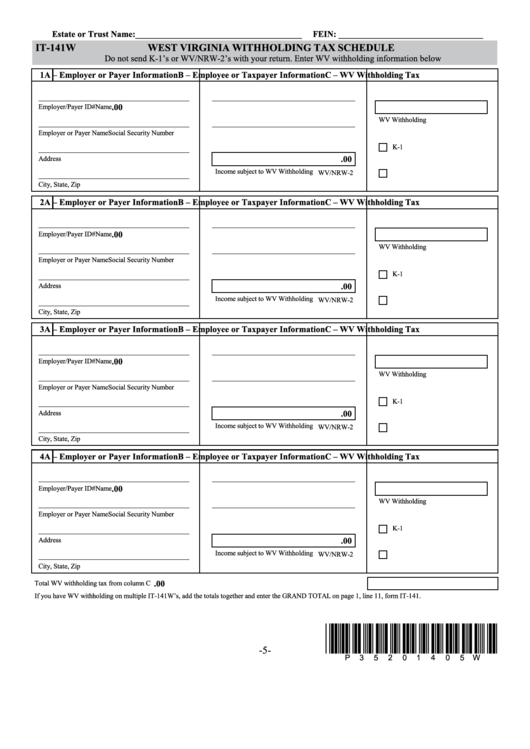

Form It-141w - West Virginia Withholding Tax Schedule

ADVERTISEMENT

estate or trust name:______________________________________

fein: _________________________________

it-141w

weSt Virginia withholDing tax SCheDule

Do not send K-1’s or WV/NRW-2’s with your return. Enter WV withholding information below

1

a – employer or Payer information

B – employee or taxpayer information

C – wV withholding tax

.00

Employer/Payer ID#

Name

WV Withholding

Employer or Payer Name

Social Security Number

k-1

.00

Address

Income subject to WV Withholding

WV/NRW-2

City, State, Zip

2

a – employer or Payer information

B – employee or taxpayer information

C – wV withholding tax

.00

Employer/Payer ID#

Name

WV Withholding

Employer or Payer Name

Social Security Number

k-1

.00

Address

Income subject to WV Withholding

WV/NRW-2

City, State, Zip

3

a – employer or Payer information

B – employee or taxpayer information

C – wV withholding tax

.00

Employer/Payer ID#

Name

WV Withholding

Employer or Payer Name

Social Security Number

k-1

.00

Address

Income subject to WV Withholding

WV/NRW-2

City, State, Zip

4

a – employer or Payer information

B – employee or taxpayer information

C – wV withholding tax

.00

Employer/Payer ID#

Name

WV Withholding

Employer or Payer Name

Social Security Number

k-1

.00

Address

Income subject to WV Withholding

WV/NRW-2

City, State, Zip

.00

Total WV withholding tax from column C above.................................................................................................................

If you have WV withholding on multiple IT-141W’s, add the totals together and enter the GRAND TOTAL on page 1, line 11, form IT-141.

*p35201405w*

-5-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1