( e.g. , consuls and

day of the month following the month for which you are filing.

diplomats), display rooms, sample rooms, offices, and private dining

•

rooms. Attach additional sheets if necessary. See Publication 106,

If you are an annual filer, this return is due on or before

Allowable Deductions for IDOR-Collected Hotel Taxes, for more

January 31 of the year following the year for which you are filing.

information. To receive a copy of Publication 106, call 1 800 356-6302

Note: You are required to file monthly unless we notify you to do

or visit our web site at tax.illinois.gov.

otherwise.

Step 4: Figure your MPEA Hotel Tax

What if I fail to file this return and pay the

Line 6 - If your business site is located in Chicago, write the total

amount I owe?

MPEA Hotel Tax you collected for this liability period. If you do not

You owe a late-filing penalty if you do not file a processable return

know this figure, multiply Line 5 by the preprinted rate.

by the due date, a late-payment penalty if you do not pay the tax

you owe by the date the tax is due, and a bad check penalty if your

Step 6: Figure your tax

remittance is not honored by your financial institution. Interest is

Line 8 - Multiply Line 7 by the preprinted rate. This is the state tax.

calculated on tax from the day after the original due date of your

Line 9 - If your business site is located in Chicago, multiply Line 7 by

return through the date you pay the tax. We will bill you for penalties

the preprinted rate. This is the total of all the Chicago taxes due:

and interest. For more information about penalties and interest, see

Municipal Hotel Tax, Illinois Sports Facilities Tax (ISFT), and Metro-

Publication 103, Uniform Penalties and Interest. To receive a copy of

politan Pier and Exposition Authority (MPEA) Hotel Tax.

Publication 103, visit our web site at tax.illinois.gov or call us at

1 800 356-6302.

Step 7: Figure your discount

Line 11 - If you filed your return and paid on time (postmarked or

What should I do if my business information has

delivered on or before the due date), multiply Line 10 by the pre-

changed or I am filing a final return?

printed rate.

If any of your business information (such as name and address)

changes after you register your business with us, you must notify us

Note: For the entire calendar year, you are entitled to a cost of

in writing.

collection discount of $25 or 2.1 percent of Line 10, whichever is

greater. When you file your December return, check all the returns

If you sold your business, fill in the following information:

you have filed for that year. If the total of your cost of collection

discounts on all returns (except the return for December) is less than

New owner’s name _______________________________________

$25, forward the difference to Line 11.

New owner’s address _____________________________________

Step 8: Figure your payment due

Line 13 - If you have a credit you wish to apply toward your tax, write

_______________________________________________________

the amount of your credit on Line 13. For each credit memorandum,

write the credit memorandum number and amount of credit on the

What should I do if I have multiple sites?

lines provided. Be sure to attach the original credit memorandum to

If you have businesses at more than one site, you must complete and

your return. We will not accept photocopies.

attach Form RHM-7, Multiple-Site Schedule, to your Form RHM-1. If

you are using more than one Form RHM-7, add all page totals for

Line 14 - Figure your payment due. Subtract Line 13 from Line 12

each column, and transfer the grand totals to the appropriate lines on

and write the difference on Line 14. This is the amount you owe. If

this return.

you do not pay the tax you owe by the due date, you will owe

additional penalty and interest. We will bill you for penalties and

interest you owe. For more information, see Publication 103, Uniform

Step-by-Step Instructions

Penalties and Interest. To receive a copy of Publication 103, visit our

web site at tax.illinois.gov or call us at 1 800 356-6302.

Step 1: Write your taxable receipts

Line 1 - Write the total of all room rental receipts for this liability

Step 9: Sign below

period, including state and local taxes collected.

If this return is completed by a paid tax preparer, the preparer must

sign on the first line. Whether or not this return is completed by a paid

Step 2: Figure your total deductions

tax preparer, an owner, partner, or officer of the business must sign

Line 2 - Write the total of local hotel taxes paid directly to a local

on the second line.

jurisdiction. This figure should not include the following local hotel

This form is authorized by the Hotel Operators' Occupation Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-2117

RHM-1 Back (R-12/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1