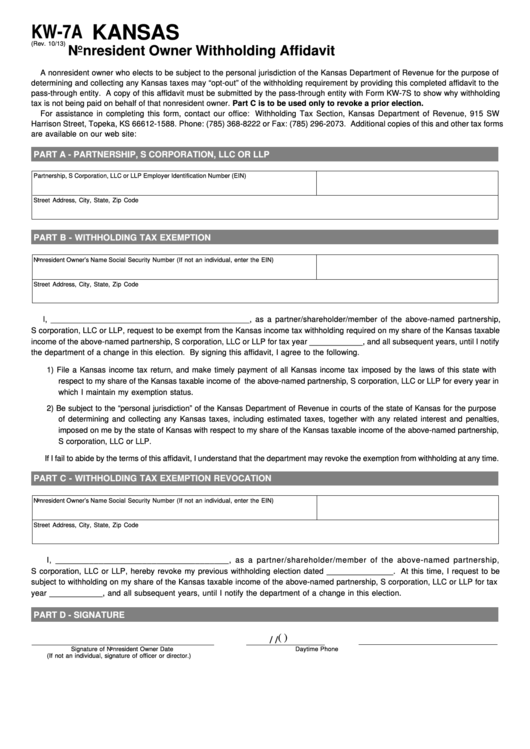

KW-7A

KANSAS

(Rev. 10/13)

Nonresident Owner Withholding Affidavit

A nonresident owner who elects to be subject to the personal jurisdiction of the Kansas Department of Revenue for the purpose of

determining and collecting any Kansas taxes may “opt-out” of the withholding requirement by providing this completed affidavit to the

pass-through entity. A copy of this affidavit must be submitted by the pass-through entity with Form KW-7S to show why withholding

tax is not being paid on behalf of that nonresident owner. Part C is to be used only to revoke a prior election.

For assistance in completing this form, contact our office: Withholding Tax Section, Kansas Department of Revenue, 915 SW

Harrison Street, Topeka, KS 66612-1588. Phone: (785) 368-8222 or Fax: (785) 296-2073. Additional copies of this and other tax forms

are available on our web site:

PART A - PARTNERSHIP, S CORPORATION, LLC OR LLP

Partnership, S Corporation, LLC or LLP

Employer Identification Number (EIN)

Street Address, City, State, Zip Code

PART B - WITHHOLDING TAX EXEMPTION

Nonresident Owner’s Name

Social Security Number (If not an individual, enter the EIN)

Street Address, City, State, Zip Code

I, ____________________________________________, as a partner/shareholder/member of the above-named partnership,

S corporation, LLC or LLP, request to be exempt from the Kansas income tax withholding required on my share of the Kansas taxable

income of the above-named partnership, S corporation, LLC or LLP for tax year ____________, and all subsequent years, until I notify

the department of a change in this election. By signing this affidavit, I agree to the following.

1) File a Kansas income tax return, and make timely payment of all Kansas income tax imposed by the laws of this state with

respect to my share of the Kansas taxable income of the above-named partnership, S corporation, LLC or LLP for every year in

which I maintain my exemption status.

2) Be subject to the “personal jurisdiction” of the Kansas Department of Revenue in courts of the state of Kansas for the purpose

of determining and collecting any Kansas taxes, including estimated taxes, together with any related interest and penalties,

imposed on me by the state of Kansas with respect to my share of the Kansas taxable income of the above-named partnership,

S corporation, LLC or LLP.

If I fail to abide by the terms of this affidavit, I understand that the department may revoke the exemption from withholding at any time.

PART C - WITHHOLDING TAX EXEMPTION REVOCATION

Nonresident Owner’s Name

Social Security Number (If not an individual, enter the EIN)

Street Address, City, State, Zip Code

I, ____________________________________, as a partner/shareholder/member of the above-named partnership,

S corporation, LLC or LLP, hereby revoke my previous withholding election dated _______________. At this time, I request to be

subject to withholding on my share of the Kansas taxable income of the above-named partnership, S corporation, LLC or LLP for tax

year ____________, and all subsequent years, until I notify the department of a change in this election.

PART D - SIGNATURE

(

)

/

/

Signature of Nonresident Owner

Date

Daytime Phone

(If not an individual, signature of officer or director.)

1

1