Form Rv-F1400301 - Application For Inheritance Tax Consent To Transfer

ADVERTISEMENT

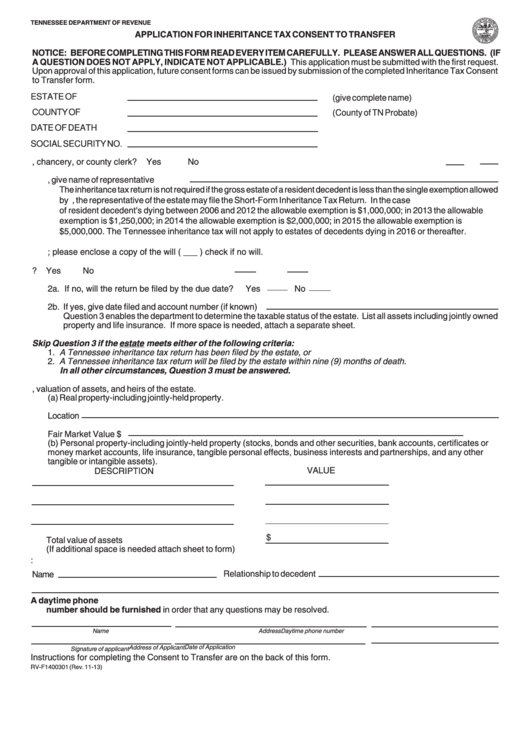

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR INHERITANCE TAX CONSENT TO TRANSFER

NOTICE: BEFORE COMPLETING THIS FORM READ EVERY ITEM CAREFULLY. PLEASE ANSWER ALL QUESTIONS. (IF

A QUESTION DOES NOT APPLY, INDICATE NOT APPLICABLE.) This application must be submitted with the first request.

Upon approval of this application, future consent forms can be issued by submission of the completed Inheritance Tax Consent

to Transfer form.

ESTATE OF

(give complete name)

COUNTY OF

(County of TN Probate)

DATE OF DEATH

SOCIAL SECURITY NO.

1. Has a representative been duly appointed and qualified by the probate, chancery, or county clerk? Yes

No

a. If yes, give name of representative

The inheritance tax return is not required if the gross estate of a resident decedent is less than the single exemption allowed

by T.C.A. Section 67-8-316, the representative of the estate may file the Short-Form Inheritance Tax Return. In the case

of resident decedent's dying between 2006 and 2012 the allowable exemption is $1,000,000; in 2013 the allowable

exemption is $1,250,000; in 2014 the allowable exemption is $2,000,000; in 2015 the allowable exemption is

$5,000,000. The Tennessee inheritance tax will not apply to estates of decedents dying in 2016 or thereafter.

b. If no; please enclose a copy of the will ( ___ ) check if no will.

2. Has an Inheritance Tax Return been filed? Yes

No

2a. If no, will the return be filed by the due date?

Yes

No

2b. If yes, give date filed and account number (if known)

Question 3 enables the department to determine the taxable status of the estate. List all assets including jointly owned

property and life insurance. If more space is needed, attach a separate sheet.

Skip Question 3 if the estate meets either of the following criteria:

1. A Tennessee inheritance tax return has been filed by the estate, or

2. A Tennessee inheritance tax return will be filed by the estate within nine (9) months of death.

In all other circumstances, Question 3 must be answered.

3. Please provide the following information concerning assets of the estate, valuation of assets, and heirs of the estate.

(a) Real property-including jointly-held property.

Location

Fair Market Value $

(b) Personal property-including jointly-held property (stocks, bonds and other securities, bank accounts, certificates or

money market accounts, life insurance, tangible personal effects, business interests and partnerships, and any other

tangible or intangible assets).

VALUE

DESCRIPTION

$

Total value of assets

(If additional space is needed attach sheet to form)

4. Beneficiaries of the estate are:

Relationship to decedent

Name

5. Please list below the name and address of the qualified representative or attorney for the above estate. A daytime phone

number should be furnished in order that any questions may be resolved.

Name

Address

Daytime phone number

Date of Application

Address of Applicant

Signature of applicant

Instructions for completing the Consent to Transfer are on the back of this form.

RV-F1400301 (Rev. 11-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2