Print

Reset

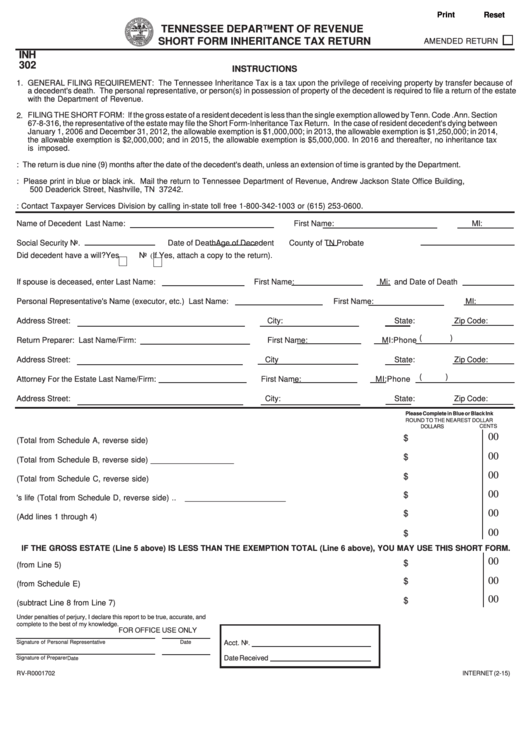

TENNESSEE DEPARTMENT OF REVENUE

SHORT FORM INHERITANCE TAX RETURN

AMENDED RETURN

INH

302

INSTRUCTIONS

1. GENERAL FILING REQUIREMENT: The Tennessee Inheritance Tax is a tax upon the privilege of receiving property by transfer because of

a decedent's death. The personal representative, or person(s) in possession of property of the decedent is required to file a return of the estate

with the Department of Revenue.

FILING THE SHORT FORM: If the gross estate of a resident decedent is less than the single exemption allowed by Tenn. Code .Ann. Section

2.

67-8-316, the representative of the estate may file the Short Form-Inheritance Tax Return. In the case of resident decedent's dying between

January 1, 2006 and December 31, 2012, the allowable exemption is $1,000,000; in 2013, the allowable exemption is $1,250,000; in 2014,

the allowable exemption is $2,000,000; and in 2015, the allowable exemption is $5,000,000. In 2016 and thereafter, no inheritance tax

is imposed.

3. DUE DATE: The return is due nine (9) months after the date of the decedent's death, unless an extension of time is granted by the Department.

4. FILING: Please print in blue or black ink. Mail the return to Tennessee Department of Revenue, Andrew Jackson State Office Building,

500 Deaderick Street, Nashville, TN 37242.

5. FOR ASSISTANCE: Contact Taxpayer Services Division by calling in-state toll free 1-800-342-1003 or (615) 253-0600.

Name of Decedent Last Name:

First Name:

MI:

Social Security No.

Date of Death

Age of Decedent

County of TN Probate

Did decedent have a will?

Yes

No

If Yes, attach a copy to the return).

(

If spouse is deceased, enter Last Name:

First Name:

Mi:

and Date of Death

Personal Representative's Name (executor, etc.) Last Name:

First Name:

MI:

Address Street:

City:

State:

Zip Code:

(

)

Return Preparer: Last Name/Firm:

First Name:

MI:

Phone

Address Street:

City

State:

Zip Code:

(

)

Attorney For the Estate Last Name/Firm:

First Name:

MI:

Phone

Address Street:

City:

State:

Zip Code:

Please Complete in Blue or Black Ink

ROUND TO THE NEAREST DOLLAR

CENTS

DOLLARS

00

$

1. Real Estate (Total from Schedule A, reverse side) .........................................................................................

_______________________

00

$

2. Personal and Miscellaneous Property (Total from Schedule B, reverse side) ................................................

_______________________

00

$

3. Jointly-Owned Property (Total from Schedule C, reverse side) ......................................................................

_______________________

00

$

4. Transfers during decedent's life (Total from Schedule D, reverse side) .........................................................

_______________________

00

$

5. Total Gross Estate (Add lines 1 through 4) .....................................................................................................

_______________________

00

$

6. Allowable Exemption ........................................................................................................................................

_______________________

IF THE GROSS ESTATE (Line 5 above) IS LESS THAN THE EXEMPTION TOTAL (Line 6 above), YOU MAY USE THIS SHORT FORM.

00

$

7. TOTAL GROSS ESTATE (from Line 5) ...........................................................................................................

_______________________

00

$

8. TOTAL DEDUCTIONS (from Schedule E) ......................................................................................................

_______________________

00

$

9. NET ESTATE (subtract Line 8 from Line 7) ....................................................................................................

_______________________

Under penalties of perjury, I declare this report to be true, accurate, and

complete to the best of my knowledge.

FOR OFFICE USE ONLY

Signature of Personal Representative

Date

Acct. No.

Date Received

Signature of Preparer

Date

RV-R0001702

INTERNET (2-15)

1

1 2

2