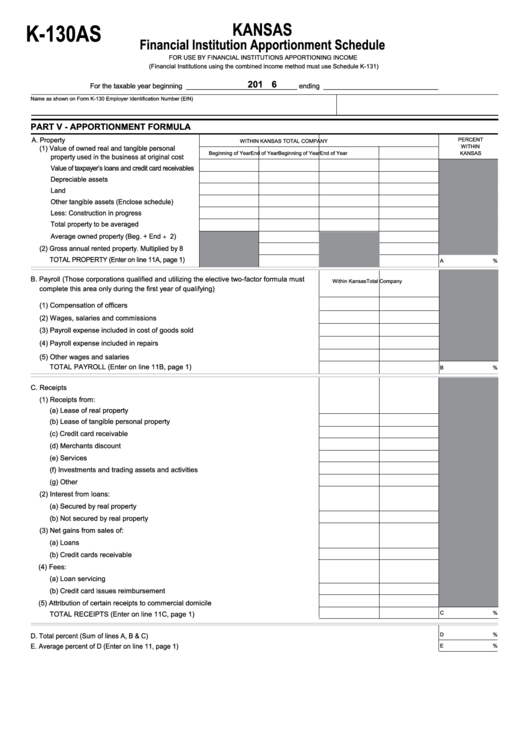

K-130AS

KANSAS

Financial Institution Apportionment Schedule

FOR USE BY FINANCIAL INSTITUTIONS APPORTIONING INCOME

(Financial Institutions using the combined income method must use Schedule K-131)

2 0 1 6

For the taxable year beginning _____________________________ ending ______________________________

Name as shown on Form K-130

Employer Identification Number (EIN)

PART V - APPORTIONMENT FORMULA

A. Property

PERCENT

WITHIN KANSAS

TOTAL COMPANY

WITHIN

(1) Value of owned real and tangible personal

Beginning of Year

End of Year

Beginning of Year

End of Year

KANSAS

property used in the business at original cost

Value of taxpayer’s loans and credit card receivables

Depreciable assets ..............................................

Land .....................................................................

Other tangible assets (Enclose schedule) ...........

Less: Construction in progress ...........................

Total property to be averaged ..............................

Average owned property (Beg. + End ÷ 2) ..........

(2) Gross annual rented property. Multiplied by 8 ......

TOTAL PROPERTY (Enter on line 11A, page 1) ......

A

%

B. Payroll (Those corporations qualified and utilizing the elective two-factor formula must

Within Kansas

Total Company

complete this area only during the first year of qualifying)

(1) Compensation of officers ..................................................................................................

(2) Wages, salaries and commissions ...................................................................................

(3) Payroll expense included in cost of goods sold ................................................................

(4) Payroll expense included in repairs ..................................................................................

(5) Other wages and salaries .................................................................................................

TOTAL PAYROLL (Enter on line 11B, page 1) ......................................................... ......

B

%

C. Receipts

(1) Receipts from:

(a) Lease of real property ................................................................................................

(b) Lease of tangible personal property ...........................................................................

(c) Credit card receivable ................................................................................................

(d) Merchants discount ....................................................................................................

(e) Services .....................................................................................................................

(f) Investments and trading assets and activities .............................................................

(g) Other ..........................................................................................................................

(2) Interest from loans:

(a) Secured by real property ............................................................................................

(b) Not secured by real property ......................................................................................

(3) Net gains from sales of:

(a) Loans ..........................................................................................................................

(b) Credit cards receivable ...............................................................................................

(4) Fees:

(a) Loan servicing ............................................................................................................

(b) Credit card issues reimbursement ..............................................................................

(5) Attribution of certain receipts to commercial domicile .....................................................

TOTAL RECEIPTS (Enter on line 11C, page 1) .............................................................

C

%

D

%

D. Total percent (Sum of lines A, B & C) ............................................................................................................................................................

E. Average percent of D (Enter on line 11, page 1) ..........................................................................................................................................

E

%

1

1 2

2