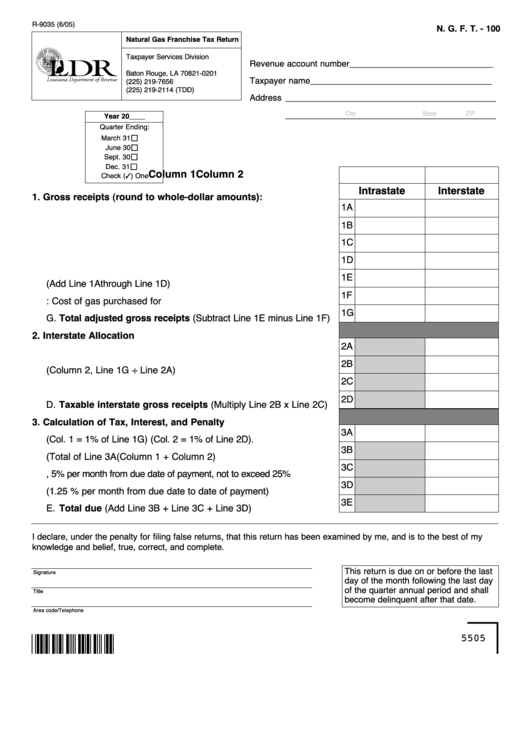

R-9035 (6/05)

N. G. F. T. - 100

Natural Gas Franchise Tax Return

Taxpayer Services Division

Revenue account number ______________________________

P.O. Box 201

Baton Rouge, LA 70821-0201

Taxpayer name ______________________________________

(225) 219-7656

(225) 219-2114 (TDD)

Address ____________________________________________

City

State

ZIP

____________________________________________

Year 20____

Quarter Ending:

March 31

June 30

Sept. 30

Dec. 31

Column 1

Column 2

Check (✓) One

Intrastate

Interstate

1. Gross receipts (round to whole-dollar amounts):

1A

A. From the sale of natural gas........................................................

1B

B. For hire ........................................................................................

1C

C. For use ........................................................................................

1D

D. Other income ..............................................................................

1E

E. Total gross receipts (Add Line 1A through Line 1D)......................

1F

F. Deduct: Cost of gas purchased for resale ..................................

1G

G. Total adjusted gross receipts (Subtract Line 1E minus Line 1F)

2. Interstate Allocation

2A

A. Total miles of pipeline ..................................................................

2B

B. Average receipts per mile (Column 2, Line 1G ÷ Line 2A) ........

2C

C. Louisiana miles of pipeline ..........................................................

2D

D. Taxable interstate gross receipts (Multiply Line 2B x Line 2C)

3. Calculation of Tax, Interest, and Penalty

3A

A. Amount of tax (Col. 1 = 1% of Line 1G) (Col. 2 = 1% of Line 2D).

3B

B. Total tax due (Total of Line 3A (Column 1 + Column 2) ..............

3C

C. Penalty, 5% per month from due date of payment, not to exceed 25%

3D

D. Interest (1.25 % per month from due date to date of payment) ....

3E

E. Total due (Add Line 3B + Line 3C + Line 3D) ............................

I declare, under the penalty for filing false returns, that this return has been examined by me, and is to the best of my

knowledge and belief, true, correct, and complete.

This return is due on or before the last

Signature

day of the month following the last day

of the quarter annual period and shall

Title

become delinquent after that date.

Area code/Telephone

5505

1

1